Seagate 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Trade names reflect the value associated with Maxtor’s brand names. Trade names were valued using the Relief-

from-

Royalty Method, a form of the Income Approach, which estimates the royalty cost avoided by owning the trade

names as opposed to having to license them from an independent third party. The resulting cash flow savings

estimated over the remaining useful life of the trade names are then discounted to present value to arrive at the fair

value allocated to this intangible. Trade names are being amortized to Operating Expenses over the estimated useful

life of four years.

In-Process Research and Development

As of the date of the acquisition, all future development activities at Maxtor were discontinued. Therefore there

were no assets that qualified as in-process research and development.

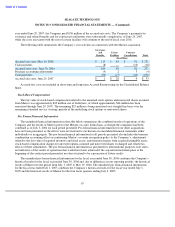

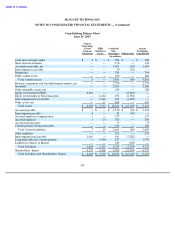

Debt Assumed

Upon the closing of the Merger, the Company assumed all of Maxtor’s outstanding debt, including Maxtor’s

convertible senior notes. In addition, upon the closing of the Merger, Seagate and Maxtor entered into a supplemental

indenture whereby the Seagate agreed to unconditionally guarantee the notes on a senior unsecured basis (see

Note 14).

In accordance with APBO 14, the Company determined the existence of substantial premium for both the

2.375% Notes and 6.8% Notes and recorded the notes at par value with the resulting excess over par (the substantial

premium) recorded in Additional Paid-In Capital included in Shareholders’ Equity. All other debt was recorded at

fair market value.

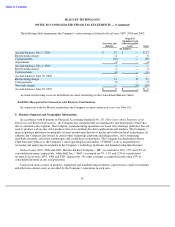

Adverse/Favorable Leasehold Interests

In accordance with the guidance in SFAS No. 141, the Company analyzed all contractual leases to determine the

fair value of the leasehold interests. An adverse leasehold position exists when the present value of the contractual

rental obligation is greater than the present value of the market rental obligation, and conversely for a favorable

leasehold interest. The Company recorded adverse leasehold interests totaling $74 million and favorable leasehold

interest aggregating $4 million, which will be amortized to Cost of Revenue and Operating Expenses over the

remaining duration of the leases.

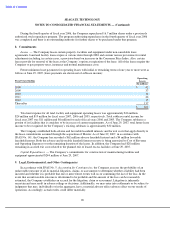

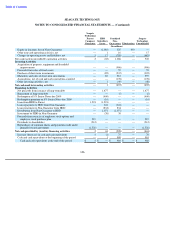

Recognition of Liabilities in Connection with Maxtor Acquisition

Under EITF 95-3, Recognition of Liabilities in Connection with a Business Combination, the Company has

accrued certain exit costs aggregating $247 million, of which $108 million relates to employee severance,

$45 million relates to the planned exit of leased or owned excess facilities and $94 million relates to the cancellation

or settlement of contractual obligations that will not provide any future economic benefit. The severance and

associated benefits liability relates to the employment termination of approximately 4,900 Maxtor employees,

primarily in the U.S. and Far East, all of whom had been terminated as of June 29, 2007. In the fiscal

96

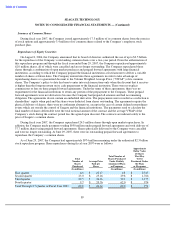

Substantial

Premium

Estimated

Recorded in

Initial

Par

Fair Value on

Additional Paid in

Carrying

Value

May 19, 2006

Capital

Amount

(In millions)

6.80% Senior Convertible Notes due April 2010

$

135

$

153

$

18

$

135

5.75% Subordinated Debentures due March 2012

55

49

—

49

2.375% Senior Convertible Notes due August 2012

326

483

157

326

LIBOR Based China Manufacturing Facility Loan

60

60

—

60

$

576

$

745

$

175

$

570