Seagate 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

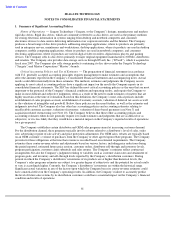

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

expands disclosures about fair value measurements. This Statement applies under other accounting pronouncements

that require or permit fair value measurements, the FASB having previously concluded in those accounting

pronouncements that fair value is the relevant measurement attribute. Accordingly, this Statement does not require

any new fair value measurements. However, for some entities, the application of this Statement will change current

practice. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15,

2007, and interim periods within those fiscal years. The Company is currently evaluating the effect that the adoption

of SFAS No. 157 will have on its consolidated results of operations and financial condition.

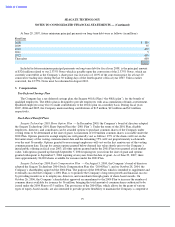

In June 2006, the FASB issued FASB Interpretation No. (“FIN”) 48, Accounting for Uncertainty in Income

Taxes — An Interpretation of FASB Statement No. 109 (“FIN No. 48”). This Interpretation clarifies the accounting

for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with SFAS No. 109.

This Interpretation prescribes a recognition threshold and measurement attribute for the financial statement

recognition and measurement of a tax position taken or expected to be taken in a tax return. This Interpretation is

effective for fiscal years beginning after December 15, 2006 and will be adopted by the Company in the first quarter

of fiscal year 2008. The Company is currently evaluating the effect that the adoption of FIN No. 48 will have on its

consolidated results of operations and financial condition.

In February 2006, the FASB issued SFAS No. 155, Accounting for Certain Hybrid Financial Instruments

(“SFAS No. 155”), which amends SFAS No. 133, and SFAS No. 140, Accounting for Transfers and Servicing of

Financial Assets and Extinguishments of Liabilities

(“SFAS No. 140”). SFAS No. 155 simplifies the accounting for

certain derivatives embedded in other financial instruments by allowing them to be accounted for as a whole if the

holder elects to account for the entire instrument on a fair value basis. SFAS No. 155 also clarifies and amends

certain other provisions of SFAS No. 133 and SFAS No. 140. SFAS No. 155 is effective for all financial instruments

acquired, issued, or subject to a remeasurement event occurring in fiscal years beginning after September 15, 2006.

Earlier adoption is permitted, provided the company has not yet issued financial statements, including for interim

periods, for that fiscal year. The Company does not expect the adoption of SFAS No. 155 to have a material impact

on its consolidated financial position, results of operations, or cash flows.

66