Seagate 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Fiscal Years Ended

Foreign Currency Exchange Risk. We may enter into foreign currency forward exchange contracts to manage exposure related to certain

foreign currency commitments and anticipated foreign currency denominated expenditures. Our policy prohibits us from entering into derivative

financial instruments for speculative or trading purposes. During fiscal years 2010 and 2009, we did not enter into any hedges of net investments

in foreign operations.

We also hedge a portion of our foreign currency denominated balance sheet positions with foreign currency forward exchange contracts to

reduce the risk that our earnings will be adversely affected by changes in currency exchange rates. The changes in fair value of these hedges are

recognized in earnings in the same period as the gains and losses from the remeasurement of the assets and liabilities. These foreign currency

forward exchange contracts are not designated as hedging instruments under ASC 815, Derivatives and Hedging (previously SFAS 161,

Disclosures About Derivative Instruments and Hedging Activities

). All these forward contracts mature within 12 months.

We evaluate hedging effectiveness prospectively and retrospectively and record any ineffective portion of the hedging instruments in Other

income (expense) on the Consolidated Statements of Operations. We did not have any net gains (losses) recognized in Other income (expense)

for cash flow hedges due to hedge ineffectiveness during fiscal year 2010, nor did we discontinue any material cash flow hedges for a forecasted

transaction in the same period.

67

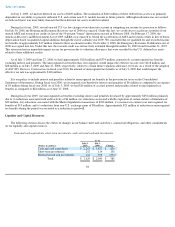

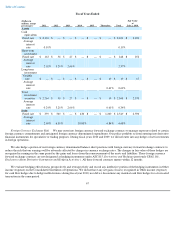

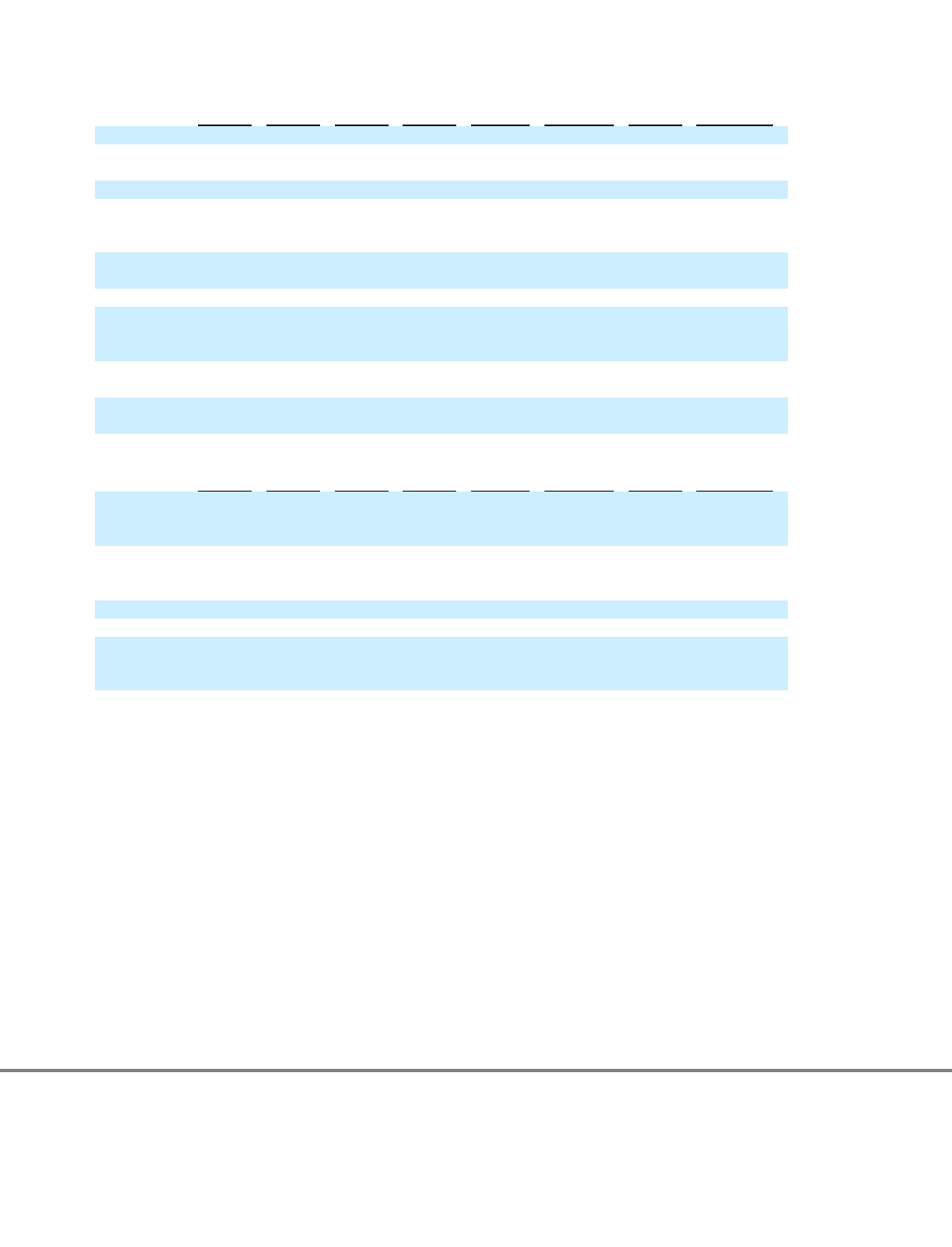

(Dollars in

millions, except

percentages)

2011 2012 2013 2014 2015 Thereafter Total

Fair Value

at

July 2, 2010

Assets

Cash

equivalents:

Fixed rate

$

2,101

$

—

$

—

$

—

$

—

$

—

$

2,101

$

2,101

Average

interest

rate

0.10

%

0.10

%

Short

-

term

investments:

Fixed rate

$

163

$

58

$

27

$

—

$

—

$

—

$

248

$

252

Average

interest

rate

2.02

%

3.20

%

2.66

%

2.37

%

Long

-

term

investments:

Variable

rate

$

—

$

—

$

—

$

—

$

—

$

19

$

19

$

17

Average

interest

rate

0.61

%

0.61

%

Total

investment

securities

$

2,264

$

58

$

27

$

—

$

—

$

19

$

2,368

$

2,370

Average

interest

rate

0.24

%

3.20

%

2.66

%

0.61

%

0.34

%

Debt

Fixed rate

$

359

$

560

$

—

$

430

$

—

$

1,200

$

2,549

$

2,590

Average

interest

rate

2.69

%

6.38

%

10.00

%

6.84

%

6.68

%