Seagate 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

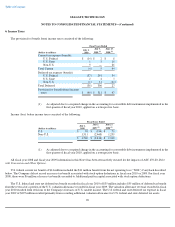

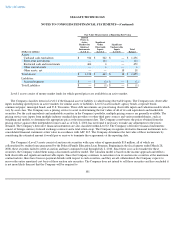

The following tables show the effect of the Company's derivative instruments on OCI and the Consolidated Statement of Operations for the

fiscal year ended July 3, 2009:

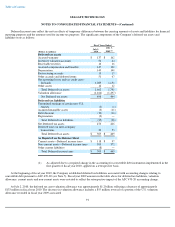

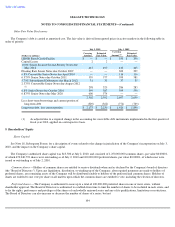

8. Fair Value

Measurement of Fair Value

Fair value is defined as the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between

market participants at the measurement date. When determining the fair value measurements for assets and liabilities required to be recorded at

fair value, the Company considers the principal or most advantageous market in which it would transact and it considers assumptions that market

participants would use when pricing the asset or liability.

Fair Value Hierarchy

A fair value hierarchy is based on whether the market participant assumptions used in determining fair value are obtained from independent

sources (observable inputs) or reflects the Company's own assumptions of market participant valuation (unobservable inputs). A financial

instrument's categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value

measurement. The three levels of inputs that may be used to measure fair value:

Level 1—Quoted prices in active markets that are unadjusted and accessible at the measurement date for identical, unrestricted assets or

liabilities;

Level 2—Quoted prices for identical assets and liabilities in markets that are inactive; quoted prices for similar assets and liabilities in

active markets or financial instruments for which significant inputs are observable, either directly or indirectly; or

Level 3—Prices or valuations that require inputs that are both unobservable and significant to the fair value measurement.

98

(Dollars in millions)

Derivatives Designated as Cash Flow

Hedges under ASC 815

Amount of

Gain or

(Loss)

Recognized

in OCI on

Derivative

(Effective

Portion)

Location of Gain

or (Loss)

Reclassified

from

Accumulated

OCI into

Income

(Effective

Portion)

Amount of

Gain or (Loss)

Reclassified

from

Accumulated

OCI into

Income

(Effective

Portion)

Location of Gain

or (Loss)

Recognized in

Income on

Derivative

(Ineffective

Portion and

Amount

Excluded

from

Effectiveness

Testing)

Amount of

Gain

or (Loss)

Recognized in

Income

(Ineffective

Portion and

Amount

Excluded from

Effectiveness

Testing)

(a)

Foreign currency forward

exchange contracts

$

(24

)

Cost of

revenue

$

(36

)

Cost of

revenue

$

(1

)

Derivatives Not Designated as Hedging Instruments under ASC 815

Location of Gain or

(Loss) Recognized in

Income on Derivative

Amount of Gain or

(Loss) Recognized in

Income on Derivative

Foreign currency forward exchange contracts

Other, net

$

(18

)

Total return swap

Operating expenses

(1

)

$

(19

)

(a) The amount of gain or (loss) recognized in income represents $0 related to the ineffective portion of the hedging

relationships and $(1) million related to the amount excluded from the assessment of hedge effectiveness, for the fiscal

year ended July 3, 2009, respectively.