XM Radio 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.line basis. We allocate a portion of certain programming costs which are related to sponsorship and marketing

activities to sales and marketing expenses on a straight-line basis over the term of the agreement.

Advertising Costs

Media is expensed when aired and advertising production costs are expensed as incurred. Market development

funds consist of fixed and variable payments to reimburse retailers for the cost of advertising and other product

awareness activities. Fixed market development funds are expensed over the periods specified in the applicable

agreement; variable costs are expensed when aired and production costs are expensed as incurred. During the years

ended December 31, 2010, 2009 and 2008, we recorded advertising costs of $110,050, $128,784 and $109,253,

respectively. These costs are reflected in Sales and marketing expense in our consolidated statements of operations.

Stock-Based Compensation

We account for equity instruments granted to employees in accordance with ASC 718, Compensation — Stock

Compensation. ASC 718 requires all share-based compensation payments to be recognized in the financial

statements based on fair value. ASC 718 requires forfeitures to be estimated at the time of grant and revised in

subsequent periods if actual forfeitures differ from initial estimates. We use the Black-Scholes-Merton option-

pricing model to value stock option awards and have elected to treat awards with graded vesting as a single award.

Share-based compensation expense is recognized ratably over the requisite service period, which is generally the

vesting period, net of forfeitures. We measure non-vested stock awards using the fair market value of restricted

shares of common stock on the day the award is granted.

Fair value as determined using Black-Scholes-Merton model varies based on assumptions used for the

expected life, expected stock price volatility and risk-free interest rates. We estimate the fair value of awards granted

using the hybrid approach for volatility, which weights observable historical volatility and implied volatility of

qualifying actively traded options on our common stock. The expected life assumption represents the weighted-

average period stock-based awards are expected to remain outstanding. These expected life assumptions are

established through a review of historical exercise behavior of stock-based award grants with similar vesting

periods. Where historical patterns do not exist, contractual terms are used. The risk-free interest rate represents the

daily treasury yield curve rate at the grant date based on the closing market bid yields on actively traded

U.S. treasury securities in the over-the-counter market for the expected term. Our assumptions may change in future

periods.

Equity instruments granted to non-employees are accounted for in accordance with ASC 505, Equity. The final

measurement date for the fair value of equity instruments with performance criteria is the date that each

performance commitment for such equity instrument is satisfied or there is a significant disincentive for non-

performance.

Stock-based awards granted to employees, non-employees and members of our board of directors include

warrants, stock options, restricted stock and restricted stock units.

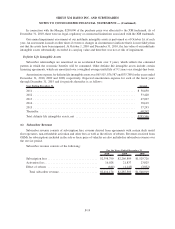

Subscriber Acquisition Costs

Subscriber acquisition costs consist of costs incurred to acquire new subscribers and include hardware

subsidies paid to radio manufacturers, distributors and automakers, including subsidies paid to automakers who

include a satellite radio and a prepaid subscription to our service in the sale or lease price of a new vehicle; subsidies

paid for chip sets and certain other components used in manufacturing radios; device royalties for certain radios;

commissions paid to retailers and automakers as incentives to purchase, install and activate radios; product warranty

obligations; and provisions for inventory allowance. Subscriber acquisition costs do not include advertising, loyalty

payments to distributors and dealers of radios and revenue share payments to automakers and retailers of radios.

F-12

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)