XM Radio 2010 Annual Report Download - page 74

Download and view the complete annual report

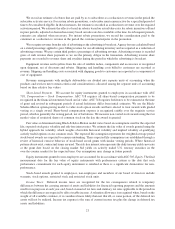

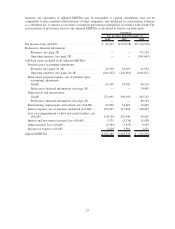

Please find page 74 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$55,610 over the next five years, the majority of which is attributable to the construction and launch of our FM-6

satellite and related launch vehicle.

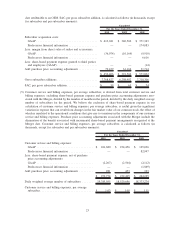

Based upon our current plans, we believe that we have sufficient cash, cash equivalents and marketable

securities to cover our estimated funding needs. We expect to fund operating expenses, capital expenditures,

working capital requirements, interest payments, taxes and scheduled maturities of our debt with existing cash and

cash flow from operations, and we believe that we will be able to generate sufficient revenues to meet our cash

requirements.

Our ability to meet our debt and other obligations depends on our future operating performance and on

economic, financial, competitive and other factors. We continually review our operations for opportunities to adjust

the timing of expenditures to ensure that sufficient resources are maintained. Our financial projections are based on

assumptions, which we believe are reasonable but contain significant uncertainties.

We regularly evaluate our business plans and strategy. These evaluations often result in changes to our business

plans and strategy, some of which may be material and significantly change our cash requirements. These changes

in our business plans or strategy may include: the acquisition of unique or compelling programming; the

introduction of new features or services; significant new or enhanced distribution arrangements; investments in

infrastructure, such as satellites, equipment or radio spectrum; and acquisitions, including acquisitions that are not

directly related to our satellite radio business. In addition, our operations are affected by the FCC order approving

the Merger, which imposed certain conditions upon, among other things, our program offerings and our ability to

increase prices.

Debt Covenants

The indentures governing our debt include restrictive covenants. As of December 31, 2010, we were in

compliance with our debt covenants.

For a discussion of our “Debt Covenants”, refer to Note 11 to our consolidated financial statements in this

Annual Report.

Off-Balance Sheet Arrangements

We do not have any significant off-balance sheet arrangements other than those disclosed in Note 15 to our

consolidated financial statements in this Annual Report that are reasonably likely to have a material effect on our

financial condition, results of operations, liquidity, capital expenditures or capital resources.

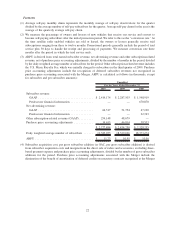

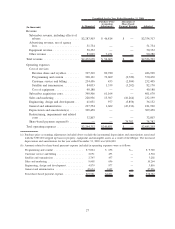

2009 Long-Term Stock Incentive Plan

In May 2009, our stockholders approved the Sirius XM Radio Inc. 2009 Long-Term Stock Incentive Plan (the

“2009 Plan”). Employees, consultants and members of our board of directors are eligible to receive awards under

the 2009 Plan, which provides for the grant of stock options, restricted stock, restricted stock units and other stock-

based awards that the compensation committee of our board of directors may deem appropriate. Vesting and other

terms of stock-based awards are set forth in the agreements with the individuals receiving the awards. Stock-based

awards granted under the 2009 Plan are generally subject to a vesting requirement. Stock-based awards generally

expire ten years from the date of grant. Each restricted stock unit entitles the holder to receive one share of common

stock upon vesting. As of December 31, 2010, approximately 268,255,000 shares of common stock were available

for future grants under the 2009 Plan.

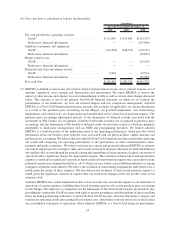

Other Plans

We maintain four other share-based benefit plans — the XM 2007 Stock Incentive Plan, the Amended and

Restated Sirius Satellite Radio 2003 Long-Term Stock Incentive Plan, the XM 1998 Shares Award Plan and the XM

Talent Option Plan. No further awards may be made under these plans. Outstanding awards under these plans are

being continued.

18