Seagate 2009 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2009 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

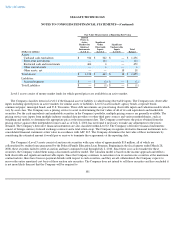

September 5, 2004 expiring seven years from the date of grant. As of July 2, 2010, there were approximately 3.3 million common shares

available for issuance under the SOP.

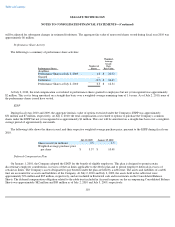

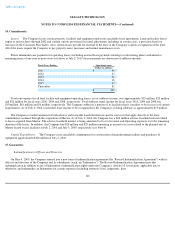

Seagate Technology 2004 Stock Compensation Plan —On August 5, 2004, the Company's board of directors adopted the Seagate

Technology 2004 Stock Compensation Plan (the "SCP"), and on October 28, 2004, the Company's shareholders approved the SCP. A maximum

of 63.5 million common shares is issuable under the SCP, including 10 million authorized for issuance of share awards. Options granted to

employees generally vest as follows: 25% of the shares on the first anniversary of the vesting commencement date and the remaining 75%

proportionately each month over the next 36 months. Share awards granted to employees generally vest 25% annually. As of July 2, 2010, there

were approximately 17 million common shares available for issuance under the SCP.

Seagate Technology Employee Stock Purchase Plan (the "ESPP") —The Company established the Seagate Technology Employee Stock

Purchase Plan in December 2002. As of July 2, 2010, there were 40 million common shares authorized to be issued under the ESPP. In no event

shall the total number of shares issued under the ESPP exceed 75 million common shares. The ESPP consists of a six-

month offering period with

a maximum issuance of 1.5 million common shares per offering period. The ESPP permits eligible employees who have completed 20 days of

employment prior to the commencement of any offering period to purchase common shares through payroll deductions generally at 85% of the

fair market value of the common shares. As of July 2, 2010, there were approximately 10 million common shares available for issuance under

the ESPP.

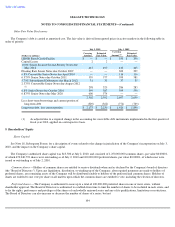

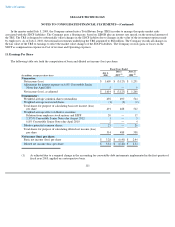

Determining Fair Value

Valuation and amortization method —The Company estimates the fair value of stock options granted using the Black-Scholes-Merton

valuation model and a single option award approach. This fair value is then amortized on a straight-line basis over the requisite service periods

of the awards, which is generally the vesting period or the remaining service (vesting) period.

Expected Term —Expected term represents the period that the Company's stock-based awards are expected to be outstanding and was

determined based on historical experience of similar awards, giving consideration to the contractual terms of the stock-based awards, vesting

schedules and expectations of future employee behavior as influenced by changes to the terms of its stock-based awards.

Expected Volatility —The Company uses a combination of the implied volatility of its traded options and historical volatility of its share

price.

Expected Dividend —The Black-Scholes-Merton valuation model calls for a single expected dividend yield as an input. The dividend yield

is determined by dividing the expected per share dividend during the coming year by the grant date share price. The expected dividend

assumption is based on the Company's current expectations about its anticipated dividend policy. Also, because the expected dividend yield

should reflect marketplace participants' expectations, the Company does not incorporate changes in dividends anticipated by management unless

those changes have been communicated to or otherwise are anticipated by marketplace participants.

Risk-Free Interest Rate —The Company bases the risk-free interest rate used in the Black-Scholes-Merton valuation model on the implied

yield currently available on U.S. Treasury zero

-coupon issues with an equivalent remaining term. Where the expected term of the Company's

stock-based awards do not correspond with the terms for which interest rates are quoted, the Company performed a straight-line interpolation to

determine the rate from the available term maturities.

107