XM Radio 2010 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

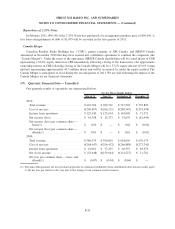

Repurchase of 3.25% Notes

In February 2011, $94,148 of the 3.25% Notes was purchased, for an aggregate purchase price of $96,041. A

loss from extinguishment of debt of $1,079 will be recorded in the first quarter of 2011.

Canada Merger

Canadian Satellite Radio Holdings Inc. (“CSR”), parent company of XM Canada, and SIRIUS Canada

announced in November 2010 that they have entered into a definitive agreement to combine the companies (the

“Canada Merger”). Under the terms of the agreement, SIRIUS Canada shareholders will be issued shares of CSR

representing a 58.0% equity interest in CSR immediately following closing of the transaction. Our approximate

ownership interest in CSR following closing of the Canada Merger will be a 37.1% equity interest (25.0% voting

interest) representing approximately 45.5 million shares and will be accounted for under the equity method. The

Canada Merger is anticipated to close during the second quarter of 2011. We are still evaluating the impact of the

Canada Merger on our financial statements.

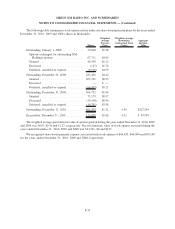

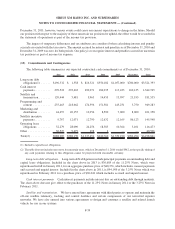

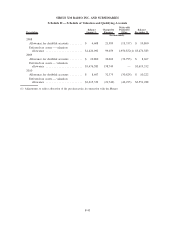

(17) Quarterly Financial Data — Unaudited

Our quarterly results of operations are summarized below:

March 31 June 30 September 30 December 31

For the Three Months Ended

2010:

Total revenue ...................... $663,784 $ 699,761 $ 717,548 $ 735,899

Cost of services .................... $(260,867) $(266,121) $(280,545) $(291,699)

Income from operations .............. $125,140 $ 125,634 $ 143,069 $ 71,571

Net income (loss) ................... $ 41,598 $ 15,272 $ 67,629 $ (81,444)

Net income (loss) per common share —

basic(1) ........................ $ 0.01 $ — $ 0.02 $ (0.02)

Net income (loss) per common share —

diluted(1) ....................... $ 0.01 $ — $ 0.01 $ (0.02)

2009:

Total revenue ...................... $586,979 $ 590,829 $ 618,656 $ 676,174

Cost of services .................... $(268,947) $(254,432) $(266,888) $(273,741)

Income from operations .............. $ 41,061 $ 37,235 $ 66,355 $ 83,675

Net (loss) income ................... $ (52,648) $(159,644) $(151,527) $ 11,781

Net loss per common share — basic and

diluted(1) ....................... $ (0.07) $ (0.04) $ (0.04) $ —

(1) The sum of the quarterly net loss per share applicable to common stockholders (basic and diluted) does not necessarily agree

to the net loss per share for the year due to the timing of our common stock issuances.

F-42

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)