XM Radio 2010 Annual Report Download - page 32

Download and view the complete annual report

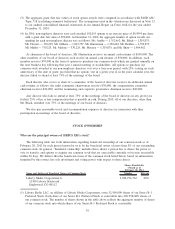

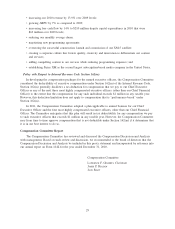

Please find page 32 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In this CD&A, we use certain financial performance measures that are not calculated and presented in

accordance with generally accepted accounting principles in the United States of America (“Non-GAAP”).

These Non-GAAP financial measures include: adjusted EBITDA; average monthly revenue per subscriber

(“ARPU”); and free cash flow. We also use in this CD&A subscriber churn and conversion rate, two

performance metrics which management uses in measuring our business. We use these Non-GAAP financial

measures and other performance metrics to manage our business, set operational goals and, in certain cases, as

a basis for determining compensation for our employees. Please refer to the footnotes contained in our Annual

Report for the year ended December 31, 2010 which accompanies this proxy statement for a discussion of

such Non-GAAP financial measures and reconciliations to the most directly comparable GAAP measure and a

discussion of these other performance metrics.

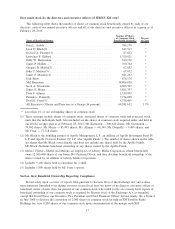

Fiscal Year 2010 Pay Implications

Performance-Based Discretionary Annual Bonuses. None of our named executive officers or employees

is entitled to a guaranteed bonus. Following the end of 2010, the Compensation Committee met to determine

whether to exercise its discretion to pay bonuses to our named executive officers with respect to 2010. In

making this determination, the Compensation Committee carefully reviewed our performance against various

key metrics included in our budget and business plan for 2010, including our efforts to increase subscribers,

revenue, adjusted EBITDA, free cash flow and OEM conversion rate and to control subscriber churn and

operating expenses.

Following its review of our 2010 performance, which the Compensation Committee determined to be

exceptional, the Compensation Committee exercised its discretion and approved a cash bonus pool to be

divided among our employees, other than the named executive officers, and approved the individual amounts

to be granted to our named executive officers. The actual amount of the bonus paid to each named executive

officer was based on a combination of factors, including our 2010 corporate performance, his or her individual

contributions and performance in his or her functional areas of responsibility and, with respect to all named

executive officers other than himself, upon recommendations made by Mr. Karmazin, our Chief Executive

Officer. The amount of Mr. Karmazin’s bonus was approved by the board of directors following a recommen-

dation from the Compensation Committee. The amount of the bonus paid to each named executive officer, and

the specific factors taken into consideration in determining such amounts, is set forth below under the heading

“Executive Compensation Elements”.

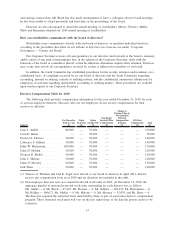

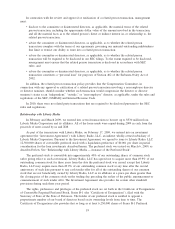

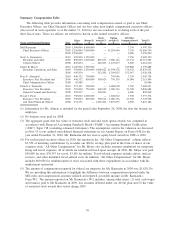

Long-Term Equity Grants. We made a broad-based grant of stock options to our employees in 2010,

including Ms. Altman and Mr. Frear, who received options to purchase 1,052,300 shares and 2,244,800 shares,

respectively. The specific number of options granted to each of these named executive officers was determined

by the Compensation Committee with the assistance of our Chief Executive Officer, as further described under

“— Long-Term Incentive Compensation — Process”. In addition, we granted options to purchase

13,163,495 shares to Mr. Donnelly in connection with his entering into an extended employment agreement

with us in 2010. There were no other long-term equity grants to any of our other named executive officers in

2010.

Base Salary Increases. Mr. Donnelly’s base salary was increased in connection with his entering into an

extended employment agreement in 2010, as described below. In 2010, Mr. Greenstein’s base salary increased

from $850,000 to $925,000, and Mr. Meyer’s base salary increased from $950,000 to $1,100,000. These salary

increases were negotiated with Messrs. Greenstein and Meyer in 2009 as part of the execution of new

employment agreements with each of them. There were no other contractual base salary increases for any of

our other named executive officers in 2010.

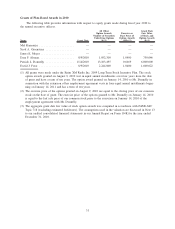

Employment Agreement with Mr. Donnelly. Consistent with our practice for our other named executive

officers, we entered into a new employment agreement with Mr. Donnelly in 2010. The extended agreement,

which is described in more detail below under the heading “Potential Payments upon Termination or

Change-in-Control — Employment Agreements,” increased Mr. Donnelly’s base salary to $575,000 from

$525,000 and provided him with a grant of options to purchase 13,163,495 shares of our common stock at an

exercise price of $0.6669 per share (the last sale price of our common stock on the NASDAQ prior to the

22