XM Radio 2010 Annual Report Download - page 118

Download and view the complete annual report

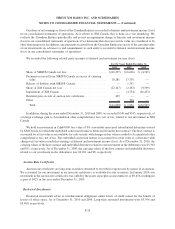

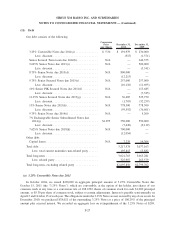

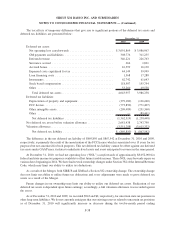

Please find page 118 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$489,065 aggregate principal amount of the 11.25% Notes. The 7.625% Senior Notes mature on November 1, 2018.

Substantially all of our domestic wholly-owned subsidiaries guarantee our obligations under the 7.625% Senior

Notes.

Expired Credit Arrangements

LM Term Loan and LM Purchase Money Loan

In February 2009, SIRIUS entered into a Credit Agreement (the “LM Credit Agreement”) with Liberty Media

Corporation, as administrative agent and collateral agent. The LM Credit Agreement provided for a $250,000 term

loan (“LM Term Loan”) and $30,000 of purchase money loans (“LM Purchase Money Loan”). Concurrently with

entering into the LM Credit Agreement, SIRIUS borrowed $250,000 under the LM Term Loan. The proceeds of the

LM Term Loan were used (i) to repay at maturity our outstanding 2.5% Convertible Notes due February 17, 2009

and (ii) for general corporate purposes, including related transaction costs.

In August 2009, SIRIUS used net proceeds from the sale of its 9.75% Notes to extinguish the LM Term Loan

and LM Purchase Money Loan. We recorded an aggregate loss on extinguishment of the LM Term Loan and LM

Purchase Money Loan of $134,520 consisting primarily of the unamortized discount, deferred financing fees and

unaccreted portion of the repayment premium to Loss on extinguishment of debt and credit facilities, net, in our

consolidated statements of operations.

Amended and Restated Credit Agreement due 2011

In March 2009, XM amended and restated the $100,000 Senior Secured Term Loan due 2009, dated as of

June 26, 2008, and the $250,000 Senior Secured Revolving Credit Facility due 2009, dated as of May 5, 2006. These

facilities were combined as term loans into the Amended and Restated Credit Agreement, dated as of March 6,

2009. Liberty Media LLC purchased $100,000 aggregate principal amount of such loans from the lenders.

In June 2009, XM used net proceeds from the sale of its 11.25% Notes to repay amounts due under and

extinguish the Amended and Restated Credit Agreement. XM paid a repayment premium of $6,500. We recorded an

aggregate loss on extinguishment of the Amended and Restated Credit Agreement of $49,996 consisting primarily

of the unamortized discount, deferred financing fees and unaccreted portion of the repayment premium to Loss on

extinguishment of debt and credit facilities, net, in our consolidated statements of operations.

Second-Lien Credit Agreement

In February 2009, XM entered into a Credit Agreement (the “XM Credit Agreement”) with Liberty Media

Corporation, as administrative agent and collateral agent. The XM Credit Agreement provided for a $150,000 term

loan. On March 6, 2009, XM amended and restated the XM Credit Agreement (the “Second-Lien Credit

Agreement”) with Liberty Media Corporation.

In June 2009, XM terminated the Second-Lien Credit Agreement in connection with the sale of the

11.25% Notes and repaid all amounts due thereunder. We recorded a loss on termination of the Second-Lien

Credit Agreement of $57,663 related to deferred financing fees to Loss on extinguishment of debt and credit

facilities, net, in our consolidated statements of operations.

Covenants and Restrictions

Our debt generally requires compliance with certain covenants that restrict our ability to, among other things,

(i) incur additional indebtedness unless our consolidated leverage ratio would be no greater than 6.00 to 1.00 after

the incurrence of the indebtedness, (ii) incur liens, (iii) pay dividends or make certain other restricted payments,

investments or acquisitions, (iv) enter into certain transactions with affiliates, (v) merge or consolidate with another

person, (vi) sell, assign, lease or otherwise dispose of all or substantially all of our assets, and (vii) make voluntary

F-30

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)