Seagate 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

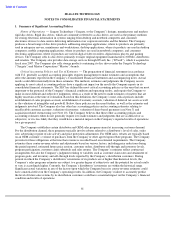

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

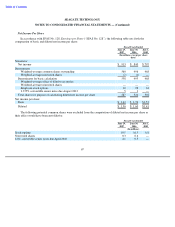

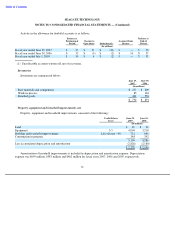

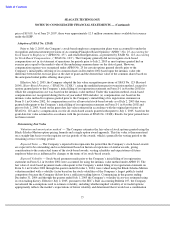

The fair value of the Company’s investment in debt securities, by remaining contractual maturity, is as follows

(in millions):

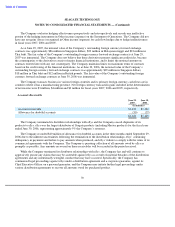

Fair Value Disclosures — The carrying value of cash and equivalents approximates fair value. The fair values

of short-term investments, debentures, notes and loans are estimated based on quoted market prices as of June 29,

2007.

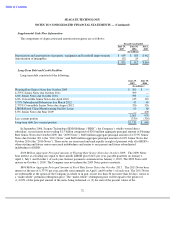

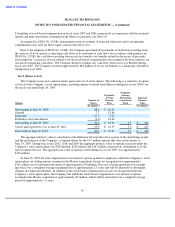

The carrying values and fair values of the Company’s financial instruments are as follows:

Derivative Financial Instruments — The Company recognizes all of its derivative financial instruments in the

balance sheet as either assets or liabilities. All derivative financial instruments are carried at fair value. The effective

portion of the gain or loss on a derivative designated as a cash flow hedge is reported in Other comprehensive income

and the ineffective portion is reported in earnings. Amounts in Other comprehensive income are reclassified into

earnings in the same period during which the hedged forecasted transaction affects earnings. The gain or loss on a

derivative instrument not qualifying for hedge accounting is recognized currently in earnings. The Company may

enter into foreign currency forward exchange contracts to manage exposure related to certain foreign currency

commitments, certain foreign currency denominated balance sheet positions and anticipated foreign currency

denominated expenditures. The Company’s policy prohibits it from entering into derivative financial instruments for

speculative or trading purposes. During fiscal years 2007, 2006 and 2005, the Company did not enter into any hedges

of net investments in foreign operations.

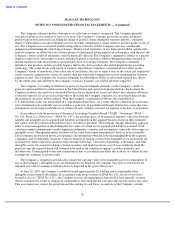

The Company has established a foreign currency hedging program to protect against the increase in value of

foreign currency cash flows resulting from operating and capital expenditures over the next year. The Company

hedges portions of its forecasted expenditures denominated in foreign currencies with forward exchange contracts.

When the U.S. dollar weakens significantly against the foreign currencies, the increase in value of the future foreign

currency expenditure is offset by gains in the value of the forward exchange contracts designated as hedges.

Conversely, as the U.S. dollar strengthens, the decrease in value of the future foreign currency cash flows is offset by

losses in the value of the forward exchange contracts. These forward foreign exchange contracts, carried at fair value,

may have maturities up to twelve months.

69

June 29,

June 30,

2007

2006

Due in less than 1 year

$

916

$

986

Due in 1 to 3 years

27

175

$

943

$

1,161

June 29, 2007

June 30, 2006

Carrying

Estimated

Carrying

Estimated

Amount

Fair Value

Amount

Fair Value

(In millions)

Cash equivalents

$

862

$

862

$

757

$

757

Short

-

term investments

157

156

831

823

Floating Rate Senior Notes due October 2009

(300

)

(300

)

—

—

6.375% Senior Notes due October 2011

(599

)

(588

)

—

—

6.8% Senior Notes due October 2016

(598

)

(577

)

—

—

6.8% Convertible Senior Notes due April 2010

(135

)

(145

)

(135

)

(144

)

5.75% Subordinated Debentures due March 2012

(45

)

(45

)

(49

)

(47

)

2.375% Convertible Senior Notes due August 2012

(326

)

(455

)

(326

)

(457

)

LIBOR Based China Manufacturing Facility Loan

(60

)

(60

)

(60

)

(60

)

8.0% Senior Notes due May 2009

—

—

(

400

)

(412

)