Seagate 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

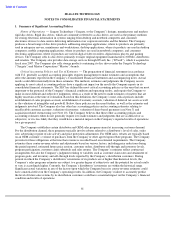

Foreign Currency Exchange Risk. We transact business in various foreign countries. Our primary foreign

currency cash flows are in countries where we have a manufacturing presence. We have established a foreign

currency hedging program to protect against the increase in value of foreign currency cash flows resulting from

operating and capital expenditures over the next year. We hedge portions of our forecasted expenses denominated in

foreign currencies with forward exchange contracts. When the U.S. dollar weakens significantly against the foreign

currencies, the increase in the value of the future foreign currency expenditure is offset by gains in the value of the

forward contracts designated as hedges. Conversely, as the U.S. dollar strengthens, the decrease in value of the future

foreign currency cash flows is offset by losses in the value of the forward contracts. These forward foreign exchange

contracts, carried at fair value, may have maturities of up to twelve months. Additionally, in the fourth quarter of

fiscal year 2007, we entered into forward contracts to hedge the capital expense costs associated with a new

manufacturing facility under construction in Malaysia.

We evaluate hedging effectiveness prospectively and retrospectively and record any ineffective portion of the

hedging instruments in other income (expense) on the statement of operations. We did not have any net gains (losses)

recognized in other income (expense) for cash flow hedges due to hedge ineffectiveness in fiscal years 2007, 2006

and 2005.

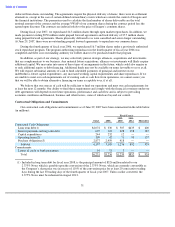

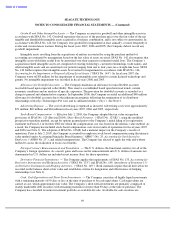

As of June 29, 2007, our notional fair values of foreign exchange forward contracts totaled $148 million. We do

not believe that these derivatives present significant credit risks, because the counterparties to the derivatives consist

of major financial institutions, and we manage the notional amount of contracts entered into with any one

counterparty. We maintain limits on maximum tenor of contracts based on the credit rating of the financial

institutions. We do not enter derivative financial instruments for speculative or trading purposes. The table below

provides information as of June 29, 2007 about our derivative financial instruments, comprised of foreign currency

forward exchange contracts. The table is provided in U.S. dollar equivalent amounts and presents the notional

amounts (at the contract exchange rates) and the weighted average contractual foreign currency exchange rates.

56

Fair Value

Fiscal Year

Fiscal Year

Fiscal Year

Fiscal Year

Fiscal Year

June 29,

2008

2009

2010

2011

2012

Thereafter

Total

2007

(In millions)

Assets

Cash equivalents:

Fixed rate

$

862

$

862

$

862

Average interest rate

5.27

%

5.27

%

Short

-

term investments:

Fixed rate

$

130

$

27

$

157

$

156

Average interest rate

4.29

%

4.95

%

4.40

%

Total investment securities

$

992

$

27

$

1,019

$

1,018

Average interest rate

5.14

%

4.95

%

5.14

%

Long

-

Term Debt

Fixed rate

$

330

$

5

$

142

$

5

$

630

$

600

$

1,712

$

1,810

Average interest rate

2.43

%

5.75

%

6.76

%

5.75

%

6.35

%

6.8

%

5.78

%

Variable rate

$

30

$

330

$

360

$

360

Average interest rate

5.81

%

6.19

%

6.16

%

Average

Estimated

Notional

Contract

Fair

Amount

Rate

Value

(In millions, except average contract rate)

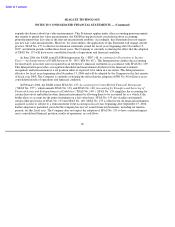

Foreign currency forward exchange contracts:

Thai baht

$

23

34.58

$

—

Singapore dollar

86

1.52

—

Malaysian ringgit

39

3.48

—

$

148

$

—