XM Radio 2010 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

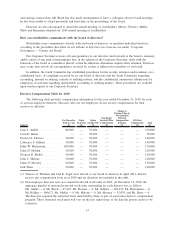

(3) The aggregate grant date fair values of stock option awards were computed in accordance with FASB ASC

Topic 718 (excluding estimated forfeitures). The assumptions used in the valuation are discussed in Note 13

to our audited consolidated financial statements in our Annual Report on Form 10-K for the year ended

December 31, 2010.

(4) In 2010, non-employee directors were each awarded 102,015 options at an exercise price of $0.9994 per share

with a grant date fair value of $70,000. At December 31, 2010, the aggregate number of option awards out-

standing for each non-employee director was as follows: Ms. Amble — 1,312,462; Mr. Black — 1,319,875;

Mr. Flowers — 370,225; Mr. Gilberti — 1,063,757; Mr. Hartenstein — 1,358,462; Mr. Holden — 1,359,875;

Mr. Maffei — 370,225; Mr. Malone — 370,225; Mr. Mooney — 1,319,875; and Mr. Shaw — 1,404,462.

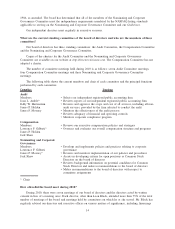

As chairman of the board of directors, Mr. Hartenstein receives an annual cash retainer of $100,000. The

other members of our board of directors each receive an annual cash retainer of $50,000. In addition, each

member receives $70,000 in the form of options to purchase our common stock which are granted annually on

the next business day following that year’s annual meeting of stockholders. All options to purchase our

common stock awarded to our non-employee directors vest over a four-year period, with 25% vesting on each

anniversary of the date of grant; provided that no options vest in a given year if, in the prior calendar year, the

director failed to attend at least 75% of the meetings of the board.

Each director who serves as chair of a committee of the board of directors receives an additional annual

cash retainer as follows: the audit committee chairwoman receives $30,000; the compensation committee

chairman receives $20,000; and the nominating and corporate governance chairman receives $10,000.

Any director who fails to attend at least 75% of the meetings of the board of directors in any given year

forfeits 25% of his or her compensation that is payable in cash. During 2010, all of our directors, other than

Mr. Black, attended over 75% of the meetings of our board of directors.

We also pay reasonable travel and accommodation expenses of directors in connection with their

participation in meetings of the board of directors.

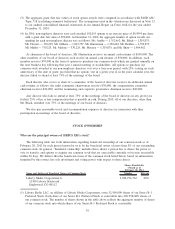

STOCK OWNERSHIP

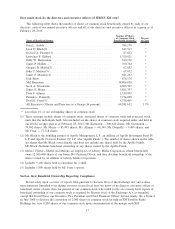

Who are the principal owners of SIRIUS XM’s stock?

The following table sets forth information regarding beneficial ownership of our common stock as of

February 28, 2011 by each person known by us to be the beneficial owner of more than 5% of our outstanding

common stock. In general, “beneficial ownership” includes those shares a person has or shares the power to

vote or transfer, and options to acquire our common stock that are exercisable currently or become exercisable

within 60 days. We believe that the beneficial owner of the common stock listed below, based on information

furnished by this owner, has sole investment and voting power with respect to these shares.

Name and Address of Beneficial Owner of Common Stock Number Percent

Shares Beneficially

Owned as of

February 28, 2011

Liberty Media Corporation(1) .................................. 2,586,976,762 40%

12300 Liberty Boulevard

Englewood, CO 80112

(1) Liberty Radio LLC, an affiliate of Liberty Media Corporation, owns 12,500,000 shares of our Series B-1

Preferred Stock. Each share of our Series B-1 Preferred Stock is convertible into 206.9581409 shares of

our common stock. The number of shares shown in the table above reflects the aggregate number of shares

of our common stock into which shares of our Series B-1 Preferred Stock is convertible.

16