Seagate 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Raw Materials

We believe Seagate is leading the transition to perpendicular recording technology. We are currently shipping

perpendicular technology based products for all four major markets, and during the June 2007 quarter, we shipped

over 28 million disc drives that use perpendicular recording technology compared to 17 million disc drives shipped

in the immediately preceding quarter. We expect that by the end of fiscal year 2008, all of our drive shipments will

utilize perpendicular recording technology. Our products based on perpendicular technology require increased

quantities of precious metals like ruthenium, which has led to an increase (that is likely to continue) in the inventory

levels for these raw materials. The price of ruthenium has increased significantly over the last year and may continue

to be volatile. In addition, ruthenium has at times been difficult to acquire. We believe we have adequate supply

plans in place to support our expected perpendicular product ramp requirements.

Investments

In fiscal year 2007, we made $906 million of capital investments, $218 million of which occurred in the June

2007 quarter. For fiscal year 2008, we expect approximately $900 million in capital investment will be required to

continue to proceed with our planned media and substrate capacity expansions in Asia and to align capacity additions

with current levels of customer demand, while we continue to improve our utilization of capital equipment.

In January 2007, we completed our acquisition of EVault in an all cash transaction valued at approximately

$186 million, which includes approximately $2 million in acquisition costs as part of our effort to extend our storage

solutions offerings.

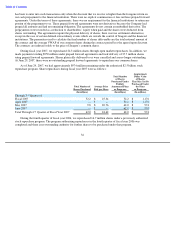

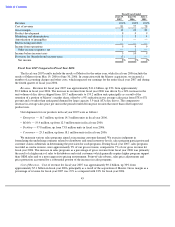

Results of Operations

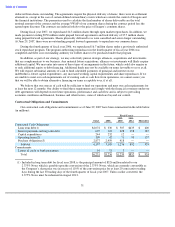

We list in the tables below the historical consolidated statements of operations in dollars and as a percentage of

revenue for the fiscal years indicated.

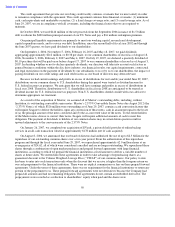

42

Fiscal Years Ended

June 29,

June 30,

July 1,

2007

2006

2005

(In millions)

Revenue

$

11,360

$

9,206

$

7,553

Cost of revenue

9,175

7,069

5,880

Gross margin

2,185

2,137

1,673

Product development

904

805

645

Marketing and administrative

589

447

306

Amortization of intangibles

49

7

—

Restructuring and other

29

4

—

Income from operations

614

874

722

Other income (expense), net

(53

)

50

10

Income before income taxes

561

924

732

Provision for (benefit from) income taxes

(352

)

84

25

Net income

$

913

$

840

$

707