XM Radio 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

subscriber base alone by nearly 1 million subscribers

in 2010. Six times as many new customers chose to

pay for our service in 2010 than in 2009.

At the same time, we remain focused on customer

service and are continuing to study ways to improve

and enhance our customer service experience. Early

this year, we added improvements to our website to

allow customers to more easily manage their accounts

online. We expect to continue to look for ways to make

purchasing a subscription to our service, managing

subscribers’ accounts and even finding answers to

questions, quick and easy.

We continue to find new and better ways for

subscribers to access SiriusXM.

Today SiriusXM is available through every major

automaker as factory or dealer-installed equipment

in new cars. Our factory penetration across vehicles

sold in the U.S. market is up to 62% last year from 56%

in 2009. Our entrance into the pre-owned vehicle

market is also starting to bear fruit and is developing

along the lines we expected. We are also encouraged

by the return of consumer confidence in the auto

industry. In addition, sales of our radios at retail

locations nationwide and through our websites con-

tinue to be important distribution outlets for us.

While the car is often our first point of entry with a

subscriber, we are increasingly expanding the plat-

forms through which we are offering our content.

Consumers demand mobility and with SiriusXM they

have it. We have fully penetrated the smartphone

market with increasingly popular apps for the iPhone,

iPad, iPod touch, Blackberry and Android platforms.

We are also offering more and more content through

our mobile apps and are pleased that our new agree-

ments with Howard Stern and the NFL provide for

them to be available on smartphones to our

subscribers.

As consumers have shown in their demand for access

through mobile devices, our subscribers want more

control over when, where and what they are listening

to. With this in mind, we are working to bring Sir-

iusXM 2.0 into the marketplace later in 2011. We

expect that SiriusXM 2.0 will increase both content

and functionality for our subscribers. We are planning

to expand our audio content lineup by a significant

number of channels. We are also improving and

expanding functionality. Subscribers will be able to

buy music from their radio. We will also have DVR-

like capabilities that consumers have become accus-

tomed to with pause and replay, as well as record and

playback. We are very excited about this advanced

listening platform and believe our subscribers will be

as well.

We are also excited about our satellite radio services in

Canada. We own a minority stake in both SIRIUS

Canada and Canadian Satellite Radio Holdings, also

known as XM Canada. Both companies offer over 120

channels of music, news, sports, talk and entertain-

ment programming, and have over 1.7 million sub-

scribers on a combined basis. In November 2010, the

two companies announced a definitive agreement to

combine in a stock-for-stock transaction. The trans-

action is subject to regulatory review and approvals,

but we expect that this merger will pave the way for

our service to continue to grow and flourish in Canada.

Upon completion of the merger, we will have a 37.1%

economic interest in the combined Canadian entity.

Our financial strength and flexibility has never

been better.

As of December 31, 2010, we had only $198 million of

debt maturing before 2013. In the first two months of

2011, we further reduced that to $104 million. In

addition, our overall debt levels compared to our rev-

enue and adjusted EBITDA is manageable, reasonable

and, most importantly, declining. In 2010, we moved

quickly to take advantage of favorable debt markets to

extend maturities and reduce the interest rate on our

outstanding debt. As we go forward, we plan to be

opportunistic and search for ways to improve our

balance sheet for the benefit of our stockholders.

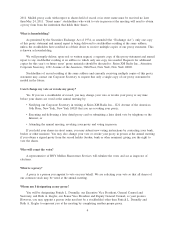

Improving Adjusted EBITDA ($ mm)

2006 2007 2008 2009 2010

$626

$463

($679)

($565)

($136)

Our capital expenditures are decreasing and this is a

positive for us. We successfully placed a new satellite

into orbit at the end of 2010. In the fourth quarter of

2011, we will complete our satellite replacement cycle.

We expect our satellite capital expenditures to decline

by nearly $90 million in 2011, and by another

$100 million in 2012 to nearly zero. We do not expect

to begin construction of another satellite before late

2016 or 2017.