Seagate 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

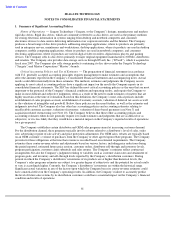

In February 2006, the FASB issued SFAS No. 155, Accounting for Certain Hybrid Financial Instruments

(“SFAS No. 155”), which amends SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities

(“SFAS No. 133”), and SFAS No. 140, Accounting for Transfers and Servicing of Financial Assets and

Extinguishments of Liabilities

(“SFAS No. 140”). SFAS No. 155 simplifies the accounting for certain derivatives

embedded in other financial instruments by allowing them to be accounted for as a whole if the holder elects to

account for the entire instrument on a fair value basis. SFAS No. 155 also clarifies and amends certain other

provisions of SFAS No. 133 and SFAS No. 140. SFAS No. 155 is effective for all financial instruments acquired,

issued, or subject to a remeasurement event occurring in fiscal years beginning after September 15, 2006. Earlier

adoption is permitted, provided the company has not yet issued financial statements, including for interim periods,

for that fiscal year. We do not expect the adoption of SFAS No. 155 to have a material impact on our consolidated

financial position, results of operations, or cash flows.

In July 2007, the FASB agreed to issue for comment a proposed FASB Staff Position (FSP) addressing

convertible instruments that may be settled in cash upon conversion, including those that may require partial cash

settlement. The proposed FSP would require the issuer to separately account for the liability and equity components

of the instrument in a manner that reflects the issuer’s economics interests. The proposed FSP would require

bifurcation of a component of the debt, classification of that component in equity, with the accretion of the discount

on the debt resulting in the “economic interest cost” being reflected in the statement of operations through higher

interest expense. The proposed FSP if issued would be effective for fiscal years beginning after December 15, 2007,

and would be applied retrospectively to all periods presented pursuant to the guidance of SFAS No. 154, Accounting

Changes and Error Corrections (“SFAS No. 154”). Our accounting for the 2.375% Notes acquired from Maxtor and

therefore our financial position and results of operations may be impacted by the proposed FSP. We will evaluate the

impact of the final FSP on our financial position and results of operations when issued.

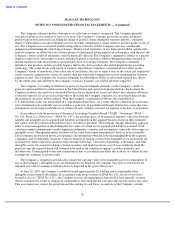

Interest Rate Risk. Our exposure to market risk for changes in interest rates relates primarily to our investment

portfolio and long-term debt. We currently do not use derivative financial instruments in either our investment

portfolio or to hedge debt.

As stated in our investment policy, we are averse to principal loss and ensure the safety and preservation of our

invested funds by limiting default risk and market risk. We mitigate default risk by maintaining portfolio investments

in diversified, high-quality investment grade securities with limited time to maturity. We constantly monitor our

investment portfolio and position our portfolio to respond appropriately to a reduction in credit rating of any

investment issuer, guarantor or depository. We maintain a highly liquid portfolio by investing only in marketable

securities with active secondary or resale markets.

We have both fixed and variable rate debt obligations. We enter into debt obligations to support general

corporate purposes including capital expenditures and working capital needs. We currently do not use interest rate

derivatives to hedge our interest rate exposure.

At June 29, 2007, we had $23 million in marketable securities that had been in a continuous unrealized loss

position for a period greater than twelve months. The unrealized loss on these marketable securities was immaterial.

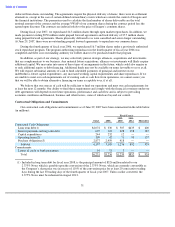

The table below presents principal (or notional) amounts and related weighted average interest rates by year of

maturity for our investment portfolio and debt obligations as of June 29, 2007. All investments mature in three years

or less. Included in long term debt for fiscal year 2008, is the principal amount of $326 million related to our

2.375% Notes which is payable upon the conversion of the 2.375% Notes, which are currently convertible as the

Company’s share price was in excess of 110% of the conversion price for at least 20 consecutive trading days during

the last 30 trading days of the fourth quarter of fiscal year 2007. Unless earlier converted, the 2.375% Notes must be

redeemed in August 2012.

55

ITEM 7A.

QUALITATIVE AND QUANTITATIVE DISCLOSURES ABOUT MARKET RISK