XM Radio 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

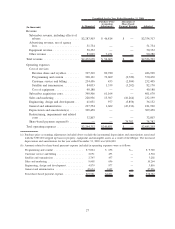

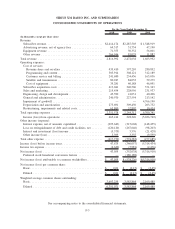

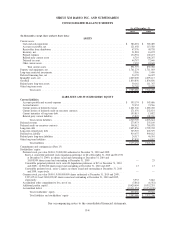

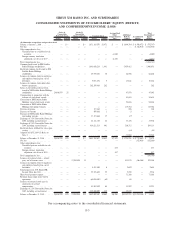

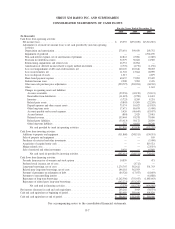

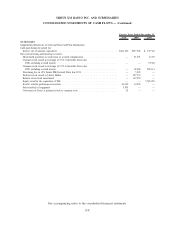

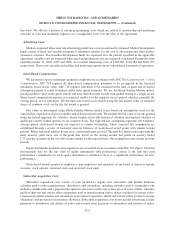

SIRIUS XM RADIO INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (DEFICIT)

AND COMPREHENSIVE INCOME (LOSS)

Shares Amount Shares Amount Shares Amount

Accumulated

Other

Comprehensive

Loss

Additional

Paid-in

Capital

Accumulated

Deficit

Total

Stockholders’

Equity

(Deficit)

Series A

Convertible

Preferred Stock

Series B

Convertible

Preferred Stock Common Stock

(In thousands, except share and per share data)

Balance at January 1, 2008 . . ...... — $— — $— 1,471,143,570 $1,471 $ — $ 3,604,764 $ (4,398,972) $ (792,737)

Net loss ................... — — — — — — — — (5,316,910) (5,316,910)

Other comprehensive loss:

Unrealized loss on available-for-sale

securities . . . ............. — — — — — — (1,040) — — (1,040)

Foreign currency translation

adjustment, net of tax of $137 .... — — — — — — (6,831) — — (6,831)

Total comprehensive loss.......... (5,324,781)

Common stock issued to XM Satellite

Radio Holdings stockholders ...... — — — — 1,440,858,219 1,441 — 5,459,412 — 5,460,853

Restricted common stock issued to XM

Satellite Radio Holdings

stockholders . . ............. — — — — 29,739,201 30 — 66,598 — 66,628

Issuance of common stock to employees

and employee benefit plans, net of

forfeitures ................. — — — — 5,091,274 5 — 10,841 — 10,846

Issuance of common stock under share

borrow agreements ............ — — — — 262,399,983 262 — — — 262

Series A convertible preferred stock

issued to XM Satellite Radio Holdings

stockholders . . ............. 24,808,959 25 — — — — — 47,070 — 47,095

Compensation in connection with the

issuance of stock-based awards ..... — — — — — — — 83,610 — 83,610

Conversion of XM Satellite Radio

Holdings vested stock-based awards . . — — — — — — — 94,616 — 94,616

Conversion of XM Satellite Radio

Holdings outstanding warrants ..... — — — — — — — 115,784 — 115,784

Exercise of options ............. — — — 117,442 — — 208 — 208

Exercise of warrants ............ — — — — 899,836 1 — (1) — —

Exercise of XM Satellite Radio Holdings

outstanding warrants ........... — — — — 17,173,644 17 — (17) — —

Exchange of 3.5% Convertible Notes due

2008, including accrued interest .... — — — — 24,131,155 24 — 33,478 — 33,502

Exchange of 2.5% Convertible Notes due

2009, including accrued interest .... — — — — 400,211,513 401 — 208,712 — 209,113

Restricted shares withheld for taxes upon

vesting .................. — — — — — — — (84) — (84)

Adoption of ASU 2009-15 (Refer to

Note 3) .................. — — — — — — — 70,960 — 70,960

Balance at December 31, 2008 ...... 24,808,959 $25 — $— 3,651,765,837 $3,652 $(7,871) $ 9,795,951 $ (9,715,882) $ 75,875

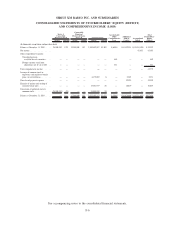

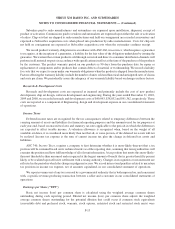

Net loss ................... — — — — — — — — (352,038) (352,038)

Other comprehensive loss:

Unrealized gain on available-for-sale

securities . . . ............. — — — — — — 473 — — 473

Foreign currency translation

adjustment, net of tax of $110 .... — — — — — — 817 — — 817

Total comprehensive loss.......... — — — — — — — — — (350,748)

Issuance of preferred stock — related

party, net of issuance costs . ...... — — 12,500,000 13 — — — 410,179 (186,188) 224,004

Issuance of common stock to employees

and employee benefit plans, net of

forfeitures ................. — — — — 8,511,009 8 — 2,622 — 2,630

Structuring fee on 10% Senior PIK

Secured Notes due 2011 . . . ...... — — — — 59,178,819 59 — 5,859 — 5,918

Share-based payment expense . ...... — — — — — — — 71,388 — 71,388

Returned shares under share borrow

agreements . . . ............. — — — — (60,000,000) (60) — 60 — —

Issuance of restricted stock units in

satisfaction of accrued

compensation . . ............. — — — — 83,803,422 84 — 31,207 — 31,291

Exchange of 2.5% Convertible Notes due

2009, including accrued interest .... — — — — 139,400,000 139 — 35,025 — 35,164

Balance at December 31, 2009 ...... 24,808,959 $25 12,500,000 $13 3,882,659,087 $3,882 $(6,581) $10,352,291 $(10,254,108) $ 95,522

See accompanying notes to the consolidated financial statements.

F-5