XM Radio 2010 Annual Report Download - page 60

Download and view the complete annual report

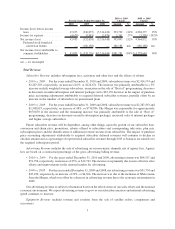

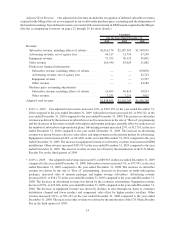

Please find page 60 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•2010 vs. 2009: For the years ended December 31, 2010 and 2009, equipment revenue was $71,355 and

$50,352, respectively, an increase of 42%, or $21,003. The increase was driven by royalties from increased

OEM installations and aftermarket radios and accessories.

•2009 vs. 2008: For the years ended December 31, 2009 and 2008, equipment revenue was $50,352 and

$56,001, respectively, a decrease of 10%, or $5,649. The decrease was primarily due to a decline in sales

through our direct to consumer distribution channel and lower product royalties, partially offset by the

inclusion of XM revenue for a full year.

We expect equipment revenue to fluctuate based on OEM installations for which we receive royalty payments

for our technology and, to a lesser extent, on the volume and mix of equipment sales in our direct to consumer

business.

Other Revenue includes the U.S. Music Royalty Fee, revenue from affiliates, content licensing fees and

syndication fees.

•2010 vs. 2009: For the years ended December 31, 2010 and 2009, other revenue was $266,946 and

$83,029, respectively. The $183,917 increase was primarily due to the full year impact of the U.S. Music

Royalty Fee introduced in the third quarter of 2009.

•2009 vs. 2008: For the years ended December 31, 2009 and 2008, other revenue was $83,029 and $11,882,

respectively, an increase of 599%, or $71,147. The increase was primarily due to the introduction of the

U.S. Music Royalty Fee in the third quarter of 2009 and the inclusion of XM revenue for a full year.

Future other revenues will be dependent upon revenues from affiliates, content and syndication fees, and the

monthly fee assessed for the U.S. Music Royalty Fee. The FCC’s order approving the Merger allows us to pass

through cost increases incurred since the filing of our FCC merger application as a result of statutorily or

contractually required payments to the music, recording and publishing industries for the performance of musical

works and sound recordings or for device recording fees.

Operating Expenses

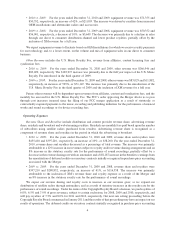

Revenue Share and Royalties include distribution and content provider revenue share, advertising revenue

share, residuals and broadcast and web streaming royalties. Residuals are monthly fees paid based upon the number

of subscribers using satellite radios purchased from retailers. Advertising revenue share is recognized as a

component of revenue share and royalties in the period in which the advertising is broadcast.

•2010 vs. 2009: For the years ended December 31, 2010 and 2009, revenue share and royalties were

$435,410 and $397,210, respectively, an increase of 10%, or $38,200. For the year ended December 31,

2010, revenue share and royalties decreased as a percentage of total revenue. The increase was primarily

attributable to a 12% increase in our revenues subject to royalty and/or revenue sharing arrangements and an

8% increase in the statutory royalty rate for the performance of sound recordings, partially offset by a

decrease in the revenue sharing rate with an automaker and a $18,187 increase in the benefit to earnings from

the amortization of deferred credits on executory contracts initially recognized in purchase price accounting

associated with the Merger.

•2009 vs. 2008: For the years ended December 31, 2009 and 2008, revenue share and royalties were

$397,210 and $280,852, respectively, an increase of 41%, or $116,358. The increase was primarily

attributable to the inclusion of XM’s revenue share and royalty expense as a result of the Merger and

an 8% increase in the statutory royalty rate for the performance of sound recordings.

We expect our revenue sharing and royalty costs to increase as our revenues grow, as we expand our

distribution of satellite radios through automakers, and as a result of statutory increases in the royalty rate for the

performance of sound recordings. Under the terms of the Copyright Royalty Board’s decision, we paid royalties of

6.0%, 6.5% and 7.0% of gross revenues, subject to certain exclusions, for 2008, 2009 and 2010, respectively, and

will pay royalties of 7.5% and 8.0% for 2011 and 2012, respectively. Our next rate setting proceeding before the

Copyright Royalty Board commenced in January 2011 and the results of that proceeding may have an impact on our

results of operations. The deferred credits on executory contracts initially recognized in purchase price accounting

4