Seagate 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

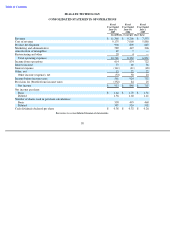

We had approximately $1.1 billion in cash, cash equivalents and short-

term investments at June 29, 2007, which

includes $988 million of cash and cash equivalents. Cash and cash equivalents increased by $78 million during fiscal

year 2007. This increase in cash and cash equivalents during fiscal year 2007 was primarily attributable to net

proceeds received from the issuance of long-term debt totaling approximately $1.5 billion, cash provided by

operating activities and maturities and sales of short-term investments in excess of purchases of short-term

investments, substantially offset by capital expenditures, the redemption of our 8% Notes, the repurchase of our

common shares and the acquisition of EVault.

In September 2006, Seagate Technology HDD Holdings (“HDD”), our wholly-owned direct subsidiary issued

senior notes totaling $1.5 billion comprised of $300 million aggregate principal amount of Floating Rate Senior

Notes due October 2009 (the

“2009 Notes”), $600 million aggregate principal amount of 6.375% Senior Notes due

October 2011 (the “2011 Notes”) and $600 million aggregate principal amount of 6.800% Senior Notes due October

2016 (the “2016 Notes”). The notes are guaranteed by Seagate Technology on a full and unconditional basis.

Until required for other purposes, our cash and cash equivalents are maintained in highly liquid investments with

remaining maturities of 90 days or less at the time of purchase. Our short-term investments consist primarily of

readily marketable debt securities with remaining maturities of more than 90 days at the time of purchase.

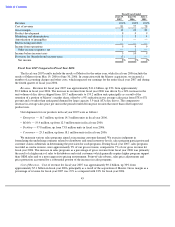

Cash Provided by Operating Activities

Cash provided by operating activities for fiscal year 2007 was approximately $943 million and consisted

primarily of net income adjusted for non-cash items including depreciation, amortization, stock-based compensation

and tax benefits related to a change in our valuation allowance for deferred tax assets, combined with a decrease in

accounts payable, variable performance-based compensation earned during fiscal year 2006 and paid in fiscal year

2007 and the payment of accrued exit costs and retention bonuses related to the Maxtor acquisition, partially offset

by a reduction in inventories.

Cash provided by operating activities for fiscal year 2006 was approximately $1.5 billion and consisted

primarily of net income adjusted for non-cash items including depreciation, amortization and stock-based

compensation, combined with an increase in accounts receivable and inventories, partially offset by increases in

accounts payable and accrued expenses.

Cash provided by operating activities for fiscal year 2005 was approximately $1.4 billion and consisted

primarily of net income adjusted for non-cash items including depreciation and amortization, combined with an

increase in accounts payable and accrued expenses offset by an increase in accounts receivable.

Cash Used in Investing Activities

During fiscal year 2007, we used $402 million for net cash investing activities, which was primarily attributable

to expenditures for property, equipment and leasehold improvements of approximately $906 million and

$178 million (net of cash acquired) for the acquisition of EVault, partially offset by $675 million of maturities and

sales of short-term investments in excess of purchases of short-

term investments. The approximately $906 million we

invested in property, equipment and leasehold improvements was comprised of:

Net cash used in investing activities was approximately $561 million for fiscal year 2006 and was primarily

attributable to expenditures for property, equipment and leasehold improvements partially offset by the maturities

48

• $219 million for manufacturing facilities and equipment related to our subassembly and disc drive final

assembly and test facilities in the United States and the Far East;

• $418 million to upgrade the capabilities of our thin-film media operations in the United States, Singapore and

Northern Ireland;

• $240 million for manufacturing facilities and equipment for our recording head operations in the United

States, the Far East and Northern Ireland; and

•

$

29 million for other capital additions.