Seagate 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

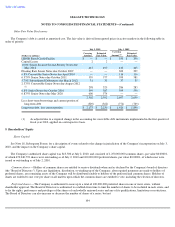

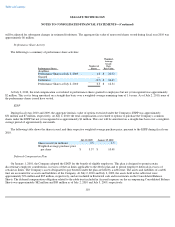

Other Fair Value Disclosures

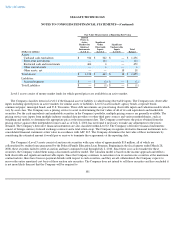

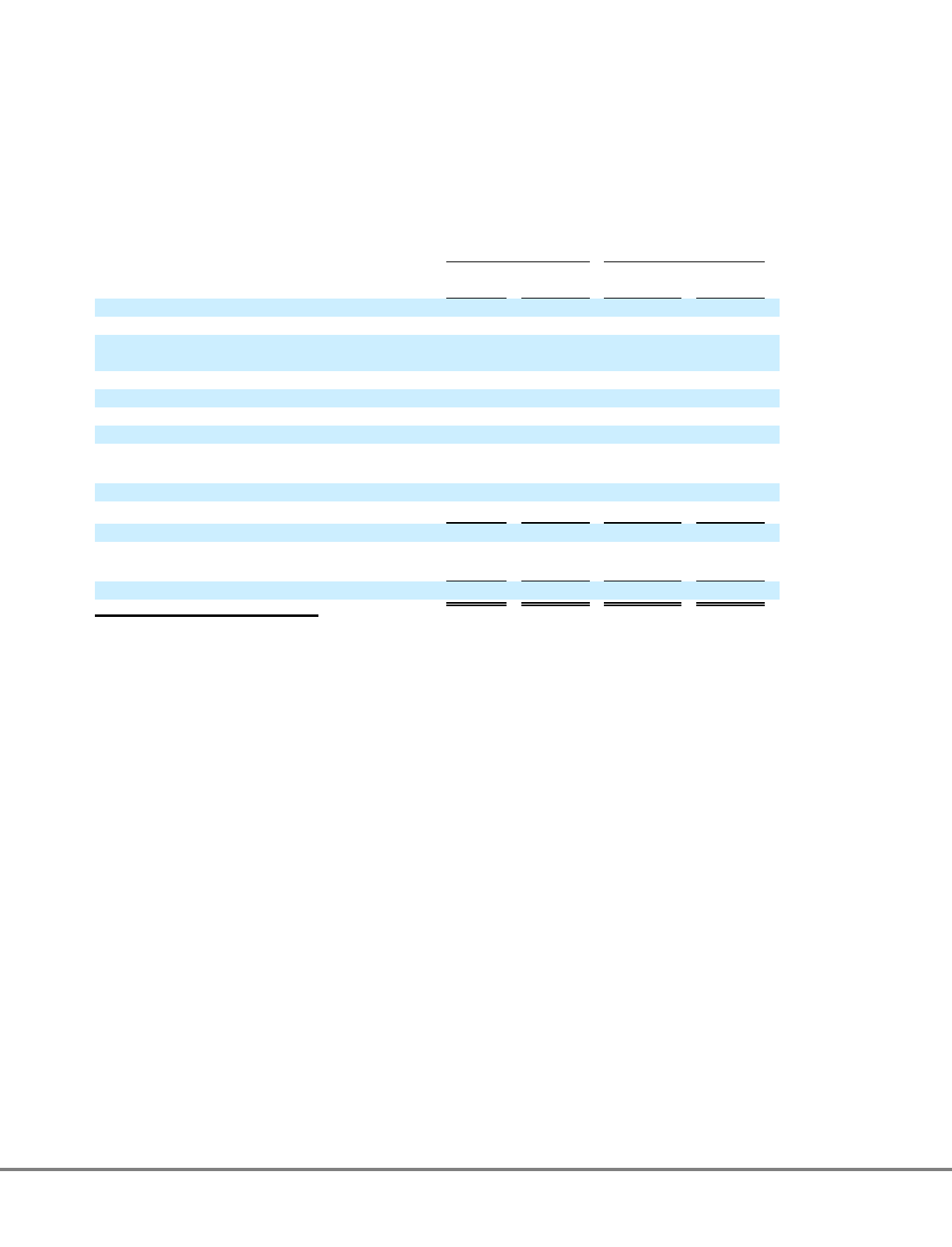

The Company's debt is carried at amortized cost. The fair value is derived from quoted prices in active markets in the following table in

order of priority:

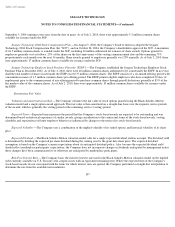

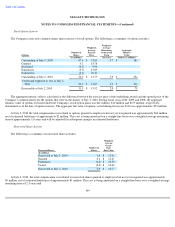

9. Shareholders' Equity

Share Capital

See Note 18, Subsequent Events, for a description of events related to the change in jurisdiction of the Company's incorporation on July 3,

2010, and the impact on the Company's share capital.

The Company's authorized share capital was $13,500 at July 2, 2010, and consisted of 1,250,000,000 common shares, par value $0.00001,

of which 470,240,793 shares were outstanding as of July 2, 2010 and 100,000,000 preferred shares, par value $0.00001, of which none were

issued or outstanding as of July 2, 2010.

Common shares —Holders of common shares are entitled to receive dividends when and as declared by the Company's board of directors

(the "Board of Directors"). Upon any liquidation, dissolution, or winding up of the Company, after required payments are made to holders of

preferred shares, any remaining assets of the Company will be distributed ratably to holders of the preferred and common shares. Holders of

shares are entitled to one vote per share on all matters upon which the common shares are entitled to vote, including the election of directors.

Preferred shares —The Company is authorized to issue up to a total of 100,000,000 preferred shares in one or more series, without

shareholder approval. The Board of Directors is authorized to establish from time to time the number of shares to be included in each series, and

to fix the rights, preferences and privileges of the shares of each wholly unissued series and any of its qualifications, limitations or restrictions.

The Board of Directors can also increase or decrease the number of shares of a series, but not

104

July 2, 2010

July 3, 2009

(Dollars in millions)

Carrying

Amount

Estimated

Fair Value

Carrying

Amount

(1)

Estimated

Fair Value

LIBOR Based Credit Facility

$

—

$

—

$

350

$

350

Capital Leases

2

2

—

—

10.0% Senior Secured Second

-

Priority Notes due

May 2014

413

490

410

445

Floating Rate Senior Notes due October 2009

—

—

300

299

6.8% Convertible Senior Notes due April 2010

—

—

116

116

6.375% Senior Notes due October 2011

559

577

599

581

5.75% Subordinated Debentures due March 2012

31

33

37

35

2.375% Convertible Senior Notes due August 2012

(1)

298

329

286

283

6.8% Senior Notes due October 2016

599

587

599

550

6.875% Senior Notes due May 2020

600

574

—

—

2,502

2,592

2,697

2,659

Less short

-

term borrowings and current portion of

long

-

term debt

(329

)

(362

)

(771

)

(769

)

Long

-

term debt, less current portion

$

2,173

$

2,230

$

1,926

$

1,890

(1) As adjusted due to a required change in the accounting for convertible debt instruments implemented in the first quarter of

fiscal year 2010, applied on a retrospective basis.