XM Radio 2010 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

December 31, 2011; however, various events could cause our current expectations to change in the future. Should

our position with respect to the majority of these uncertain tax positions be upheld, the effect would be recorded in

the statement of operations as part of the income tax provision.

The impact of temporary differences and tax attributes are considered when calculating interest and penalty

accruals associated with the tax reserve. The amount accrued for interest and penalties as of December 31, 2010 and

December 31, 2009 was zero for both periods. Our policy is to recognize interest and penalties accrued on uncertain

tax positions as part of income tax expense.

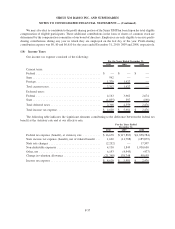

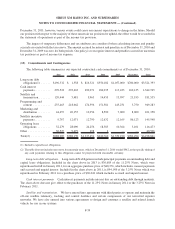

(15) Commitments and Contingencies

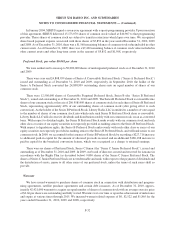

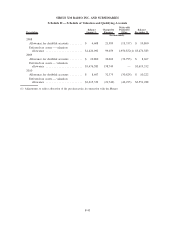

The following table summarizes our expected contractual cash commitments as of December 31, 2010:

2011 2012 2013 2014 2015 Thereafter Total

Long-term debt

obligations(1) ...... $196,332 $ 1,558 $ 816,321 $550,182 $1,057,000 $700,000 $3,321,393

Cash interest

payments.......... 299,518 292,463 290,271 186,935 113,433 160,125 1,342,745

Satellite and

transmission ....... 120,444 5,481 5,963 14,455 13,997 21,195 181,535

Programming and

content ........... 255,463 218,662 174,596 151,581 145,231 3,750 949,283

Marketing and

distribution ........ 44,657 20,155 12,956 8,590 7,000 8,000 101,358

Satellite incentive

payments.......... 9,767 12,071 12,790 12,632 12,165 86,123 145,548

Operating lease

obligations ........ 32,279 28,090 24,256 18,383 10,364 3,101 116,473

Other .............. 30,527 9,679 298 2 — — 40,506

Total(2) ............ $988,987 $588,159 $1,337,451 $942,760 $1,359,190 $982,294 $6,198,841

(1) Includes capital lease obligations.

(2) The table does not include our reserve for uncertain taxes, which at December 31, 2010 totaled $942, as the specific timing of

any cash payments relating to this obligation cannot be projected with reasonable certainty.

Long-term debt obligations. Long-term debt obligations include principal payments on outstanding debt and

capital lease obligations. Included in the chart above in 2013 is $36,685 of the 11.25% Notes, which were

repurchased in full in January 2011, for an aggregate purchase price of $40,376, which includes consent payments

and accrued and unpaid interest. Included in the chart above in 2011, is $94,148 of the 3.25% Notes which was

repurchased in February 2011 for a purchase price of $96,041 which includes accrued and unpaid interest.

Cash interest payments. Cash interest payments include interest due on outstanding debt through maturity.

The chart above does not give effect to the purchases of the 11.25% Notes in January 2011 or the 3.25% Notes in

February 2011.

Satellite and transmission. We have entered into agreements with third parties to operate and maintain the

off-site satellite telemetry, tracking and control facilities and certain components of our terrestrial repeater

networks. We have also entered into various agreements to design and construct a satellite and related launch

vehicle for use in our systems.

F-39

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)