Seagate 2009 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2009 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

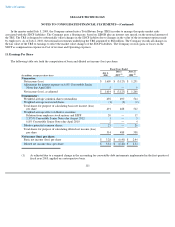

14. Commitments

Leases. The Company leases certain property, facilities and equipment under non-cancelable lease agreements. Land and facility leases

expire at various dates through 2082 and contain various provisions for rental adjustments including, in certain cases, a provision based on

increases in the Consumer Price Index. Also, certain leases provide for renewal of the lease at the Company's option at expiration of the lease.

All of the leases require the Company to pay property taxes, insurance and normal maintenance costs.

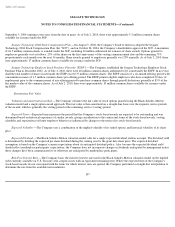

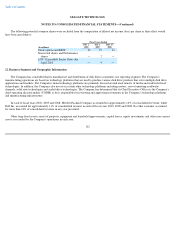

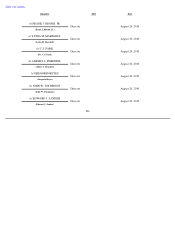

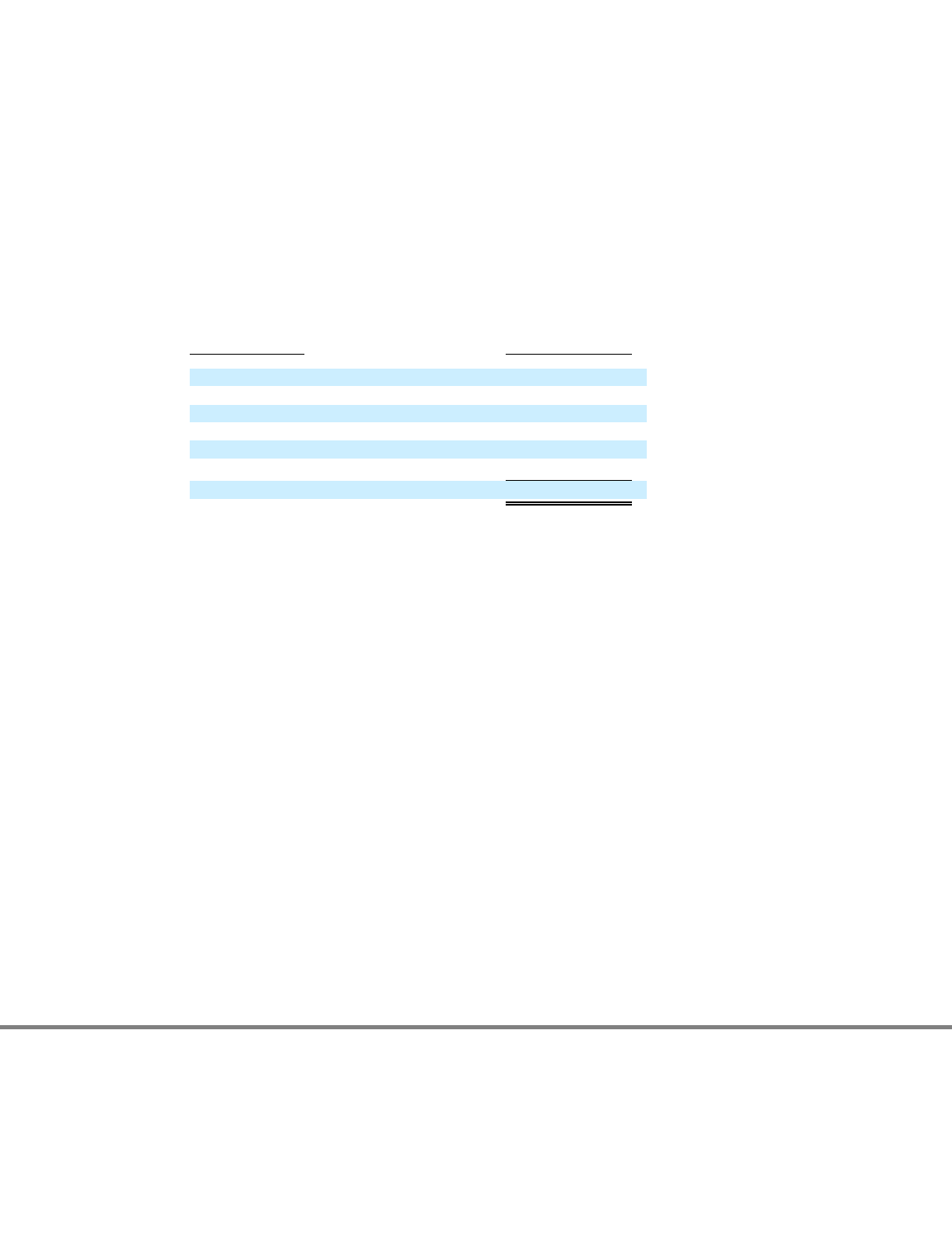

Future minimum lease payments for operating leases (including accrued lease payments relating to restructuring plans) with initial or

remaining terms of one year or more were as follows at July 2, 2010 (lease payments are shown net of sublease income):

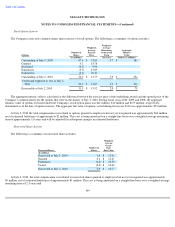

Total rent expense for all land, facility and equipment operating leases, net of sublease income, was approximately $25 million, $23 million

and $32 million for fiscal years 2010, 2009 and 2008, respectively. Total sublease rental income for fiscal years 2010, 2009 and 2008 was

$10 million, $10 million and $6 million, respectively. The Company subleases a portion of its facilities that it considers to be in excess of current

requirements. As of July 2, 2010, total future lease income to be recognized for the Company's existing subleases is approximately $15 million.

The Company recorded amounts for both adverse and favorable leasehold interests and for exit costs that apply directly to the lease

commitments assumed through the acquisition of Maxtor. As of July 2, 2010, the Company has a $30 million adverse leasehold interest related

to leases acquired from Maxtor. The adverse leasehold interest is being amortized to Cost of revenue and Operating expenses over the remaining

duration of the leases. In addition, the Company had $24 million and $29 million remaining in accrued exit costs related to the planned exit of

Maxtor leased excess facilities at July 2, 2010 and July 3, 2009, respectively (see Note 4).

Capital Expenditures. The Company's non-cancelable commitments for construction of manufacturing facilities and purchases of

equipment approximated $326 million at July 2, 2010.

15. Guarantees

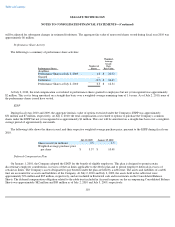

Indemnifications to Officers and Directors

On May 4, 2009, the Company entered into a new form of indemnification agreement (the "Revised Indemnification Agreement") with its

officers and directors of the Company and its subsidiaries (each, an "Indemnitee"). The Revised Indemnification Agreement provides

indemnification in addition to any of Indemnitee's indemnification rights under the Company's Articles of Association, applicable law or

otherwise, and indemnifies an Indemnitee for certain expenses (including attorneys' fees), judgments, fines

116

Fiscal Years Ending

Operating Leases

(Dollars in millions)

2011

$

48

2012

43

2013

26

2014

18

2015

13

Thereafter

81

$

229