Seagate 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

During fiscal year 2009, the Company determined that the adverse change in the business climate discussed under "Goodwill" above was

also an indicator requiring the testing of its other long-lived assets for recoverability. The Company determined that the asset group to be tested

for recoverability was at the reporting unit level as it was the lowest level at which cash flows were identifiable. The Company tested the other

long-lived assets of both the Hard Disk Drive and Services reporting units for recoverability and concluded that the carrying value of the Hard

Disk Drive reporting unit was recoverable while that of the Services reporting unit was not.

The Company recorded impairment charges of $3 million for the property and equipment and intangible assets of the Services reporting

unit during fiscal year 2009. The Company recorded these impairment charges in Impairment of goodwill and other long-lived assets, net of

recoveries in the Consolidated Statement of Operations. No impairment charge was recorded for the intangible assets or property, equipment and

leasehold improvements of the Hard Disk Drive reporting unit.

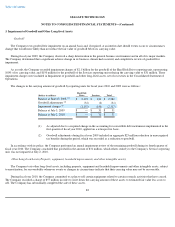

Other intangible assets consist primarily of existing technology, customer relationships and trade names acquired in business combinations.

Acquired intangibles are amortized on a straight-line basis over the respective estimated useful lives of the assets. Amortization of the existing

technology intangible asset is charged to Cost of revenue while the amortization of the other intangible assets is included in Operating expenses

in the Consolidated Statements of Operations. In fiscal years 2010, 2009 and 2008, amortization expense for other intangible assets was

$35 million, $69 million and $94 million, respectively.

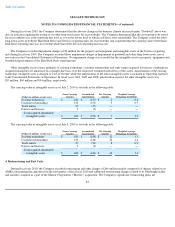

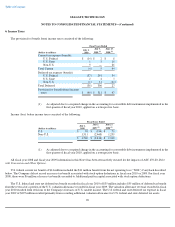

The carrying value of intangible assets as of July 2, 2010 is set forth in the following table:

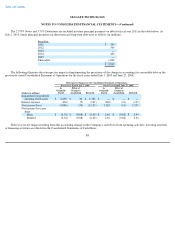

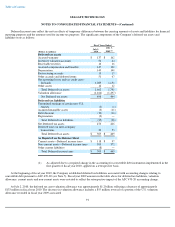

The carrying value of intangible assets as of July 3, 2009 is set forth in the following table:

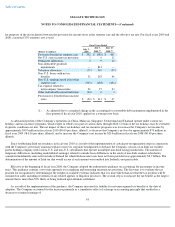

4. Restructuring and Exit Costs

During fiscal year 2010, the Company recorded restructuring and other charges of $66 million mainly comprised of charges related to its

AMK restructuring plan announced in the first quarter of fiscal year 2010 and additional restructuring charges related to its Pittsburgh facility

and facilities acquired as a part of the Maxtor Corporation ("Maxtor") acquisition. The Company's significant restructuring plans are

83

(Dollars in millions, except years)

Gross Carrying

Amount Accumulated

Amortization Net Carrying

Amount Weighted Average

Remaining Useful Life

Existing technology

$

181

$

(177

)

$

4

0.6

Customer relationships

156

(153

)

3

0.9

Trade names

37

(37

)

—

—

Patents and licenses

9

(9

)

—

—

Total acquired identifiable

intangible assets

$

383

$

(376

)

$

7

1.0

(Dollars in millions, except years)

Gross Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Weighted Average

Remaining Useful Life

Existing technology

$

181

$

(169

)

$

12

1.5

Customer relationships

156

(134

)

22

1.2

Trade names

37

(29

)

8

0.9

Patents and licenses

9

(9

)

—

—

Total acquired identifiable

intangible assets

$

383

$

(341

)

$

42

1.3