Seagate 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

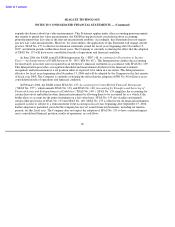

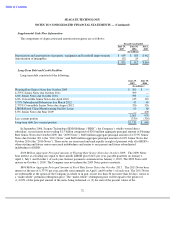

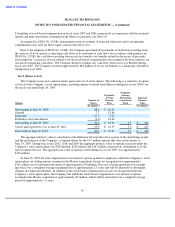

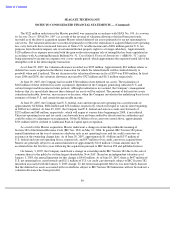

At June 29, 2007, future minimum principal payments on long-term debt were as follows (in millions):

Included in future minimum principal payments on long-term debt for fiscal year 2008, is the principal amount

of $326 million related to our 2.375% Notes which is payable upon the conversion of the 2.375% Notes, which are

currently convertible as the Company’s share price was in excess of 110% of the conversion price for at least 20

consecutive trading days during the last 30 trading days of the fourth quarter of fiscal year 2007. Unless earlier

converted, the 2.375% Notes must be redeemed in August 2012.

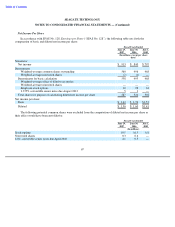

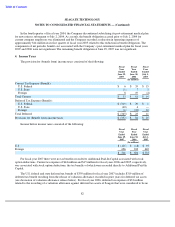

Tax-Deferred Savings Plan

The Company has a tax-deferred savings plan, the Seagate 401(k) Plan (“the 40l(k) plan”), for the benefit of

qualified employees. The 40l(k) plan is designed to provide employees with an accumulation of funds at retirement.

Qualified employees may elect to make contributions to the 401(k) plan on a monthly basis. During fiscal years

2007, 2006 and 2005, the Company made matching contributions of $15 million, $13 million and $13 million,

respectively.

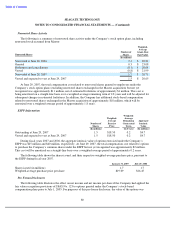

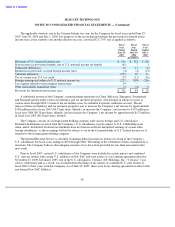

Stock-Based Benefit Plans

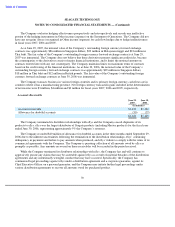

Seagate Technology 2001 Share Option Plan — In December 2000, the Company’s board of directors adopted

the Seagate Technology 2001 Share Option Plan (the “2001 Plan”). Under the terms of the 2001 Plan, eligible

employees, directors, and consultants can be awarded options to purchase common shares of the Company under

vesting terms to be determined at the date of grant. A maximum of 100 million common shares is issuable under the

2001 Plan. Options granted to exempt employees will generally vest as follows: 25% of the shares will vest on the

first anniversary of the vesting commencement date and the remaining 75% will vest proportionately each month

over the next 36 months. Options granted to non-exempt employees will vest on the first anniversary of the vesting

commencement date. Except for certain options granted below deemed fair value shortly prior to the Company’s

initial public offering in fiscal year 2003, all other options granted under the 2001 Plan were granted at fair market

value, with options granted up through September 5, 2004 expiring ten years from the date of grant and options

granted subsequent to September 5, 2004 expiring seven years from the date of grant. As of June 29, 2007, there

were approximately 84,000 shares available for issuance under the 2001 Plan.

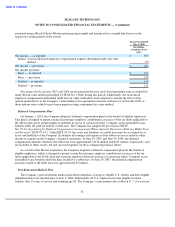

Seagate Technology 2004 Stock Compensation Plan — On August 5, 2004, the Company’s board of directors

adopted the Seagate Technology 2004 Stock Compensation Plan (the “2004 Plan”), and on October 28, 2004, the

Company’

s shareholders approved the 2004 Plan. The purpose of the 2004 Plan, which is intended to supplement and

eventually succeed the Company’s 2001 Plan, is to promote the Company’s long-term growth and financial success

by providing incentives to its employees, directors, and consultants through grants of share-based awards. On

October 26, 2006, the Company’s shareholders approved an amendment to the 2004 Plan to increase the number of

common shares available for issuance by 36 million, bringing the total amount of common shares authorized to be

issued under the 2004 Plan to 63.5 million. The provisions of the 2004 Plan, which allows for the grant of various

types of equity-based awards, are also intended to provide greater flexibility to maintain the Company’s competitive

75

Fiscal Year

2008

$

330

2009

35

2010

472

2011

5

2012

630

Thereafter

600

$

2,072

3.

Compensation