XM Radio 2010 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• the executive’s salary history and his or her total compensation, including other cash bonus and stock

based awards;

• the competitiveness of the market for the executive’s services; and

• the recommendations of our Chief Executive Officer (except as to his own compensation).

In setting base salaries, the Compensation Committee also considers the importance of linking a high

proportion of each executive officer’s compensation to performance in the form of the discretionary annual

bonus as well as long-term stock-based compensation, which is tied to our stock price performance.

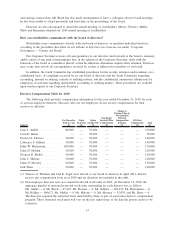

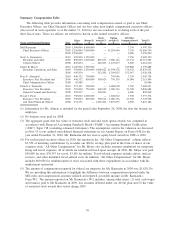

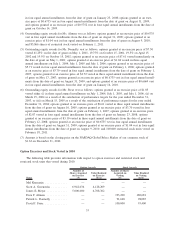

2010 Base Salary Decisions. During 2010, our Compensation Committee approved an increase in the

base salary of Mr. Donnelly beginning in January 2010 from $525,000 to $575,000 as part of an agreement to

extend his employment. The Compensation Committee believed this increase was appropriate given the

competitive market for his services and his individual performance. In 2010, Mr. Greenstein’s base salary

increased from $850,000 to $925,000 and Mr. Meyer’s base salary increased from $950,000 to $1,100,000.

These salary increases were negotiated with Messrs. Greenstein and Meyer in 2009 as part of the execution of

new employment agreements with each of them.

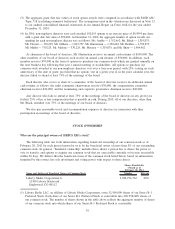

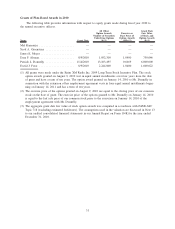

In 2010, Messrs. Meyer and Donnelly waived the increase in their base salaries that each would have

been entitled to in 2011 under their employment agreements. We did not solicit those waivers; rather

Messrs. Meyer and Donnelly approached us regarding the contractually required increases in their salaries

after weighing factors important to each of them. We understand that Messrs. Meyer and Donnelly waived

their increases in base salaries principally as a demonstration of leadership and a signal to our employees that

any increase in their compensation would be based on our performance in the form of bonuses and increases

in the value of their stock options. In January 2011, Mr. Greenstein’s base salary increased from $925,000 to

$1,000,000 as required by the terms of his employment agreement.

Annual Bonus

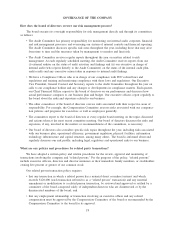

Objectives. The Compensation Committee may award any annual bonuses in cash, restricted stock,

restricted stock units or a combination thereof. The Compensation Committee believes that discretionary

bonuses, as opposed to formula-based bonuses, provide the best means of incentivizing our named executive

officers to enhance stockholder value. Our bonus approach allows the Compensation Committee to take into

consideration all factors relevant to an executive’s performance without being limited by specified financial or

operational metrics.

The bonuses approved by the Compensation Committee for 2010 were intended to achieve two principal

objectives:

• to link compensation with performance that enhances stockholder value, as measured at the company

and individual levels; and

• to reward our named executive officers based on individual performance and contributions to the

company.

Process. Although our annual bonus awards are discretionary, the Compensation Committee employed

the process described below to assist in shaping its decision and assist in evaluating whether it was appropriate

to award bonuses to our named executive officers with respect to 2010. The Compensation Committee may

not employ the same process, or may adopt a modified or wholly different process, in making future bonus

decisions.

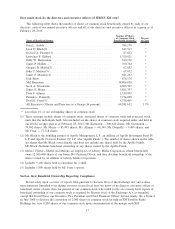

After the end of the year, the Compensation Committee evaluated our actual performance against a

variety of operating metrics to determine the appropriate funding of a bonus pool for all employees, other than

our named executive officers. As part of such evaluation, the Compensation Committee considered our

increase in subscribers, revenue, adjusted EBITDA, free cash flow and conversion rate and results in

controlling subscriber churn and operating expenses, additional accomplishments and other factors the

Compensation Committee deemed relevant. For named executive officers (other than himself), our Chief

25