Seagate 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

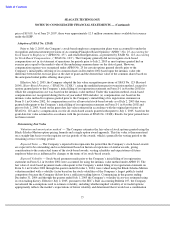

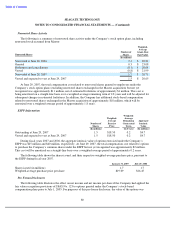

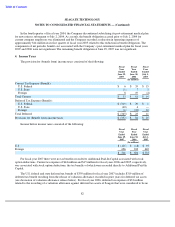

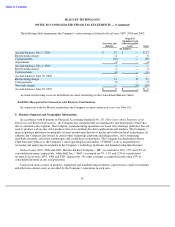

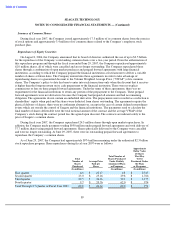

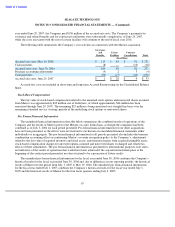

The following table summarizes the Company’s restructuring activities for fiscal years 2007, 2006 and 2005.

Accrued restructuring costs are included in Accrued restructing on the Consolidated Balance Sheet.

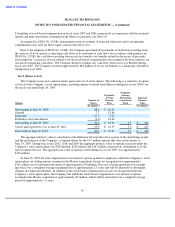

Liabilities Recognized in Connection with Business Combinations:

In connection with the Maxtor acquisition, the Company accrued certain exit costs (see Note 10).

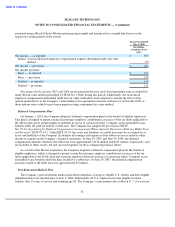

In accordance with Statement of Financial Accounting Standards No. 131, Disclosure about Segments of an

Enterprise and Related Information

, the Company has concluded that its manufacture and distribution of hard disc

drives constitutes one segment. The Company’

s manufacturing operations are based on technology platforms that are

used to produce various disc drive products that serve multiple disc drive applications and markets. The Company’s

main technology platforms are primarily focused around areal density of media and read/write head technologies. In

addition, the Company also invests in certain other technology platforms including motors, servo formatting

read/write channels, solid state technologies and sealed drive technologies. The Company has determined that its

Chief Executive Officer is the Company’s chief operating decision maker (“CODM”) as he is responsible for

reviewing and approving investments in the Company’s technology platforms and manufacturing infrastructure.

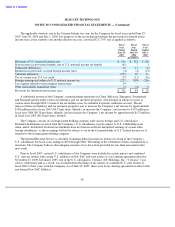

In fiscal years 2007, 2006 and 2005, Hewlett-Packard Company (“HP”) accounted for 16%, 17% and 18% of

consolidated revenue, respectively, while Dell, Inc. (“Dell”) accounted for 9%, 11% and 12% of consolidated

revenue in fiscal years 2007, 2006 and 2005, respectively. No other customer accounted for more than 10% of

consolidated revenue in any year presented.

Long-

lived assets consist of property, equipment and leasehold improvements, capital leases, equity investments

and other non-current assets as recorded by the Company’s operations in each area.

87

Impaired

Equipment and

Severance and

Other Intangible

Benefits

Assets

Total

(In millions)

Accrual balances, July 2, 2004

$

27

$

—

$

27

Restructuring charge

8

—

8

Cash payments

(30

)

—

(

30

)

Adjustments

(3

)

—

(

3

)

Accrual balances, July 1, 2005

2

—

2

Restructuring charge

4

—

4

Cash payments

(6

)

—

(

6

)

Accrual balances, June 30, 2006

—

—

—

Restructuring charge

14

19

33

Cash payments

(5

)

—

(

5

)

Non

-

cash charges

—

(

19

)

(19

)

Accrual balances, June 29, 2007

$

9

$

—

$

9

6.

Business Segment and Geographic Information