Seagate 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

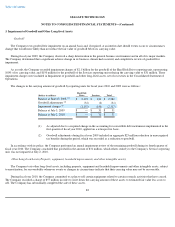

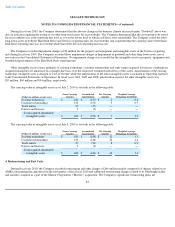

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

$300 Million Aggregate Principal Amount of Floating Rate Senior Notes due October 2009 (the "2009 Notes"). The 2009 Notes matured

and were repaid on October 1, 2009.

Convertible Notes

On July 4, 2009, the Company implemented a change in accounting in accordance with ASC 470-20, Debt with Conversion and Other

Options (formerly FSP APB 14-1, Accounting for Convertible Debt Instruments That May Be Settled in Cash upon Conversion (Including

Partial Cash Settlement)

), for its convertible debt instruments on a retrospective basis to separately account for its convertible debt in two parts,

(i) a debt component which was recorded upon acquisition at the estimated fair value of a similar debt instrument without the debt-for-equity

conversion feature; and (ii) an equity component that was included in paid-in capital and represents the estimated fair value of the conversion

feature at issuance. The bifurcation of the debt and equity components resulted in a discounted carrying value of the debt component compared

to the principal amount. The discount is accreted to the carrying value of the debt component through interest expense over the expected life of

the debt using the effective interest method.

$135 Million Aggregate Principal Amount of 6.8% Convertible Senior Notes due April 2010 (the "6.8% Notes"). The 6.8% Notes require

semi-annual interest payments payable on April 30 and October 30. The 6.8% Notes were originally assumed in the business combination with

Maxtor on May 19, 2006 and were recorded as long-term debt at a par value of $135 million and a substantial premium of $18 million, which

was recorded to Additional paid-in capital. The debt component of the 6.8% Notes at acquisition was determined to be $135 million, based on

the contractual cash flows discounted at 6.8%, which was the estimated rate of a comparable non-convertible debt instrument as of May 19,

2006. As a result, implementation of the new requirements of ASC 470-20 had no effect on the accounting for the 6.8% Notes. On April 30,

2010, the Company repaid the remaining 6.8% Notes for $77 million at maturity.

$326 Million Aggregate Principal Amount of 2.375% Convertible Senior Notes due August 2012 (the "2.375% Notes"). The 2.375%

Notes require semi

-annual interest payments payable on February 15 and August 15. The 2.375% Notes were originally assumed in the business

combination with Maxtor on May 19, 2006 and were recorded as Current portion of long-

term debt at par value of $326 million and a substantial

premium of $157 million, which was recorded to Additional paid-in capital. The debt component of the 2.375% Notes at acquisition was

determined to be $252 million, based on the contractual cash flows discounted at 6.9%, which was the estimated rate of a comparable non-

convertible debt instrument as of May 19, 2006. As a result of implementing ASC 470-

20, $74 million was recorded as an increase to Additional

paid-in capital and a corresponding debt discount as of the date of acquisition. The 2.375% Notes may, subject to certain conditions, be

converted into the Company's common shares based on a conversion rate of 60.6968 shares, per $1,000 principal amount of notes, which

represents a conversion price of approximately $16.48 per share. Effective April 3, 2010, the 2.375% Notes became convertible during the fourth

quarter of fiscal year 2010 as the Company's shares traded above 110% of the conversion price for at least 20 consecutive trading days of the last

30 trading days of the previous fiscal quarter (the "Share Price Condition"). On June 25, 2010, the Company issued a notice of redemption to the

holders of its 2.375% Notes to call the entire $326 million outstanding aggregate principal amount of the 2.375% Notes (the "2.375%

Redemption Notice"). As of July 3, 2010, the Share Price Condition was no longer satisfied and the conversion value did not exceed the

principal value on the 2.375% Notes; however, the 2.375% Notes continue to be convertible in accordance with their terms as a result of the

2.375% Redemption Notice. As a result, the 2.375% Notes are classified as Current portion of long-term debt on the Company's Consolidated

Balance Sheet at July 2, 2010. All outstanding 2.375% Notes were redeemed for cash on August 20, 2010 at a redemption price equal to

100.68% of their principal amount, plus accrued and unpaid interest to the redemption date.

87