Seagate 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

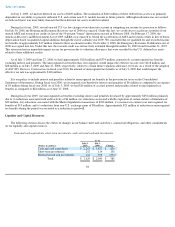

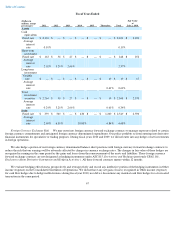

The table below provides information as of July 2, 2010 about our foreign currency forward exchange contracts. The table is provided in

U.S. dollar equivalent amounts and presents the notional amounts (at the contract exchange rates) and the weighted average contractual foreign

currency exchange rates.

Other Market Risks. We have exposure to counterparty credit downgrades in the form of credit risk related to our accounts receivable

balances, our foreign currency forward exchange contracts and our fixed income portfolio. We monitor and limit our credit exposure for both our

accounts receivable balances and our foreign currency forward exchange contracts by performing ongoing credit evaluations. We also manage

the notional amount of contracts entered into with any one counterparty, and we maintain limits on maximum tenor of contracts based on the

credit rating of the financial institutions. Additionally, the investment portfolio is diversified and structured to minimize credit risk. As of July 2,

2010, we had counterparty credit exposure of $7 million comprised of the mark-to-market valuation related to our foreign currency forward

exchange contracts in a gain position. Changes in our corporate issuer credit ratings have minimal impact on our financial results, but

downgrades may negatively impact our future transaction costs and our ability to execute transactions with various counterparties.

We have exposure to equity market risks due to changes in the fair value of the notional investments selected by our employees as part of

our Non-qualified Deferred Compensation Plan—the Seagate Deferred Compensation Plan (the "SDCP"). In the quarter ended July 3, 2009, we

entered into a Total Return Swap (TRS) in order to manage the equity market risks associated with the SDCP plan liabilities. We pay a floating

rate, based on LIBOR plus a spread, on the notional amount of the TRS. The TRS is designed to substantially offset changes in the SDCP plan

liability due to changes in the value of the investment options made by employees. The contract term of the TRS is one year and is settled on a

monthly basis therefore limiting counterparty performance risk. The terms of the TRS required us to pledge initial collateral of $18 million to the

counterparty for the term of the contract. Additional collateral may be posted contingent on the counterparty's exposure to the market value of

the TRS. As of July 2, 2010, we had $18 million pledged to the counterparty, recorded as restricted cash.

During fiscal year 2010, approximately $1 million of our auction rate securities were called by the issuers. As of July 2, 2010, we continued

to hold auction rate securities with a par value of approximately $19 million, all of which are collateralized by student loans guaranteed by the

Federal Family Education Loan Program. Beginning in the March 2008 quarter, these securities have continuously failed to settle at auction. As

of July 2, 2010, the estimated fair value of these auction rate securities was $17 million. We believe that the impairments totaling $2 million are

temporary as we do not intend to sell these securities and have concluded it is not more likely than not that we will be required to sell the

securities before the recovery of the amortized cost basis. As such, the impairment was recorded in Other comprehensive income (loss) and these

securities were classified as long-term investments.

68

(Dollars in millions, except

average contract rate)

Notional

Amount

Average

Contract Rate

Estimated Fair

Value

(1)

Foreign currency forward

exchange contracts:

Singapore Dollar

$

92

1.41

$

2

Thai Baht

569

32.53

5

Japanese Yen

1

93.30

—

Czech Koruna

10

20.62

—

Total

$

672

$

7

(1)

Equivalent to the unrealized net gain (loss) on existing contracts.