Seagate 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

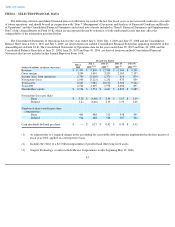

Since we became an Irish tax resident in fiscal year 2010, the Irish statutory rate of 25% is used for purposes of the reconciliation between

the provision for income taxes at the statutory rate and our effective tax rate. For fiscal years 2009 and 2008, a notional 35% statutory rate was

used.

Our income tax benefit recorded for fiscal year 2010 differed from the provision (benefit) for income taxes that would be derived by

applying the Irish statutory rate of 25% to income before income taxes primarily due to the net effect of (i) tax benefits related to earnings in

countries where we have tax holidays and tax incentive programs which are indefinitely reinvested outside of Ireland, (ii) a decrease in valuation

allowance for certain deferred tax assets, (iii) non-U.S. losses with no tax benefit, and (iv) tax expense related to intercompany transactions. Our

provision for income taxes recorded for the comparative fiscal year ended July 3, 2009 differed from the provision for income taxes that would

be derived by applying a notional U.S. 35% rate to income before income taxes primarily due to the net effect of (i) non-deductible goodwill

impairments, (ii) an increase in our valuation allowance for certain deferred tax assets, (iii) non-U.S. losses with no tax benefit, (iv) tax benefits

related to tax holiday and tax incentive programs, and (v) tax expense related to intercompany transactions.

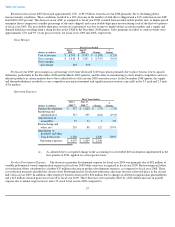

Based on our non-U.S. ownership structure and subject to (i) potential future increases in our valuation allowance for deferred tax assets;

and (ii) a future change in our intention to indefinitely reinvest earnings our subsidiaries outside of Ireland, we anticipate that our effective tax

rate in future periods will generally be less than the Irish statutory rate. Dividend distributions received from our U.S. subsidiaries may be

subject to U.S. withholding taxes when and if distributed.

The amount of temporary differences (including undistributed earnings) related to outside basis differences in the stock of non-

Irish resident

subsidiaries considered indefinitely reinvested outside of Ireland for which Irish income taxes have not been provided was approximately

$2.7 billion. The determination of the amount of Irish tax that would accrue if such amount was remitted into Ireland is not practicable.

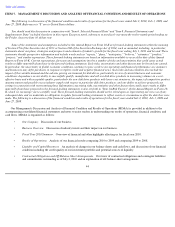

At July 2, 2010, our deferred tax asset valuation allowance was approximately $1.2 billion reflecting a decrease of approximately

$133 million in fiscal year 2010. The decrease in the valuation allowance includes a $55 million reversal of a portion of the U.S. valuation

allowance recorded in fiscal year 2009 associated with revisions to our forecasts of U.S. taxable income and a decrease associated with the

utilization of tax net operating loss carry forwards in fiscal year 2010. As of July 3, 2009, the deferred tax asset valuation allowance was

approximately $1.3 billion reflecting an increase of approximately $864 million in fiscal year 2009. The increase in valuation allowance resulted

primarily from the liquidation of our wholly owned subsidiary, Maxtor, effective June 1, 2009 and represented the net effects of the

extinguishment of all deferred tax assets related to historical carryover tax attributes of Maxtor and the increase in deferred tax assets related to

tax net operating losses incurred in connection with the liquidation transaction.

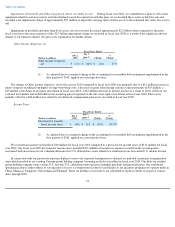

At July 2, 2010, we had net deferred tax assets of $505 million. The realization of $473 million of these deferred tax assets is primarily

dependent on our ability to generate sufficient U.S. and certain non-U.S. taxable income in future periods. Although realization is not assured,

we believe that it is more likely than not that these deferred tax assets will be realized. The amount of deferred tax assets considered realizable,

however, may increase or decrease in subsequent periods when we re-evaluate the underlying basis for our estimates of future U.S. and certain

non-U.S. taxable income.

During fiscal year ended July 2, 2010, an enacted legislative change in U.S. tax law was taken into account in computing our income tax

provision. The Worker, Homeownership, and Business Assistance Act of 2009, was enacted on November 6, 2009. This law allowed us to elect

an increased carryback period for net operating losses incurred in 2008 or 2009 from two years to three, four or five years at our option. We

recorded an $11 million income tax benefit as a result of the increased carryback period.

53