XM Radio 2010 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dear Fellow Stockholders,

April 2011

The past year was a record breaking one for

SiriusXM.

• Subscribers grew to a record number, with more than

20 million at the end of 2010.

• Free cash flow reached new heights of $210 million.

• Revenue hit $2.82 billion, up 14% over 2009.

• Adjusted EBITDA was $626 million, up 35% over

2009.

We surpassed our guidance on every measure in

2010.

At the beginning of 2010, we told investors that we

would grow our subscriber base by 500,000 and we

blew that out of the water, delivering 1.4 million new

subscribers in 2010. Our free cash flow also exceeded

our annual expectations, which is even more signifi-

cant given that as recently as 2008, free cash flow was

negative $552 million. As many of you know, I view

free cash flow as the most important measure of a

company’s performance. It’s free cash flow that

enables a company to pay down debt, make acquisi-

tions, or return capital to stockholders.

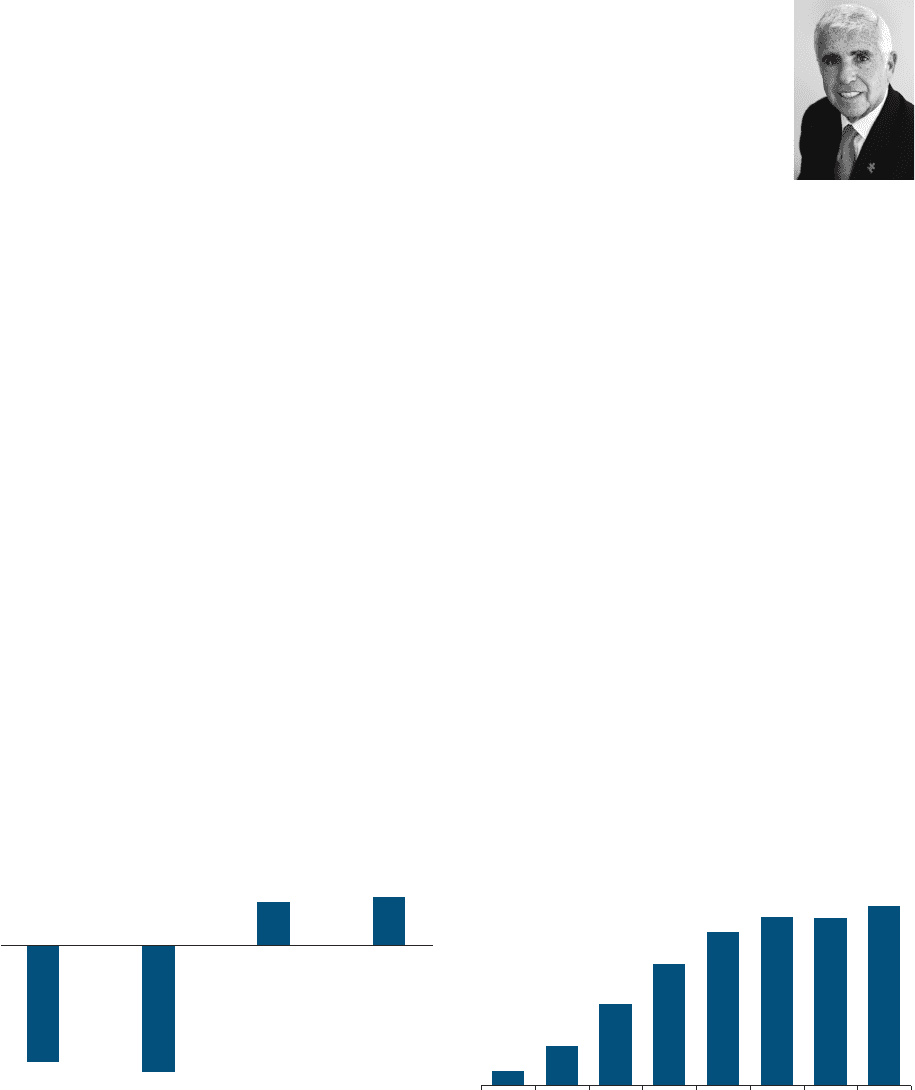

Growing Free Cash Flow ($ mm)

($505) ($552)

$185 $210

2007 2008 2009 2010

These results are impressive viewed through any lens,

but when you think about how far we have come and

the competitive and economic landscape in which we

operate, what we have accomplished is truly remark-

able. With disciplined execution and clear direction,

we successfully navigated a fragile economic envi-

ronment, an auto industry that is only now beginning

to recover and a transformed media landscape with

new competitors emerging almost daily, challenges

that have left many other companies on the sidelines.

The future has never looked brighter for

SiriusXM.

We have the best radio on radio and the quality of our

programming keeps getting better, with over 135 chan-

nels of commercial-free music, premier sports, news,

talk, entertainment, traffic, weather, and data services.

We have set a new standard in programming with

special events, such as our exclusive Paul McCartney

concert in December. We have the best sports pro-

gramming on radio with content that now covers every

major league and event of interest to our subscribers

from action in the dug-outs at spring training to the pits

at the Daytona 500. In the last year, we also have

successfully re-signed every major contract that has

come up for renewal, including Howard Stern and the

NFL, both of which we have secured through 2015.

Our exceptional programming is clearly paying

off as we are continuing to draw listeners.

At the end of 2010, there were a record 20.2 million

SiriusXM subscribers.

Increasing Subscribers (mm)

17.3

19.0 18.8

20.2

13.7

1.6

4.4

9.2

2003 2004 2005 2006 2007 2008 2009 2010

On a net basis, we added 1.4 million new subscribers,

representing a year-over-year growth rate of nearly

8%. This is impressive growth for a business that had

already scaled to be one of the largest subscriber

businesses in this country by the end of 2009. In the

last year, our conversion rate moving consumers on

trials to self-pay subscribers continued to improve and

our self-pay churn declined. We grew our self-pay