XM Radio 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

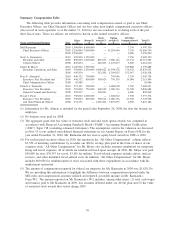

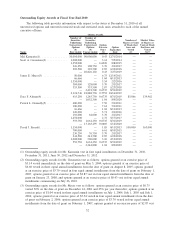

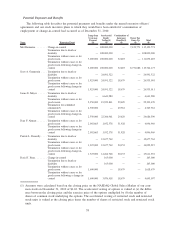

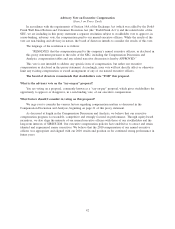

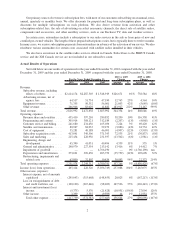

Potential Payments and Benefits

The following table describes the potential payments and benefits under the named executive officers’

agreements and our stock incentive plans to which they would have been entitled if a termination of

employment or change-in-control had occurred as of December 31, 2010:

Name Triggering Event

Lump Sum

Severance

Payment

($)

Accelerated

Equity

Vesting(1)

($)

Continuation of

Insurance

Benefits(2)

($)

Excise Tax

Gross-Up

($)

Total

($)

Mel Karmazin. . . . . . . . Change-in-control — 108,000,000 — 7,123,771 115,123,771

Termination due to death or

disability — 108,000,000 — — 108,000,000

Termination without cause or for

good reason 3,000,000 108,000,000 32,487 — 111,032,487

Termination without cause or for

good reason following change-in-

control 3,000,000 108,000,000 32,487 8,731,686 119,764,173

Scott A. Greenstein . . . . Termination due to death or

disability — 24,991,322 — — 24,991,322

Termination without cause or for

good reason 1,925,000 24,991,322 18,679 — 26,935,001

Termination without cause or for

good reason following change-in-

control 1,925,000 24,991,322 18,679 — 26,935,011

James E. Meyer . . . . . . Termination due to death or

disability — 6,641,280 — — 6,641,280

Termination without cause or for

good reason 2,350,000 19,923,841 29,629 — 22,303,470

Termination for scheduled

retirement(3) 4,700,000 — 49,781 — 4,749,781

Termination without cause or for

good reason following change-in-

control 2,350,000 22,306,961 29,629 — 24,686,590

Dara F. Altman . . . . . . . Termination without cause or for

good reason 2,092,663 1,952,378 51,928 — 4,096,969

Termination without cause or for

good reason following change-in-

control 2,092,663 1,952,378 51,928 — 4,096,969

Patrick L. Donnelly . . . . Termination due to death or

disability — 12,677,762 — — 12,677,762

Termination without cause or for

good reason 1,325,000 12,677,762 20,153 — 14,022,915

Termination without cause or for

good reason following change-in-

control 1,325,000 14,266,748 20,153 — 15,611,901

David J. Frear . . . . . . . . Change-in-control — 163,000 — — 163,000

Termination due to death or

disability — 163,000 — — 163,000

Termination without cause or for

good reason 1,600,000 — 18,679 — 1,618,679

Termination without cause or for

good reason following a change-in-

control 1,600,000 3,076,418 18,679 — 4,695,097

(1) Amounts were calculated based on the closing price on the NASDAQ Global Select Market of our com-

mon stock on December 31, 2010 of $1.63. The accelerated vesting of options is valued at (a) the differ-

ence between the closing price and the exercise price of the options multiplied by (b) the number of

shares of common stock underlying the options. The accelerated vesting of restricted stock and restricted

stock units is valued at the closing price times the number of shares of restricted stock and restricted stock

units.

38