Seagate 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

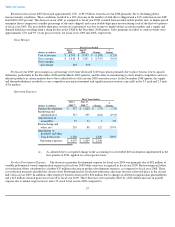

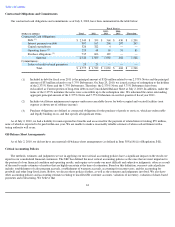

Contractual Obligations and Commitments

Our contractual cash obligations and commitments as of July 2, 2010, have been summarized in the table below:

As of July 2, 2010, we had a liability for unrecognized tax benefits and an accrual for the payment of related interest totaling $59 million,

none of which is expected to be paid within one year. We are unable to make a reasonably reliable estimate of when cash settlement with a

taxing authority will occur.

Off-Balance Sheet Arrangements

As of July 2, 2010, we did not have any material off-balance sheet arrangements (as defined in Item 303(a)(4)(ii) of Regulation S-K).

Critical Accounting Policies

The methods, estimates and judgments we use in applying our most critical accounting policies have a significant impact on the results we

report in our consolidated financial statements. The SEC has defined the most critical accounting policies as the ones that are most important to

the portrayal of our financial condition and operating results, and require us to make our most difficult and subjective judgments, often as a result

of the need to make estimates of matters that are highly uncertain at the time of estimation. Based on this definition, our most critical policies

include: establishment of sales program accruals, establishment of warranty accruals, accounting for income taxes, and the accounting for

goodwill and other long-lived assets. Below, we discuss these policies further, as well as the estimates and judgments involved. We also have

other accounting policies and accounting estimates relating to uncollectible customer accounts, valuation of inventory, valuation of share-based

payments and restructuring. We believe that

63

Fiscal Year(s)

(Dollars in millions)

Total

2011

2012-

2013

2014-

2015

Thereafter

Contractual Cash Obligations:

Debt

(1)

$

2,549

$

359

$

560

$

430

$

1,200

Interest payments on debt

907

165

268

207

267

Capital expenditures

326

322

4

—

—

Operating leases

(2)

229

48

69

31

81

Purchase obligations

(3)

735

606

129

—

—

Subtotal

4,746

1,500

1,030

668

1,548

Commitments:

Letters of credit or bank guarantees

29

29

—

—

—

Total

$

4,775

$

1,529

$

1,030

$

668

$

1,548

(1) Included in debt for fiscal year 2011 is the principal amount of $326 million related to our 2.375% Notes and the principal

amount of $33 million related to our 5.75% Debentures. On June 25, 2010, we issued a notice of redemption to the holders

of the 2.375% Notes and the 5.75% Debentures. Therefore, the 2.375% Notes and 5.75% Debentures have been

reclassified as Current portion of long-term debt on our Consolidated Balance Sheet at July 2, 2010. In addition, under the

terms of the 2.375% indenture the notes were convertible up to the redemption date. We redeemed the entire outstanding

aggregate principal amount of the 2.375% Notes and 5.75% Debentures in our first quarter of fiscal year 2011.

(2) Includes total future minimum rent expense under non-cancelable leases for both occupied and vacated facilities (rent

expense is shown net of sublease income).

(3) Purchase obligations are defined as contractual obligations for the purchase of goods or services, which are enforceable

and legally binding on us, and that specify all significant terms.