Seagate 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Approximately $461 million and $93 million of our U.S. net operating loss and tax credit carry forwards, respectively, are subject to an

annual limitation of $44.8 million pursuant to U.S. tax law.

Effective at the beginning of fiscal year 2008, we adopted the authoritative guidance on accounting for uncertain tax positions in income

taxes. This guidance contains a two-step approach to recognizing and measuring uncertain tax positions. The first step is to evaluate the tax

position for recognition by determining if the weight of available evidence indicates that it is more likely than not that the tax position will be

sustained on audit, including resolution of any related appeals or litigation processes. The second step is to measure the tax benefit as the largest

amount that is more than 50% likely of being realized upon ultimate settlement.

As a result of the implementation of the guidance, we increased our liability for net unrecognized tax benefits at the date of adoption. We

accounted for the increase primarily as a cumulative effect of a change in accounting principle that resulted in a decrease to retained earnings of

$3 million and an increase to goodwill of $25 million. The total amount of gross unrecognized tax benefits as of the date of adoption was

$385 million excluding interest and penalties.

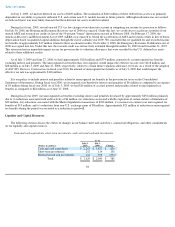

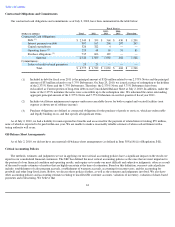

As of July 2, 2010 and July 3, 2009, we had approximately $115 million and $118 million, respectively, in unrecognized tax benefits

excluding interest and penalties. The unrecognized tax benefits that, if recognized, would impact the effective tax rate were $115 million and

$118 million as of July 2, 2010 and July 3, 2009, respectively, subject to certain future valuation allowance reversals.

It is our policy to include interest and penalties related to unrecognized tax benefits in the provision for taxes on the Consolidated

Statements of Operations. During fiscal year 2010, we recognized a net benefit for interest and penalties of $1 million as compared to a net

benefit of $6 million during fiscal year 2009. As of July 2, 2010, we had $15 million of accrued interest and penalties related to unrecognized tax

benefits as compared to $16 million as of July 3, 2009.

During the fiscal year ended July 2, 2010, our unrecognized tax benefits excluding interest and penalties decreased by approximately

$3 million primarily due to (i) reductions associated with the expiration of certain statutes of limitation of $3 million, (ii) reductions associated

with effectively settled positions of $4 million, (iii) a reduction of $5 million associated with interpretation of tax law as a result of the final 9

th

Circuit Court of Appeals' decision relating to stock based compensation deductions, (iv) increases in current year unrecognized tax benefits of

$6 million, and (v) increases from other activity, including non-U.S. exchange losses, of $3 million.

During the 12 months beginning July 3, 2010, we expect to reduce our unrecognized tax benefits by approximately $5 million as a result of

the expiration of certain statutes of limitation. We do not believe it is reasonably possible that other unrecognized tax benefits will materially

change in the next 12 months. However, the resolution and/or timing of closure on open audits are highly uncertain as to when these events

occur.

We file U.S. federal, U.S. state, and non-U.S. tax returns. The Internal Revenue Service (IRS) is currently examining fiscal years 2005

through 2007. For state and non-U.S. tax returns, we are generally no longer subject to tax examinations for years prior to fiscal year 2001. The

statute of limitation for U.S. Federal returns is open for fiscal year 2005 and forward.

Fiscal Year 2009 Compared to Fiscal Year 2008

Revenue

54

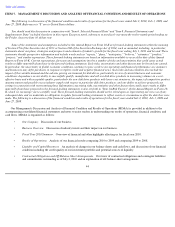

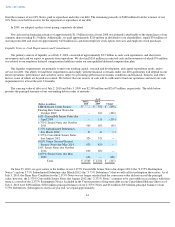

Fiscal Years Ended

(Dollars in millions)

July 3,

2009

June 27,

2008

Change

%

Change

Revenue

$

9,805

$

12,708

$

(2,903

)

(23

)%