Seagate 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

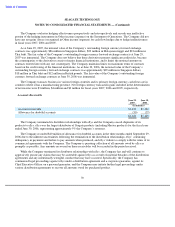

The Company evaluates hedging effectiveness prospectively and retrospectively and records any ineffective

portion of the hedging instruments in Other income (expense) on the Statement of Operations. The Company did not

have any net gains (losses) recognized in Other income (expense) for cash flow hedges due to hedge ineffectiveness

in fiscal years 2007, 2006 and 2005.

As at June 29, 2007, the notional value of the Company’s outstanding foreign currency forward exchange

contracts was approximately $86 million in Singapore dollars, $39 million in Malaysian ringgit and $23 million in

Thai baht. The fair value of the Company’s outstanding foreign currency forward exchange contracts at June 29,

2007 was immaterial. The Company does not believe that these derivatives present significant credit risks, because

the counterparties to the derivatives consist of major financial institutions, and it limits the notional amount on

contracts entered into with any one counterparty. The Company maintains limits on maximum terms of contracts

based on the credit rating of the financial institutions. As at June 30, 2006, the notional value of the Company’s

outstanding foreign currency forward exchange contracts was approximately $29 million in Singapore dollars,

$18 million in Thai baht and $12 million in British pounds. The fair value of the Company’s outstanding foreign

currency forward exchange contracts at June 30, 2006 was immaterial.

The Company transacts business in various foreign countries and its primary foreign currency cash flows are in

countries where it has a manufacturing presence. Net foreign currency transaction gains included in the determination

of net income were $3 million, $4 million and $3 million for fiscal years 2007, 2006 and 2005, respectively.

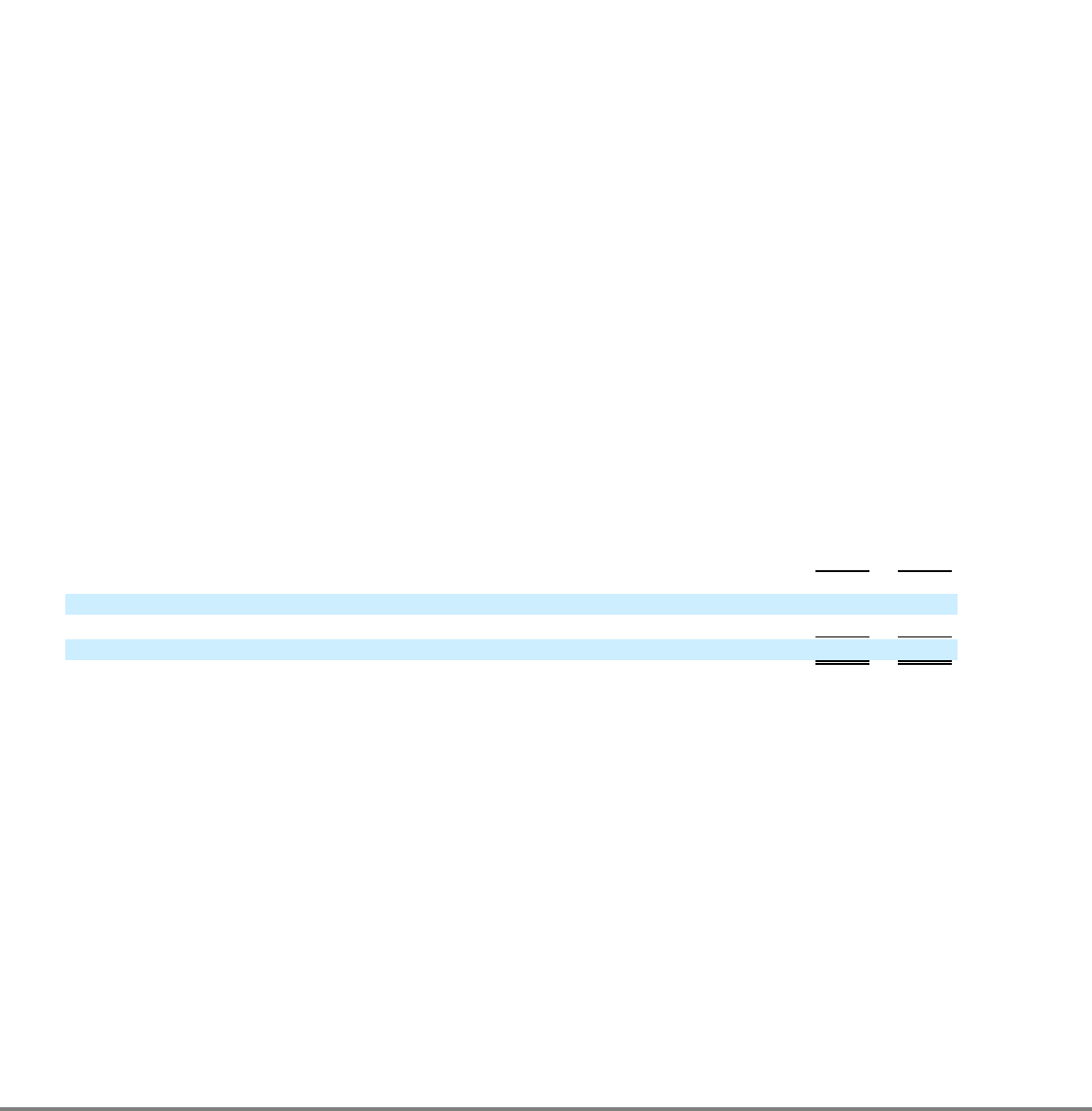

Accounts Receivable

The Company terminated its distributor relationships with eSys and the Company ceased shipments of its

products to eSys. eSys was the largest distributor of Seagate products (including Maxtor products) for the fiscal year

ended June 30, 2006, representing approximately 5% the Company’s revenues.

The Company recorded $40 million of allowance for doubtful accounts in the three months ended September 29,

2006 due to the inherent uncertainties following the termination of the distribution relationships, eSys’ continuing

delinquency in payments and failure to pay amounts when promised, and eSys’

failure to comply with the terms of its

commercial agreements with the Company. The Company is pursuing collection of all amounts owed by eSys as

promptly as possible. Any amounts recovered on these receivables will be recorded in the period received.

While the Company terminated its distributor relationships with eSys, the Company has and will continue to

aggressively pursue any claims that may be assertable against eSys as a result of material breaches of the distribution

agreements and any intentionally wrongful conduct that may have occurred. Specifically, the Company has

commenced legal proceedings against eSys under a distribution agreement and a corporate guarantee, against its

Chief Executive Officer on a personal guarantee, and the Company may initiate further legal proceedings under

various distribution agreements to recover all amounts owed for purchased product.

70

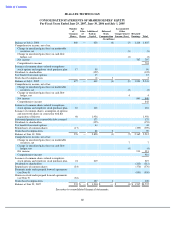

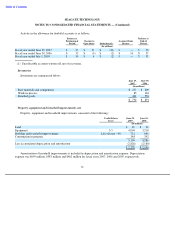

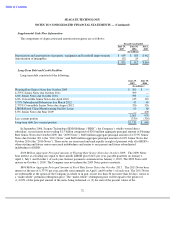

June 29,

June 30,

2007

2006

(In millions)

Accounts receivable

$

1,433

$

1,482

Allowance for doubtful accounts

(50

)

(37

)

$

1,383

$

1,445