XM Radio 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

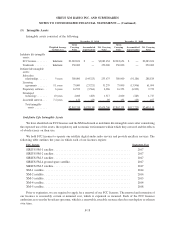

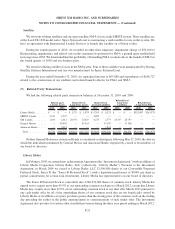

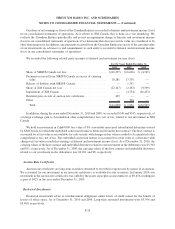

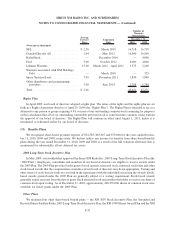

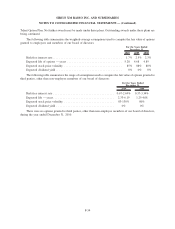

(11) Debt

Our debt consists of the following:

Conversion

Price

(per Share)

December 31,

2010

December 31,

2009

3.25% Convertible Notes due 2011(a) .............. $ 5.30 $ 191,979 $ 230,000

Less: discount ............................ (515) (1,371)

Senior Secured Term Loan due 2012(b)............. N/A — 244,375

9.625% Senior Notes due 2013(c) ................. N/A — 500,000

Less: discount ............................ — (3,341)

8.75% Senior Notes due 2015(d) .................. N/A 800,000 —

Less: discount ............................ (12,213) —

9.75% Senior Secured Notes due 2015(e) ........... N/A 257,000 257,000

Less: discount ............................ (10,116) (11,695)

10% Senior PIK Secured Notes due 2011(f) ......... N/A — 113,685

Less: discount ............................ — (7,325)

11.25% Senior Secured Notes due 2013(g) .......... N/A 36,685 525,750

Less: discount ............................ (1,705) (32,259)

13% Senior Notes due 2013(h) ................... N/A 778,500 778,500

Less: discount ............................ (59,592) (76,601)

9.75% Senior Notes due 2014(i) .................. N/A — 5,260

7% Exchangeable Senior Subordinated Notes due

2014(j) ................................... $1.875 550,000 550,000

Less: discount ............................ (7,620) (9,119)

7.625% Senior Notes due 2018(k) ................. N/A 700,000 —

Less: discount ............................ (12,054) —

Other debt:

Capital leases ................................ N/A 7,229 14,304

Total debt .................................... 3,217,578 3,077,163

Less: total current maturities non-related party ...... 195,815 13,882

Total long-term ................................ 3,021,763 3,063,281

Less: related party........................... 325,907 263,579

Total long-term, excluding related party .............. $2,695,856 $2,799,702

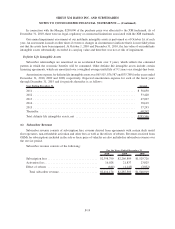

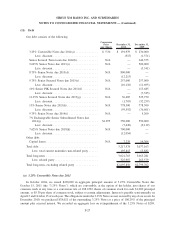

(a) 3.25% Convertible Notes due 2011

In October 2004, we issued $230,000 in aggregate principal amount of 3.25% Convertible Notes due

October 15, 2011 (the “3.25% Notes”), which are convertible, at the option of the holder, into shares of our

common stock at any time at a conversion rate of 188.6792 shares of common stock for each $1,000 principal

amount, or $5.30 per share of common stock, subject to certain adjustments. Interest is payable semi-annually on

April 15 and October 15 of each year. The obligations under the 3.25% Notes are not secured by any of our assets. In

December 2010, we purchased $38,021 of the outstanding 3.25% Notes at a price of 100.25% of the principal

amount plus accrued interest. We recorded an aggregate loss on extinguishment of the 3.25% Notes of $209,

F-27

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)