Seagate 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

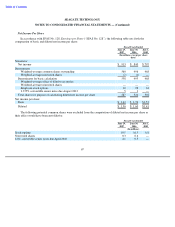

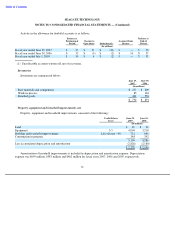

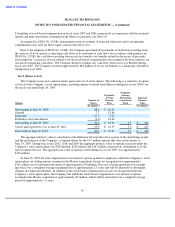

Supplemental Cash Flow Information

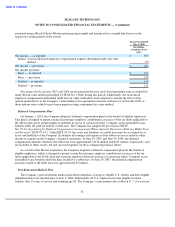

The components of depreciation and amortization expense are as follows:

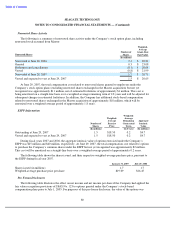

Long-Term Debt and Credit Facilities

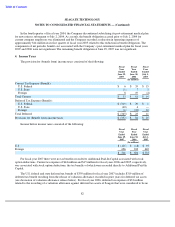

Long-term debt consisted of the following:

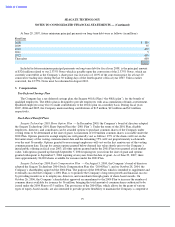

In September 2006, Seagate Technology HDD Holdings (“HDD”), the Company’s wholly-owned direct

subsidiary, issued senior notes totaling $1.5 billion comprised of $300 million aggregate principal amount of Floating

Rate Senior Notes due October 2009 (the “2009 Notes”), $600 million aggregate principal amount of 6.375% Senior

Notes due October 2011 (the

“2011 Notes”) and $600 million aggregate principal amount of 6.8% Senior Notes due

October 2016 (the “2016 Notes”). These notes are unsecured and rank equally in right of payment with all of HDD’s

other existing and future senior unsecured indebtedness and senior to any present and future subordinated

indebtedness of HDD.

$300 Million Aggregate Principal Amount of Floating Rate Senior Notes due October 2009. The 2009 Notes

bear interest at a floating rate equal to three-month LIBOR plus 0.84% per year, payable quarterly on January 1,

April 1, July 1 and October 1 of each year. Interest payments commenced on January 1, 2007. The 2009 Notes will

mature on October 1, 2009. The Company may not redeem the 2009 Notes prior to maturity.

$600 Million Aggregate Principal Amount of Fixed Rate Senior Notes due October 2011. The 2011 Notes bear

interest at the rate of 6.375% per year, payable semi-

annually on April 1 and October 1 of each year. The 2011 Notes

are redeemable at the option of the Company in whole or in part, on not less than 30 nor more than 60 days’ notice at

a “make-whole” premium redemption price. The “make-whole” redemption price will be equal to the greater of

(1) 100% of the principal amount of the notes being redeemed, or (2) the sum of the present values of the

72

Fiscal Years Ended

June 29,

June 30,

July 1,

2007

2006

2005

(In millions)

Depreciation and amortization of property, equipment and leasehold improvements

$

699

$

583

$

462

Amortization of intangibles

152

29

2

$

851

$

612

$

464

June 29,

June 30,

2007

2006

(In millions)

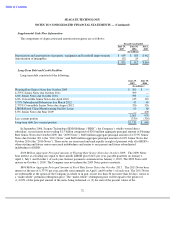

Floating Rate Senior Notes due October 2009

$

300

$

—

6.375% Senior Notes due October 2011

599

—

6.8% Senior Notes due October 2016

598

—

6.8% Convertible Senior Notes due April 2010

135

135

5.75% Subordinated Debentures due March 2012

45

49

2.375% Convertible Senior Notes due August 2012

326

326

LIBOR Based China Manufacturing Facility Loans

60

60

8.0% Senior Notes due May 2009

—

400

2,063

970

Less current portion

(330

)

(330

)

Long

-

term debt, less current portion

$

1,733

$

640