Seagate 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

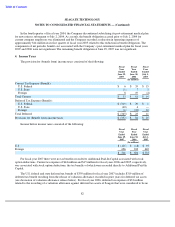

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

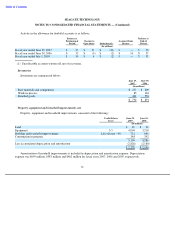

remaining scheduled payments of principal and interest on the 2011 Notes being redeemed, discounted at the

redemption date on a semi-

annual basis at a rate equal to the sum of the applicable Treasury rate plus 50 basis points.

$600 Million Aggregate Principal Amount of Fixed Rate Senior Notes due October 2016. The 2016 Notes bear

interest at the rate of 6.8% per year, payable semi-annually on April 1 and October 1 of each year. The 2016 Notes

are redeemable at the option of the Company in whole or in part, on not less than 30 nor more than 60 days’ notice at

a “make-whole” premium redemption price. The “make-whole” redemption price will be equal to the greater of

(1) 100% of the principal amount of the notes being redeemed, or (2) the sum of the present values of the remaining

scheduled payments of principal and interest on the 2016 Notes being redeemed, discounted at the redemption date

on a semi-annual basis at a rate equal to the sum of the applicable Treasury rate plus 50 basis points.

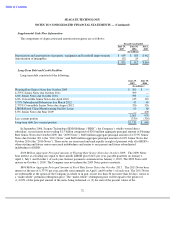

$135 Million Aggregate Principal Amount of 6.8% Convertible Senior Notes due April 2010 (the

“6.8% Notes”). As a result of its acquisition of Maxtor on May 19, 2006, the Company assumed the 6.8% Notes.

The 6.8% Notes require semi-annual interest payments payable on April 30 and October 30. The 6.8% Notes are

convertible into common shares of Seagate Technology at a conversion rate of approximately 30.1733 shares per

$1,000 principal amount of the notes. The Company may not redeem the 6.8% Notes prior to May 5, 2008.

Thereafter, the Company may redeem the 6.8% Notes at 100% of their principal amount, plus accrued and unpaid

interest, if the closing price of the common shares for 20 trading days within a period of 30 consecutive trading days

ending on the trading day before the date of the mailing of the redemption notice exceeds 130% of the conversion

price on such trading day. If, at any time, substantially all of the common shares are exchanged or acquired for

consideration that does not consist entirely of common shares that are listed on a United States national securities

exchange or approved for quotation on the NASDAQ National Market or similar system, the holders of the notes

have the right to require the Company to repurchase all or any portion of the notes at their face value plus accrued

interest.

$326 Million Aggregate Principal Amount of 2.375% Convertible Senior Notes due August 2012 (the

“2.375% Notes”). As a result of its acquisition of Maxtor on May 19, 2006, the Company assumed the

2.375% Notes. The 2.375% Notes require semi-

annual interest payments payable on February 15 and August 15. The

2.375% Notes are convertible into common shares of Seagate Technology at a conversion rate of approximately

57.3380 shares per $1,000 principal amount of the notes, at the option of the holders, at any time during a fiscal

quarter if, during the last 30 trading days of the immediately preceding fiscal quarter the common shares trade at a

price in excess of 110% of the conversion price for 20 consecutive trading days. Upon conversion, the 2.375% Notes

are subject to “net cash” settlement whereby the Company will deliver cash for the lesser of the principal amount of

the notes being converted or the “conversion value” of the notes which is calculated by multiplying the conversion

rate then in effect by the market price of the Company’s common shares at the time of conversion. To the extent that

the conversion value exceeds the principal amount of the 2.375% Notes, the Company will, at its election, pay cash

or issue common shares with a value equal to the value of such excess. If the 2.375% Notes are surrendered for

conversion, the Company may direct the conversion agent to surrender those notes to a financial institution selected

by the Company for exchange, in lieu of conversion, into a number of the Company’s common shares equal to the

applicable conversion rate, plus cash for any fractional shares, or cash or a combination of cash and the Company’s

common shares in lieu thereof. The 2.375% Notes are classified as a current liability on the consolidated balance

sheets because they are currently convertible as the Company’s share price was in excess of 110% of the conversion

price for at least 20 consecutive trading days during the last 30 trading days of the fourth quarter of fiscal year 2007.

The payment of dividends to holders of our common shares may in certain future quarters result in upward

adjustments to the conversion rate of the 2.375% Notes.

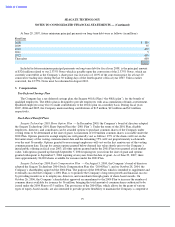

$50 Million Aggregate Principal Amount of 5.75% Subordinated Debentures due March 2012 (the

“5.75% Debentures”). As a result of the Maxtor acquisition, the Company assumed the 5.75% Debentures. The

5.75% Debentures require semi-annual interest payments on March 1 and September 1 and annual sinking fund

payments of $5 million or repurchases of $5 million in principal amount of debentures in lieu of sinking fund

73