Seagate 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

$3 million and an increase to goodwill of $25 million. The total amount of gross unrecognized tax benefits as of the date of adoption was

$385 million excluding interest and penalties.

As of July 2, 2010 and July 3, 2009, the Company had approximately $115 million and $118 million, respectively, in unrecognized tax

benefits excluding interest and penalties. The amount of unrecognized tax benefits, if recognized, that would impact the effective tax rate were

$115 million and $118 million as of July 2, 2010 and July 3, 2009, respectively, subject to certain future valuation allowance reversal.

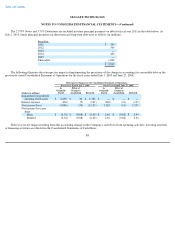

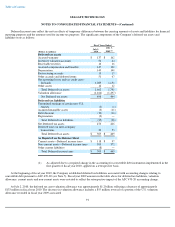

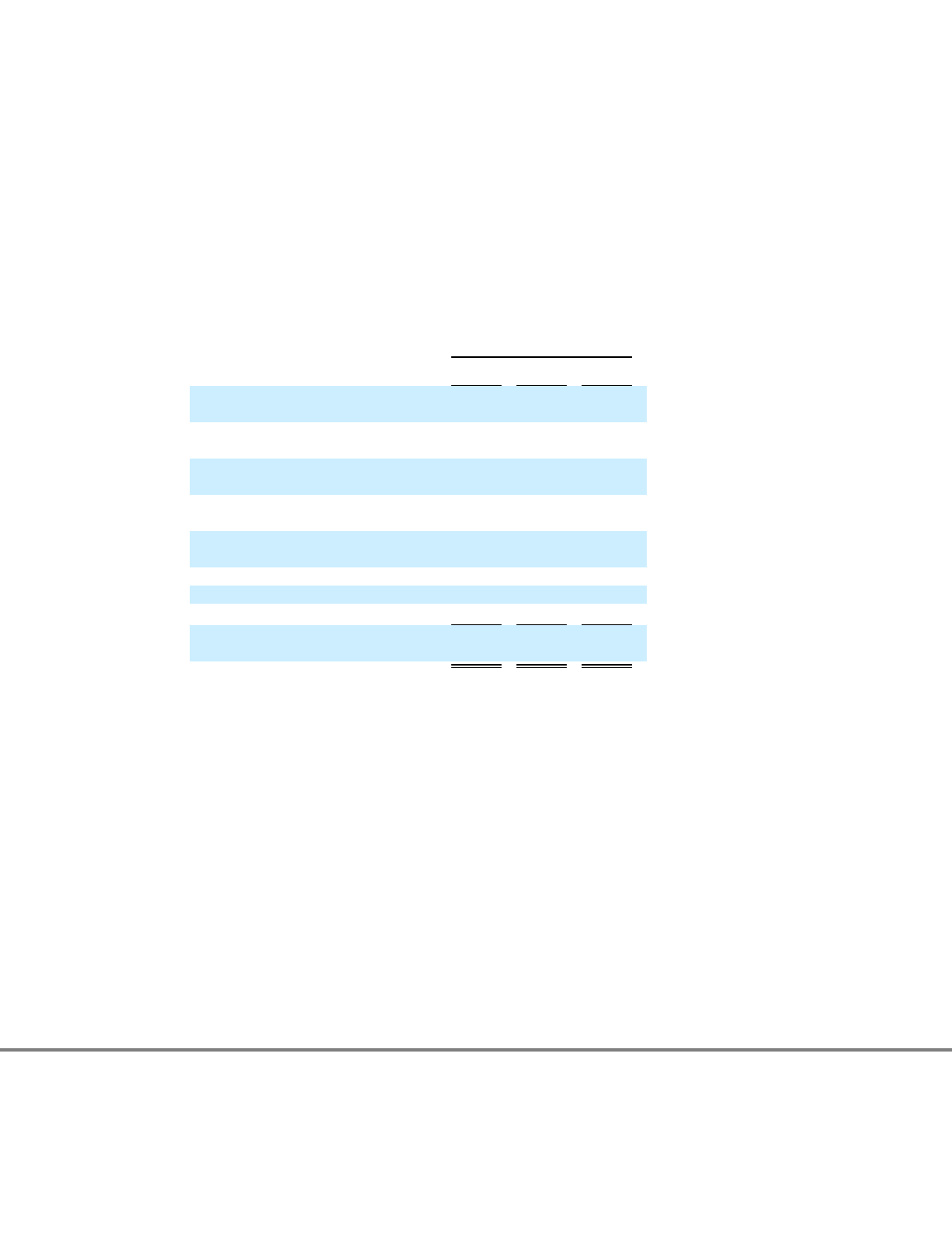

The following table summarizes the activity related to the Company's gross unrecognized tax benefits:

It is the Company's policy to include interest and penalties related to unrecognized tax benefits in the provision for taxes on the

Consolidated Statements of Operations. During fiscal year 2010, the Company recognized a net benefit for interest and penalties of $1 million as

compared to a net benefit of $6 million during fiscal year 2009 and an expense of $3 million during fiscal year 2008. As of July 2, 2010, the

Company had $15 million of accrued interest and penalties related to unrecognized tax benefits as compared to $16 million as of July 3, 2009.

During the fiscal year ended July 2, 2010, the Company's unrecognized tax benefits excluding interest and penalties decreased by

approximately $3 million primarily due to (i) reductions associated with the expiration of certain statutes of limitation of $3 million,

(ii) reductions associated with effectively settled positions of $4 million, (iii) a reduction of $5 million associated with interpretation of tax law

as a result of the final 9

th

Circuit Court of Appeals' decision relating to stock based compensation deductions, (iv) increases in current year

unrecognized tax benefits of $6 million, and (v) increases from other activity, including non-U.S. exchange losses, of $3 million.

During the 12 months beginning July 3, 2010, the Company expects to reduce its unrecognized tax benefits by approximately $5 million as

a result of the expiration of certain statutes of limitation. The Company does not believe it is reasonably possible that other unrecognized tax

benefits will materially change in the next 12 months. However, the resolution and/or timing of closure on open audits are highly uncertain as to

when these events occur.

94

Fiscal Years Ended

(Dollars in millions)

July 2,

2010 July 3,

2009 July 3,

2008

Balance of unrecognized tax benefits

at the beginning of the year

$

118

$

374

$

385

Gross increase for tax positions of

prior years

2

49

3

Gross decrease for tax positions of

prior years

(5

)

(287

)

(13

)

Gross increase for tax positions of

current year

6

13

12

Gross decrease for tax positions of

current year

—

—

(

3

)

Settlements

(4

)

—

(

1

)

Lapse of statutes of limitation

(3

)

(23

)

(9

)

Non

-

U.S. exchange (gain)/loss

1

(8

)

—

Balance of unrecognized tax benefits

at the end of the year

$

115

$

118

$

374