XM Radio 2010 Annual Report Download - page 119

Download and view the complete annual report

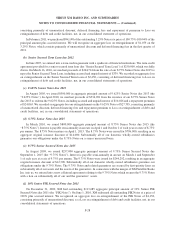

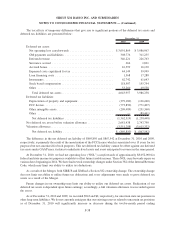

Please find page 119 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.prepayments of certain debt, in each case subject to exceptions. We operated XM as an unrestricted subsidiary for

purposes of compliance with the covenants contained in our debt instruments through January 12, 2011.

Under our debt agreements, the following generally constitute an event of default: (i) a default in the payment

of interest; (ii) a default in the payment of principal; (iii) failure to comply with covenants; (iv) failure to pay other

indebtedness after final maturity or acceleration of other indebtedness exceeding a specified amount; (v) certain

events of bankruptcy; (vi) a judgment for payment of money exceeding a specified aggregate amount; and

(vii) voidance of subsidiary guarantees, subject to grace periods where applicable. If an event of default occurs and

is continuing, our debt could become immediately due and payable.

At December 31, 2010, we were in compliance with our debt covenants.

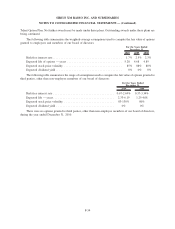

(12) Stockholders’ Equity

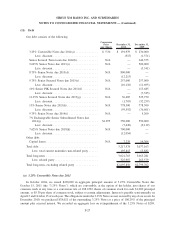

Common Stock, par value $0.001 per share

We were authorized to issue up to 9,000,000,000 shares of common stock as of December 31, 2010 and 2009.

There were 3,933,195,112 and 3,882,659,087 shares of common stock issued and outstanding as of December 31,

2010 and 2009, respectively.

As of December 31, 2010, approximately 3,361,345,000 shares of common stock were reserved for issuance in

connection with outstanding convertible debt, preferred stock, warrants, incentive stock awards and common stock

to be granted to third parties upon satisfaction of performance targets.

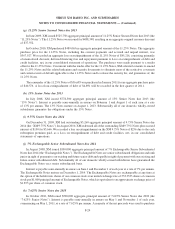

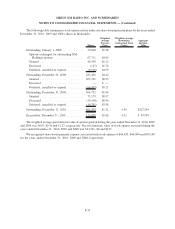

To facilitate the offering of the Exchangeable Notes, we entered into share lending agreements with Morgan

Stanley Capital Services Inc. (“MS”) and UBS AG London Branch (“UBS”) in July 2008, under which we loaned

MS and UBS an aggregate of 262,400,000 shares of our common stock in exchange for a fee of $0.001 per share.

The obligations of MS to us under its share lending agreement are guaranteed by its parent company, Morgan

Stanley. During the third quarter of 2009, MS returned to us 60,000,000 shares of our common stock borrowed in

July 2008, which were retired upon receipt. As of December 31, 2010 and 2009, there were 202,400,000 shares

loaned under the facilities.

Under each share lending agreement, the share loan will terminate in whole or in part, as the case may be, and

the relevant borrowed shares must be returned to us upon the earliest of the following: (i) the share borrower

terminates all or a portion of the loan between it and us, (ii) we notify the share borrower that some of the

Exchangeable Notes as to which borrowed shares relate have been exchanged, repaid or repurchased or are

otherwise no longer outstanding, (iii) the maturity date of the Exchangeable Notes, December 1, 2014, (iv) the date

as of which the entire principal amount of the Exchangeable Notes ceases to be outstanding as a result of exchange,

repayment, repurchase or otherwise or (v) the termination of the share lending agreement by the share borrower or

by us upon default by the other party, including the bankruptcy of us or the share borrower or, in the case of the MS

share lending agreement, the guarantor. A share borrower may delay the return of borrowed shares for up to 30

business days (or under certain circumstances, up to 60 business days) if such share borrower is legally prevented

from returning the borrowed shares to us, in which case the share borrower may, under certain circumstances,

choose to pay us the value of the borrowed shares in cash instead of returning the borrowed shares. Once borrowed

shares are returned to us, they may not be re-borrowed under the share lending agreements. There were no

requirements for the share borrowers to provide collateral.

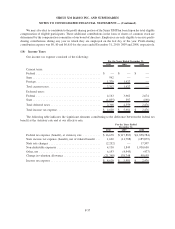

The shares we loaned to the share borrowers are issued and outstanding for corporate law purposes, and holders

of borrowed shares (other than the share borrowers) have the same rights under those shares as holders of any of our

other outstanding common shares. Under GAAP, the borrowed shares are not considered outstanding for the

purpose of computing and reporting our net income (loss) per common share. The accounting method may change

if, due to a default by either UBS or MS (or Morgan Stanley, as guarantor), the borrowed shares, or the equivalent

value of those shares, will not be returned to us as required under the share lending agreements.

F-31

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)