Seagate 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

year ended June 29, 2007, the Company paid $196 million of the accrued exit costs. The Company

’s payments for

severance and related benefits and for contractual settlements were substantially completed as of June 29, 2007,

while the costs associated with the exit of certain facilities will continue to the end of fiscal year 2016.

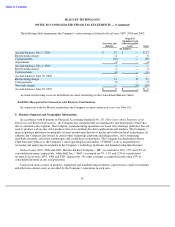

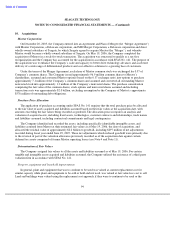

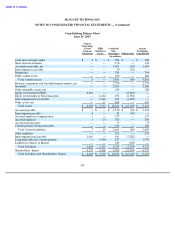

The following table summarizes the Company’s exit activities in connection with the Maxtor acquisition:

Accrued exit costs are included in short-term and long-term Accrued Restructuring on the Consolidated Balance

Sheet.

Stock-Based Compensation

The fair value of stock-based compensation related to the unearned stock options and nonvested shares assumed

from Maxtor was approximately $69 million, net of forfeitures, of which approximately $44 million has been

amortized through June 29, 2007. The remaining $25 million is being amortized on a straight-line basis over the

remaining estimated service (vesting) periods of the underlying stock options or nonvested shares.

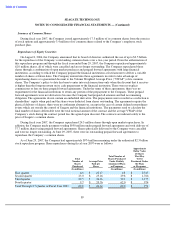

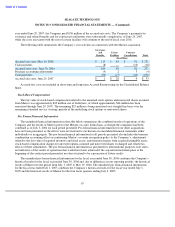

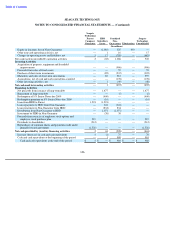

Pro Forma Financial Information

The unaudited financial information in the table below summarizes the combined results of operations of the

Company and the results of Maxtor prior to the Merger, on a pro forma basis, as though the companies had been

combined as of July 3, 2004 for each period presented. Pro forma financial information for our other acquisitions

have not been presented, as the effects were not material to our historical consolidated financial statements either

individually or in aggregate. The pro forma financial information for all periods presented also includes the business

combination accounting effect on conforming Maxtor’s revenue recognition policy to the Company’s, adjustments

related to the fair value of acquired inventory and fixed assets, amortization charges from acquired intangible assets,

stock-based compensation charges for unvested options assumed and nonvested shares exchanged and related tax

effects of these adjustments. The pro forma financial information is presented for informational purposes only and is

not indicative of the results of operations that would have been achieved if the acquisition had taken place at the

beginning of the earliest period presented, nor does it intend to be a projection of future results.

The unaudited pro forma financial information for the fiscal year ended June 30, 2006 combines the Company’s

historical results for the fiscal year ended June 30, 2006 and, due to differences in our reporting periods, the historical

results of Maxtor for the period from July 3, 2005 to May 19, 2006. The unaudited pro forma financial information

for the fiscal year ended July 1, 2005 combines the Company’s historical results for the fiscal year ended July 1,

2005 and the historical results of Maxtor for the four fiscal quarters ending July 2, 2005.

97

Severance

and

Excess

Contract

Benefits

Facilities

Cancellations

Total

(In millions)

Accrued exit costs, May 19, 2006

$

117

$

43

$

91

$

251

Cash payments

(8

)

—

(

10

)

(18

)

Accrued exits costs, June 30, 2006

109

43

81

233

Purchase accounting adjustments

(9

)

2

3

(4

)

Cash payments

(99

)

(17

)

(80

)

(196

)

Accrued exit costs, June 29, 2007

$

1

$

28

$

4

$

33