Seagate 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

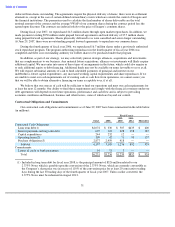

Table of Contents

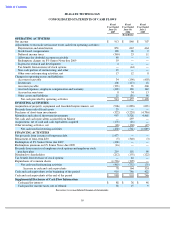

and sales of short-term investments in excess of purchases thereof as well as net cash acquired from Maxtor.

Specifically, during fiscal year 2006, we invested approximately $1.0 billion in property, equipment and leasehold

improvements comprised of:

Net cash used in investing activities was approximately $1.1 billion for fiscal year 2005 and was primarily

attributable to expenditures for property, equipment and leasehold improvements and the purchases of short-term

investments in excess of maturities and sales thereof.

The increase in the investment in property, equipment and leasehold improvements during fiscal years 2007 and

2006 as compared with fiscal year 2005 was for increased capacity to support increased unit shipments and

additional capacity for the ramp-up and production of Seagate-designed disc drive products to replace legacy

Maxtor-designed products. For fiscal year 2008, we expect approximately $900 million in capital investment will be

required to continue to proceed with our planned media and substrate capacity expansions in Asia and to align

capacity additions with current levels of customer demand, while we continue to improve our utilization of capital

equipment.

Cash Used in Financing Activities

Net cash used in financing activities of $463 million for fiscal year 2007 was primarily attributable to

approximately $1.5 billion used for the repurchases of our common shares, $416 million used in the redemption of

our 8% Notes and $212 million of dividends paid to our shareholders, largely offset by approximately $1.5 billion

received from the issuance of long-

term debt and $219 million cash provided by employee stock option exercises and

employee stock purchases.

Net cash used in financing activities of $732 million for fiscal year 2006 was primarily attributable to

$399 million used in the repurchases of common shares, the repayment of a $340 million term loan and $155 million

of dividends paid to our shareholders, partially offset by $118 million cash provided by employee stock option

exercises and employee stock purchases.

Net cash used in financing activities of $35 million for fiscal year 2005 was primarily attributable to dividends

of $122 million paid to our shareholders and principal payments on our senior secured credit facilities offset by

$90 million in cash provided by employee stock option exercises and employee stock purchases.

Liquidity Sources and Cash Requirements and Commitments

Our principal sources of liquidity as of June 29, 2007, consisted of: (1) approximately $1.1 billion in cash, cash

equivalents, and short-term investments, (2) cash we expect to generate from operations and (3) a $500 million

revolving credit facility.

Our $500 million revolving credit facility matures in September 2011. The $500 million revolving facility,

which we entered into in September 2006, replaced our previous $100 million revolving credit facility. The

$500 million revolving credit facility is available for cash borrowings and for the issuance of letters of credit up to a

sub-limit of $100 million. Although no borrowings have been drawn under this revolving credit facility to date, we

had utilized $47 million for outstanding letters of credit and bankers’ guarantees as of June 29, 2007, leaving

$453 million for additional borrowings, subject to compliance with financial covenants and other customary

conditions to borrowing.

49

• $336 million for manufacturing facilities and equipment related to our subassembly and disc drive final

assembly and test facilities in the United States and the Far East;

• $349 million to upgrade the capabilities of our thin-film media operations in the United States, Singapore and

Northern Ireland;

• $276 million for manufacturing facilities and equipment for our recording head operations in the United

States, the Far East and Northern Ireland; and

•

$

47 million for other capital additions.