XM Radio 2010 Annual Report Download - page 65

Download and view the complete annual report

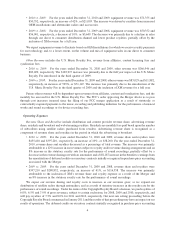

Please find page 65 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.was incurred on the retirement of our 2.5% Convertible Notes due 2009, the extinguishment of our Term

Loan and Purchase Money Loan with Liberty Media, the repayment of the XM’s Amended and Restated

Credit Agreement due 2011, the partial repayment of XM’s 10% Convertible Senior Notes due 2009 and the

termination of XM’s Second Lien Credit Agreement.

•2009 vs. 2008: For the years ended December 31, 2009 and 2008, loss on extinguishment of debt and credit

facilities, net, was $267,646 and $98,203, respectively, an increase of 173%, or $169,443. During the year

ended December 31, 2009, the loss was incurred on the retirement of our 2.5% Convertible Notes due 2009,

the extinguishment of our Term Loan and Purchase Money Loan with Liberty Media, the repayment of XM’s

Amended and Restated Credit Agreement due 2011, the partial repayment of XM’s 10% Convertible Senior

Notes due 2009 and the termination of XM’s Second Lien Credit Agreement. During the year ended

December 31, 2008, the loss was incurred on the partial induced conversion of our 2.5% Convertible Notes

due 2009.

Interest and Investment Income (Loss) includes realized gains and losses, dividends, interest income, our share

of SIRIUS Canada’s and XM Canada’s net losses and losses recorded from investments in those entities, as well as

debt instruments issued by XM Canada, when the fair value of those instruments falls below carrying value and the

decline is determined to be other than temporary.

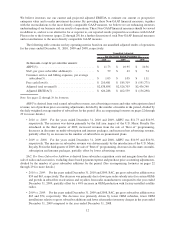

•2010 vs. 2009: For the years ended December 31, 2010 and 2009, interest and investment (loss) income

was ($5,375) and $5,576, respectively, a decrease of 196%, or $10,951. The decrease in income was

primarily attributable to higher net losses at XM Canada and SIRIUS Canada and a decrease in payments

received from SIRIUS Canada in excess of the carrying value of our investments, partially offset by the gain

on sale of auction rate securities during the year ended December 31, 2010. In addition, we recorded an

impairment charge on our investment in XM Canada during the year ended December 31, 2009.

•2009 vs. 2008: For the years ended December 31, 2009 and 2008, interest and investment (loss) income

was $5,576 and ($21,428), respectively, an increase of 126%, or $27,004. The increase was attributable to

payments received from SIRIUS Canada in excess of the carrying value of our investment, decreases in our

share of XM Canada’s net loss and decreases in impairment charges related to our investment in XM Canada

for the year ended December 31, 2009 compared to the year ended December 31, 2008, partially offset by

increases in our share of SIRIUS Canada’s net loss, lower interest rates in 2009 and a lower average cash

balance.

Income Taxes

Income Tax Expense primarily represents the deferred tax liability related to the difference in accounting for

our FCC licenses, which are amortized over 15 years for tax purposes but not amortized for book purposes in

accordance with GAAP and foreign withholding taxes on royalty income.

•2010 vs. 2009: For the years ended December 31, 2010 and 2009, income tax expense was $4,620 and

$5,981, respectively, a decrease of 23%, or $1,361 primarily related to a decrease in the applicable tax rate

and foreign withholding taxes on royalty income.

•2009 vs. 2008: For the years ended December 31, 2009 and 2008, income tax expense was $5,981 and

$2,476, respectively, an increase of 142%, or $3,505 primarily related to the inclusion of XM.

9