XM Radio 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Satellites

We own four orbiting satellites and one spare satellite, FM-4, for use in the SIRIUS system. These satellites are

of the Loral FS-1300 model series. Space Systems/Loral is constructing a sixth satellite for use in this system. We

have an agreement with International Launch Services to launch this satellite on a Proton rocket.

During the fourth quarter of 2010, we recorded an other than temporary impairment charge of $56,100 to

Restructuring, impairments, and related costs in the statement of operations for FM-4, a ground spare satellite held

in storage since 2002. We determined that the probability of launching FM-4 is remote due to the launch of XM-5 in

the fourth quarter of 2010 and our business plan.

We own five orbiting satellites for use in the XM system. Four of these satellites were manufactured by Boeing

Satellite Systems International and one was manufactured by Space Systems/Loral.

During the year ended December 31, 2010, we capitalized interest of $63,880 and expenditures of $184,727

related to the construction of our satellites and related launch vehicles for FM-6 and XM-5.

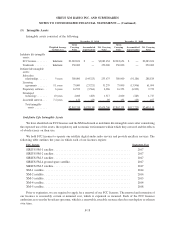

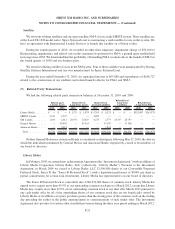

(9) Related Party Transactions

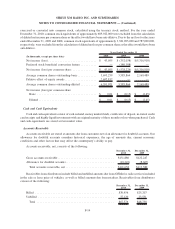

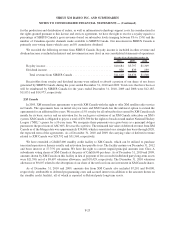

We had the following related party transaction balances at December 31, 2010 and 2009:

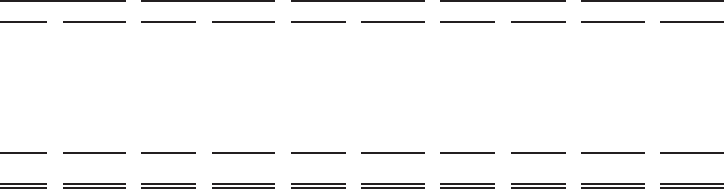

2010 2009 2010 2009 2010 2009 2010 2009 2010 2009

Related party

Current Assets

Related Party

Long-Term Assets

Related Party

Current Liabilities

Related Party

Long-Term

Liabilities

Related Party

Long-Term Debt

Liberty Media. . . . . . . . $ — $ — $ 1,571 $ 1,974 $ 9,765 $ 8,523 $ — $ — $325,907 $263,579

SIRIUS Canada . . . . . . 5,613 2,327 — — 1,805 — — — — —

XM Canada . . . . . . . . . 1,106 1,011 28,591 24,429 4,275 2,775 24,517 28,793 — —

General Motors. . . . . . . — 99,995 — 85,364 — 93,107 — 17,508 — —

American Honda . . . . . . — 2,914 — — — 3,841 — — — —

Total . . . . . . . . . . . . $6,719 $106,247 $30,162 $111,767 $15,845 $108,246 $24,517 $46,301 $325,907 $263,579

Neither General Motors nor American Honda is considered a related party following May 27, 2010, the date on

which the individuals nominated by General Motors and American Honda, respectively, ceased to be members of

our board of directors.

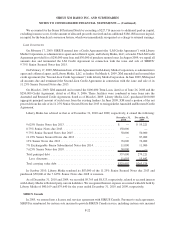

Liberty Media

In February, 2009, we entered into an Investment Agreement (the “Investment Agreement”) with an affiliate of

Liberty Media Corporation, Liberty Radio, LLC (collectively, “Liberty Media”). Pursuant to the Investment

Agreement, in March 2009 we issued to Liberty Radio, LLC 12,500,000 shares of our Convertible Perpetual

Preferred Stock, Series B (the “Series B Preferred Stock”), with a liquidation preference of $0.001 per share in

partial consideration for certain loan investments. Liberty Media has representatives on our board of directors.

The Series B Preferred Stock is convertible into 2,586,976,000 shares of common stock. Liberty Media has

agreed not to acquire more than 49.9% of our outstanding common stock prior to March 2012, except that Liberty

Media may acquire more than 49.9% of our outstanding common stock at any time after March 2011 pursuant to

any cash tender offer for all of the outstanding shares of our common stock that are not beneficially owned by

Liberty Media or its affiliates at a price per share greater than the closing price of the common stock on the trading

day preceding the earlier of the public announcement or commencement of such tender offer. The Investment

Agreement also provides for certain other standstill provisions during the three year period ending in March 2012.

F-21

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)