Seagate 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

the TRS required the Company to pledge initial collateral of $18 million to the counterparty for the term of the contract. Additional collateral

may be posted contingent on the counterparty's exposure to the market value of the TRS. The cash pledged is recorded as restricted cash. The

Company did not designate the TRS as a hedge. Rather, the Company records all changes in the fair value of the TRS to earnings to offset the

market value changes of the SDCP liabilities.

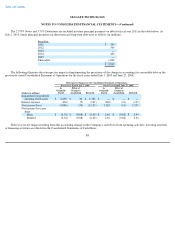

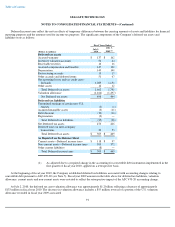

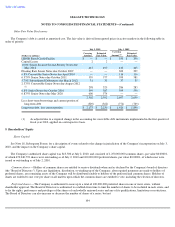

The following table shows the Company's derivative instruments measured at gross fair value as reflected in the Consolidated Balance

Sheet as of July 2, 2010:

Fair Values of Derivative Instruments

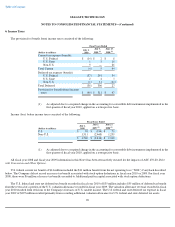

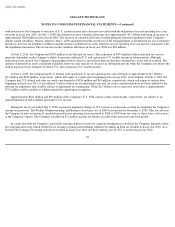

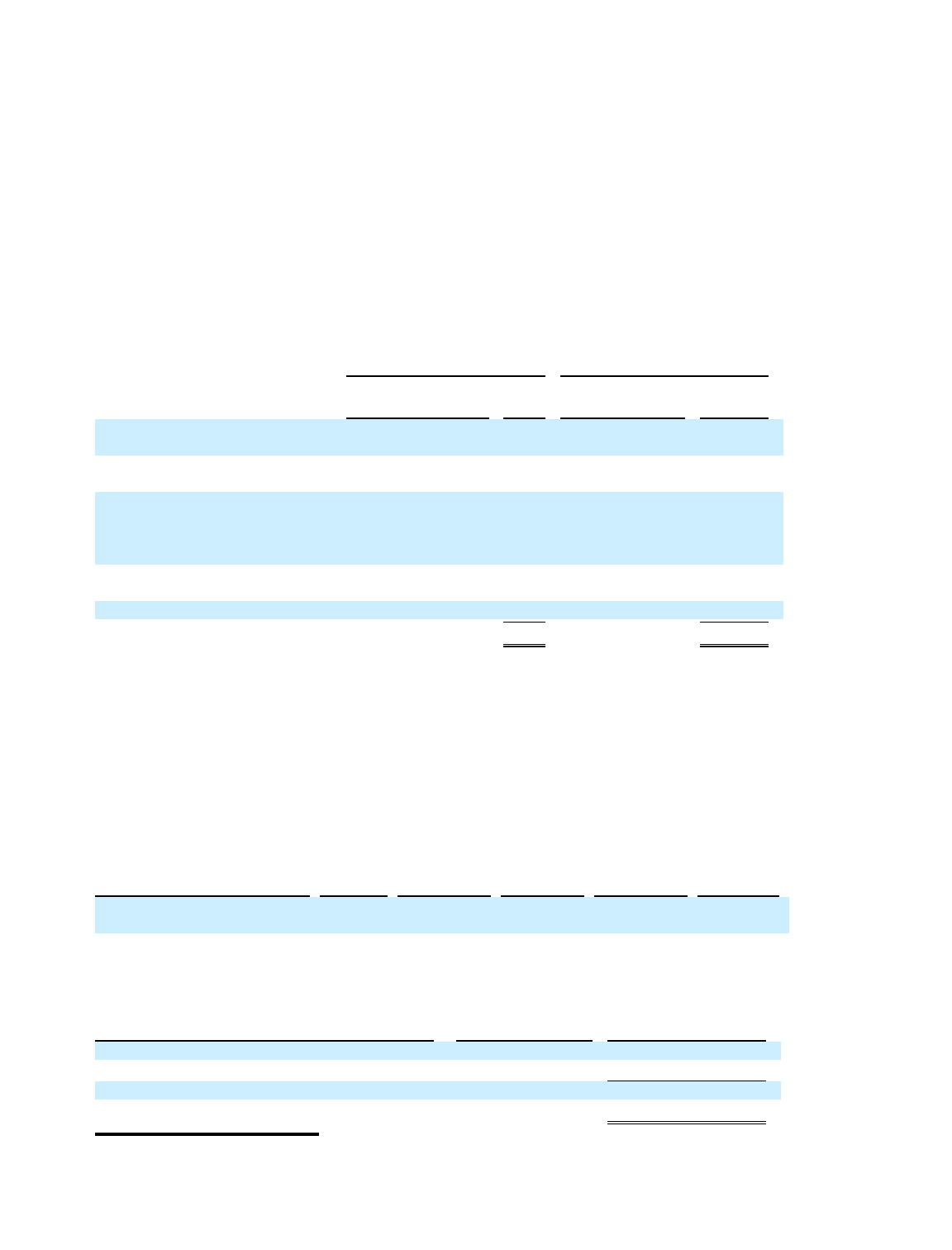

The following tables show the effect of the Company's derivative instruments on Other comprehensive income (loss) (OCI) and the

Consolidated Statement of Operations for the fiscal year ended July 2, 2010:

Asset Derivatives Liability Derivatives

(Dollars in millions)

Balance

Sheet

Location

Fair

Value

Balance

Sheet

Location

Fair

Value

Derivatives designated as hedging

instruments under ASC 815:

Foreign currency forward

exchange contracts

Other current assets

$

5

Accrued expenses

$

—

Derivatives not designated as

hedging instruments under

ASC 815:

Foreign currency forward

exchange contracts

Other current assets

$

2

Accrued expenses

$

—

Total return swap

Other current assets

—

Accrued expenses

(1

)

Total derivatives

$

7

$

(1

)

(Dollars in millions)

Derivatives Designated as Cash Flow

Hedges under ASC 815

Amount of

Gain or

(Loss)

Recognized

in OCI on

Derivative

(Effective

Portion)

Location of Gain

or (Loss)

Reclassified

from

Accumulated

OCI into

Income

(Effective

Portion)

Amount of

Gain or (Loss)

Reclassified

from

Accumulated

OCI into

Income

(Effective

Portion)

Location of Gain

or (Loss)

Recognized in

Income on

Derivative

(Ineffective

Portion and

Amount

Excluded

from

Effectiveness

Testing)

Amount of

Gain

or (Loss)

Recognized in

Income

(Ineffective

Portion and

Amount

Excluded from

Effectiveness

Testing)

(a)

Foreign currency forward

exchange contracts

$

14

Cost of

revenue

$

10

Cost of

revenue

$

1

Derivatives Not Designated as Hedging Instruments under

Statement ASC 815

Location of Gain or

(Loss) Recognized in

Income on Derivative

Amount of Gain or

(Loss) Recognized in

Income on Derivative

Foreign currency forward exchange contracts

Other, net

$

14

Total return swap

Operating expenses

9

$

23

(a) The amount of gain or (loss) recognized in income represents $0 related to the ineffective portion of the hedging

relationships and $1 million related to the amount excluded from the assessment of hedge effectiveness, for the fiscal year

ended July 2, 2010, respectively.