Seagate 2006 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

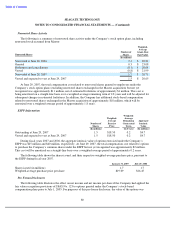

price of $19.09. As of June 29, 2007, there were approximately 12.5 million common shares available for issuance

under the ESPP.

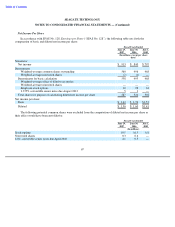

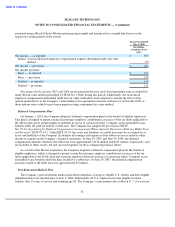

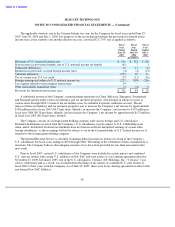

Adoption of SFAS No. 123(R)

Prior to July 2, 2005, the Company’s stock-based employee compensation plans were accounted for under the

recognition and measurement provisions of Accounting Principles Board Opinion (“APBO”) No. 25, Accounting for

Stock Issued to Employees (“APBO No. 25”), and related Interpretations, as permitted by FASB No. 123,

Accounting

for Stock

-Based Compensation , (“SFAS No. 123”). The Company generally did not recognize stock-based

compensation cost in its statement of operations for periods prior to July 2, 2005 as most options granted had an

exercise price equal to the market value of the underlying common shares on the date of grant. However,

compensation expense was recognized under APBO No. 25 for certain options granted shortly prior to the

Company’s initial public offering of its common shares in December 2002 based upon the intrinsic value (the

difference between the exercise price at the date of grant and the deemed fair value of the common shares based on

the anticipated initial public offering share price).

Effective July 2, 2005, the Company adopted the fair value recognition provisions of SFAS No. 123 (Revised

2004), Share-Based Payment , (“SFAS No. 123(R)”), using the modified-prospective-transition method, except for

options granted prior to the Company’s initial filing of its registration statement on Form S-1 in October 2002 for

which the compensation cost was based on the intrinsic value method. Under this transition method, stock-based

compensation cost recognized during the fiscal year ended 2006 includes: (a) compensation cost based on the

intrinsic value method for options granted prior to the Company’s initial filing of its registration statement on

Form S-1 in October 2002, (b) compensation cost for all unvested stock-based awards as of July 2, 2005 that were

granted subsequent to the Company’s initial filing of its registration statement on Form S-1 in October 2002 and

prior to July 2, 2005, based on the grant date fair value estimated in accordance with the original provisions of

SFAS No. 123 and (c) compensation cost for all stock-based awards granted subsequent to July 1, 2005, based on the

grant-date fair value estimated in accordance with the provisions of SFAS No. 123(R). Results for prior periods have

not been restated.

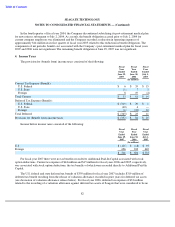

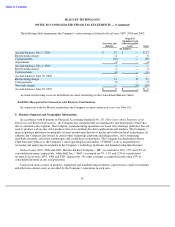

Determining Fair Value

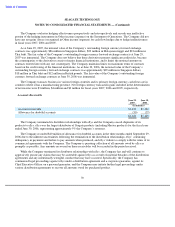

Valuation and amortization method — The Company estimates the fair value of stock options granted using the

Black-Scholes-Merton option-pricing formula and a single option award approach. This fair value is then amortized

on a straight-line basis over the requisite service periods of the awards, which is generally the vesting period or the

remaining service (vesting) period.

Expected Term — The Company’s expected term represents the period that the Company’s stock-based awards

are expected to be outstanding and was determined based on historical experience of similar awards, giving

consideration to the contractual terms of the stock-based awards, vesting schedules and expectations of future

employee behavior as influenced by changes to the terms of its stock-based awards.

Expected Volatility — Stock-based payments made prior to the Company’s initial filing of its registration

statement on Form S-1 in October 2002 were accounted for using the intrinsic value method under APBO 25. The

fair value of stock based payments made subsequent to the Company’s initial filing of its registration statement on

Form S-1 in October 2002 through the quarter ended October 1, 2004, were valued using the Black-Scholes-Merton

valuation method with a volatility factor based on the stock volatilities of the Company’s largest publicly traded

competitors because the Company did not have a sufficient trading history. Commencing in the quarter ending

December 31, 2004 and through the quarter ended July 1, 2005 the Company’s volatility factor was estimated using

its own trading history. Effective July 2, 2005, pursuant to the SEC’s Staff Accounting Bulletin 107, the Company

reevaluated the assumptions used to estimate volatility, including whether implied volatility of its traded options

appropriately reflects the market’s expectations of future volatility and determined that it would use a combination

77