XM Radio 2010 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136

|

|

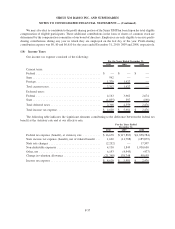

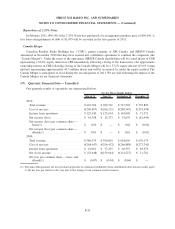

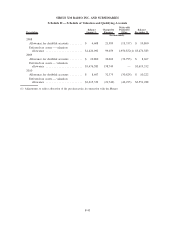

SIRIUS XM RADIO INC. AND SUBSIDIARIES

Schedule II — Schedule of Valuation and Qualifying Accounts

Description

Balance

January 1,

Charged to

Expenses

Write-offs/

Payments/

Other

Balance

December 31,

(In thousands)

2008

Allowance for doubtful accounts ........ $ 4,608 21,589 (15,337) $ 10,860

Deferred tax assets — valuation

allowance ....................... $1,426,092 99,659 1,950,832(1) $3,476,583

2009

Allowance for doubtful accounts ........ $ 10,860 30,602 (32,795) $ 8,667

Deferred tax assets — valuation

allowance ....................... $3,476,583 138,749 — $3,615,332

2010

Allowance for doubtful accounts ........ $ 8,667 32,379 (30,824) $ 10,222

Deferred tax assets — valuation

allowance ....................... $3,615,332 (21,749) (42,295) $3,551,288

(1) Adjustments to reflect allocation of the purchase price in connection with the Merger.

F-43