XM Radio 2010 Annual Report Download - page 101

Download and view the complete annual report

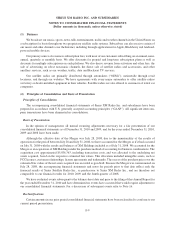

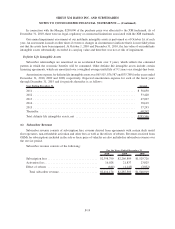

Please find page 101 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Subsidies paid to radio manufacturers and automakers are expensed upon installation, shipment, receipt of

product or activation. Commissions paid to retailers and automakers are expensed upon either the sale or activation

of radios. Chip sets that are shipped to radio manufacturers and held on consignment are recorded as inventory and

expensed as Subscriber acquisition costs when placed into production by radio manufacturers. Costs for chip sets

not held on consignment are expensed as Subscriber acquisition costs when the automaker confirms receipt.

We record product warranty obligations in accordance with ASC 460, Guarantees, which requires a guarantor

to recognize, at the inception of a guarantee, a liability for the fair value of the obligation undertaken by issuing the

guarantee. We warrant that certain products sold through our retail and direct to consumer distribution channels will

perform in all material respects in accordance with specifications in effect at the time of the purchase of the products

by the customer. The product warranty period on our products is 90 days from the purchase date for repair or

replacement of components and/or products that contain defects of material or workmanship. We record a liability

for costs that we expect to incur under our warranty obligations when the product is shipped from the manufacturer.

Factors affecting the warranty liability include the number of units sold and historical and anticipated rates of claims

and costs per claim. We periodically assess the adequacy of our warranty liability based on changes in these factors.

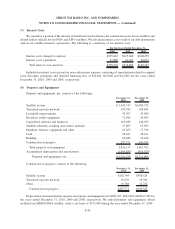

Research & Development Costs

Research and development costs are expensed as incurred and primarily include the cost of new product

development, chip set design, software development and engineering. During the years ended December 31, 2010,

2009 and 2008, we recorded research and development costs of $40,043, $38,852 and $41,362, respectively. These

costs are reported as a component of Engineering, design and development expense in our consolidated statements

of operations.

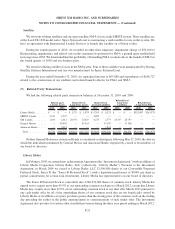

Income Taxes

Deferred income taxes are recognized for the tax consequences related to temporary differences between the

carrying amount of assets and liabilities for financial reporting purposes and the amounts used for tax purposes at

each year-end, based on enacted tax laws and statutory tax rates applicable to the periods in which the differences

are expected to affect taxable income. A valuation allowance is recognized when, based on the weight of all

available evidence, it is considered more likely than not that all, or some portion, of the deferred tax assets will not

be realized. Income tax expense is the sum of current income tax plus the change in deferred tax assets and

liabilities.

ASC 740, Income Taxes, requires a company to first determine whether it is more-likely-than-not that a tax

position will be sustained based on its technical merits as of the reporting date, assuming that taxing authorities will

examine the position and have full knowledge of all relevant information. A tax position that meets this more-likely-

than-not threshold is then measured and recognized at the largest amount of benefit that is greater than fifty percent

likely to be realized upon effective settlement with a taxing authority. Changes in recognition or measurement are

reflected in the period in which the change in judgment occurs. We record interest and penalties related to uncertain

tax positions in income tax expense, net of amounts capitalized, in our consolidated statement of operations.

We report revenues net of any tax assessed by a governmental authority that is both imposed on, and concurrent

with, a specific revenue-producing transaction between a seller and a customer in our consolidated statements of

operations.

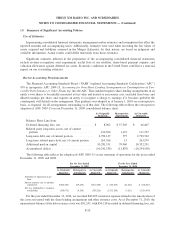

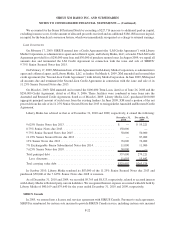

Earnings per Share (“EPS”)

Basic net income (loss) per common share is calculated using the weighted average common shares

outstanding during each reporting period. Diluted net income (loss) per common share adjusts the weighted

average common shares outstanding for the potential dilution that could occur if common stock equivalents

(convertible debt and preferred stock, warrants, stock options, restricted stock and restricted stock units) were

F-13

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)