Seagate 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

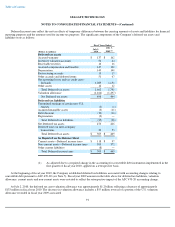

for purposes of the reconciliation between the provision for income taxes at the statutory rate and the effective tax rate. For fiscal years 2009 and

2008, a notional 35% statutory rate is used.

A substantial portion of the Company's operations in China, Malaysia, Singapore, Switzerland and Thailand operate under various tax

holidays and tax incentive programs, which expire in whole or in part at various dates through 2020. Certain of the tax holidays may be extended

if specific conditions are met. The net impact of these tax holidays and tax incentive programs was to increase the Company's net income by

approximately $307 million in fiscal year 2010 ($0.60 per share, diluted), to decrease the Company's net loss by approximately $79 million in

fiscal year 2009 ( $ 0.16 per share, diluted), and to increase the Company's net income by $214 million in fiscal year 2008 ($0.40 per share,

diluted).

Since establishing Irish tax residency in fiscal year 2010 as a result of the implementation of certain pre-reorganization steps in connection

with the Company's previously announced plan to move its corporate headquarters to Ireland, the Company consists of an Irish tax resident

parent holding company with various U.S. and non-U.S. subsidiaries that operate in multiple non-Irish taxing jurisdictions. The amount of

temporary differences (including undistributed earnings) related to outside basis differences in the stock of non-Irish resident subsidiaries

considered indefinitely reinvested outside of Ireland for which Irish income taxes have not been provided was approximately $2.7 billion. The

determination of the amount of Irish tax that would accrue if such amount was remitted into Ireland is not practicable.

Effective at the beginning of fiscal year 2008, the Company adopted the authoritative guidance on accounting for uncertainty in income

taxes. This guidance contains a two-step approach to recognizing and measuring uncertain tax positions. The first step is to evaluate the tax

position for recognition by determining if the weight of available evidence indicates that it is more likely than not that the tax position will be

sustained on audit, including resolution of any related appeals or litigation processes. The second step is to measure the tax benefit as the largest

amount that is more than 50% likely of being realized upon ultimate settlement.

As a result of the implementation of the guidance, the Company increased its liability for net unrecognized tax benefits at the date of

adoption. The Company accounted for the increase primarily as a cumulative effect of a change in accounting principle that resulted in a

decrease to retained earnings of

93

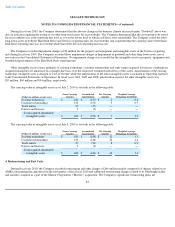

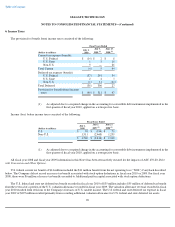

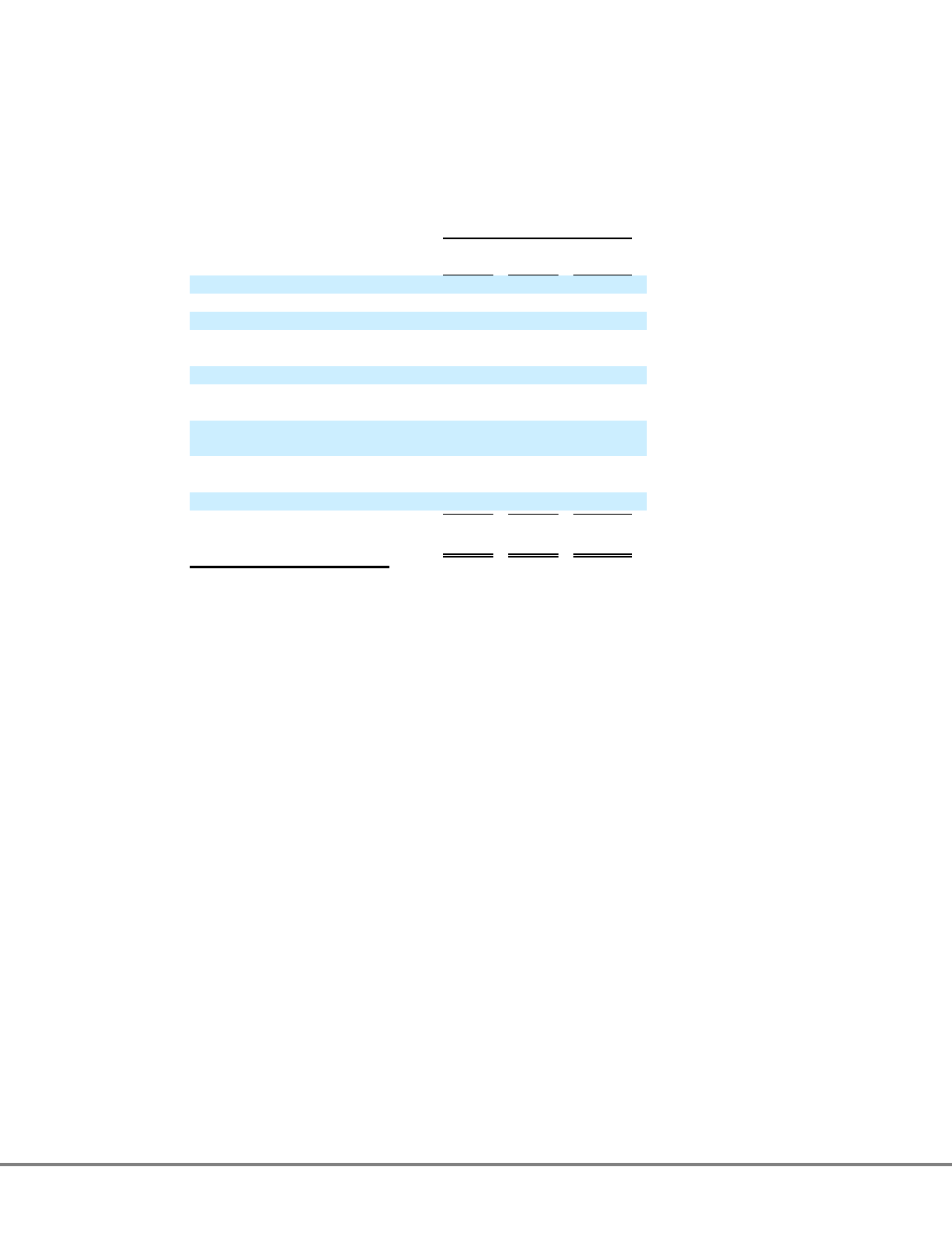

Fiscal Years Ended

(Dollars in millions)

July 2,

2010

July 3,

2009

(1)

June 27,

2008

(1)

Provision (benefit) at statutory rate

$

392

$

(985

)

$

461

Net U.S. state income tax provision

3

6

12

Permanent differences

2

9

10

Non

-deductible goodwill

impairments

—

813

—

Valuation allowance

(77

)

310

(37

)

Non

-U.S. losses with no tax

benefits

31

263

46

Non

-

U.S. earnings taxed at less than

statutory rate

(393

)

(138

)

(452

)

Tax expense related to

intercompany transactions

26

27

24

Other individually immaterial items

(24

)

6

3

Provision for (benefit from) income

taxes

$

(40

)

$

311

$

67

(1) As adjusted due to a required change in the accounting for convertible debt instruments implemented in the

first quarter of fiscal year 2010, applied on a retrospective basis.