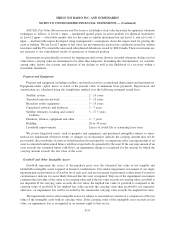

XM Radio 2010 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2010 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

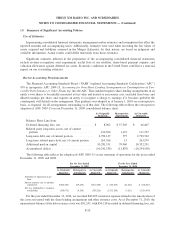

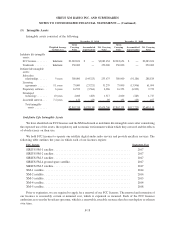

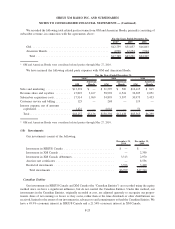

Inventory

Inventory consists of finished goods, refurbished goods, chip sets and other raw material components used in

manufacturing radios. Inventory is stated at the lower of cost, determined on a first-in, first-out basis, or market. We

record an estimated allowance for inventory that is considered slow moving, obsolete or whose carrying value is in

excess of net realizable value. The provision related to products purchased for resale in our direct to consumer

distribution channel and components held for resale by us is reported as a component of Cost of equipment in our

consolidated statements of operations. The provision related to inventory consumed in our OEM and retail

distribution channel is reported as a component of Subscriber acquisition costs in our consolidated statements of

operations.

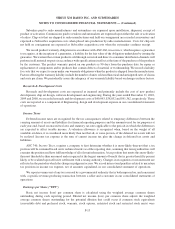

Inventory, net, consists of the following:

December 31,

2010

December 31,

2009

Raw materials ........................................... $18,181 $ 17,370

Finished goods ........................................... 24,492 19,704

Allowance for obsolescence ................................. (20,755) (20,881)

Total inventory, net ...................................... $21,918 $ 16,193

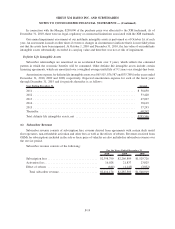

Investments

Marketable Securities — Marketable securities consist of certificates of deposit, auction rate certificates and

investments in debt and equity securities of other entities. Our investment policy objectives are the preservation of

capital, maintenance of liquidity to meet operating requirements and yield maximization. Marketable securities are

classified as available-for-sale securities and carried at fair market value. Unrealized gains and losses on

available-for-sale securities are included in Accumulated other comprehensive loss, net of tax, as a separate

component of Stockholders’ equity (deficit). Realized gains and losses, dividends and interest income, including

amortization of the premium or discount arising at purchase, are included in Interest and investment income. The

specific-identification method is used to determine the cost of all securities and the basis by which amounts are

reclassified from Accumulated other comprehensive loss into earnings.

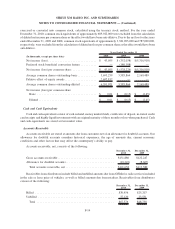

We received proceeds from the sale or maturity of marketable securities of $9,456, $0 and $5,469 for the years

ended December 31, 2010, 2009 and 2008, respectively. We recorded $425 of realized gains on marketable

securities for the year ended December 31, 2010 and $473 of net unrealized gains on marketable securities for the

year ended December 31, 2009.

Restricted Investments — Restricted investments consist of letters of credit, certificates of deposit, money

market funds and interest-bearing accounts which are restricted as to their withdrawal. We received proceeds from

the release of restricted investments of $60,400 for the year ended December 31, 2008.

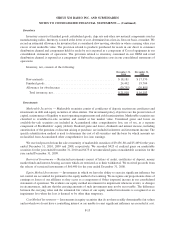

Equity Method Investments — Investments in which we have the ability to exercise significant influence but

not control are accounted for pursuant to the equity method of accounting. We recognize our proportionate share of

earnings or losses of our affiliates as they occur as a component of Other (expense) income in our consolidated

statements of operations. We evaluate our equity method investments for impairment whenever events, or changes

in circumstances, indicate that the carrying amounts of such investments may not be recoverable. The difference

between the carrying value and the estimated fair values of our equity method investments is recognized as an

impairment loss when the loss is deemed to be other than temporary.

Cost Method Investments — Investments in equity securities that do not have readily determinable fair values

and in which we do not have a controlling interest or are unable to exert significant influence are recorded at cost.

F-15

SIRIUS XM RADIO INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)