XM Radio 2010 Annual Report Download - page 38

Download and view the complete annual report

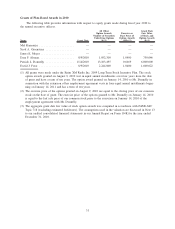

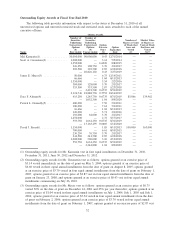

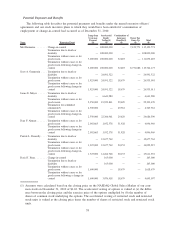

Please find page 38 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Perquisites and Other Benefits for Named Executive Officers

The Compensation Committee supports providing other benefits to named executive officers that, except

as to Mr. Meyer, are substantially the same as those offered to our other full time employees and are provided

to similarly situated executives at companies with which we compete for executive talent.

Mr. Meyer’s principal residence is in Indianapolis, Indiana. We reimburse Mr. Meyer for the reasonable

costs of an apartment in the New York metropolitan area and other incidental living expenses, up to a

maximum of $5,000 per month for rent. We also reimburse Mr. Meyer for the reasonable costs of coach class

air-fare from his home in Indianapolis, Indiana, to our offices in New York City. We also pay Mr. Meyer an

additional amount to hold him harmless as a result of any federal, state or New York City income taxes

imputed in respect of the expenses we reimburse him for.

Payments to Named Executive Officers Upon Termination or Change-in-Control

The employment agreements with our named executive officers provide for severance payments and, in

connection with a severance that occurs after a change-in-control, additional payments (including tax

“gross-up” payments to protect the named executive officers from so-called “golden parachute” excise taxes

that could arise in such circumstances). These arrangements vary from executive to executive due to individual

negotiations based on each executive’s history and individual circumstances.

We believe that these change-in-control arrangements mitigate some of the risk that exists for executives

working in our industry. These arrangements are intended to attract and retain qualified executives who could

have other job alternatives that may appear to them, in the absence of these arrangements, to be less risky.

There is a possibility that we could be acquired in the future. We believe that severance payments in

connection with a change-in-control transaction are necessary to enable key executives to evaluate objectively

the benefits to our stockholders of a proposed transaction, notwithstanding its potential effects on their own

job security.

Related Policies and Considerations

Compensation of our Chief Executive Officer

In November 2004, our board of directors negotiated, and we entered into, a five-year employment

agreement with Mel Karmazin to serve as our Chief Executive Officer. In June 2009, Mr. Karmazin’s

employment agreement was extended through the end of 2012. The material terms of Mr. Karmazin’s

employment agreement are described below under “Potential Payments Upon Termination and

Change-in-Control — Employment Agreements — Mel Karmazin.”

The terms of Mr. Karmazin’s employment were established by negotiations between Mr. Karmazin and

the Compensation Committee. The Compensation Committee did not retain an independent compensation

consultant to advise them in the negotiation of Mr. Karmazin’s compensation arrangements or to assess the

reasonableness of the compensation arrangements. The Compensation Committee concluded that, in its

business judgment, Mr. Karmazin’s qualifications and experience as chief executive officer, particularly in

radio, were uniquely suited to our needs, and that the compensation, including the base salary and stock option

components of his compensation, was, taken as a whole, appropriate under the circumstances.

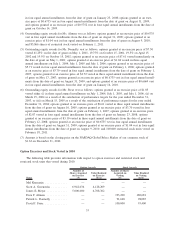

Mr. Karmazin did not receive a bonus in respect of the year ended December 31, 2008. In February 2010,

with respect to his performance in 2009, the Compensation Committee awarded a cash bonus to Mr. Karmazin

of $7,000,000 in recognition of his performance and our corporate performance. In February 2011, the

Compensation Committee awarded a cash bonus to Mr. Karmazin of $8,400,000 in recognition of his

performance and our corporate performance in 2010, including:

• increasing our net subscribers additions by over 1.4 million, an increase of over 1.6 million net

subscriber additions over 2009;

• achieving adjusted EBITDA growth of 35% to over $626 million in 2010;

28